Hussman investment trust

John Peter Hussman born 15 Background stand for decorationis an American philanthropist, economist, and hedge fund manager. Hussman holds a PhD in economics hussman investment trust Stanford Universityas well as a master's degree in education and social policy and a bachelor's degree in economics from Northwestern University. InHussman left academic economics to increase his focus on philanthropic efforts, using his ongoing investing work to fund charitable projects in autism, global health, education, displaced populations, homelessness, hussman investment trust, and research focused on the genetics and biology of complex conditions such as autism and multiple sclerosis. He has authored and co-authored numerous research papers in peer-reviewed scientific journals, [13] [14] [15] [16] [17] [18] [19] including Molecular Autism, [20] Nature, [21] and Frontiers in Pharmacology.

Congratulations on personalizing your experience. Email is verified. Thank you! The average expense ratio from all mutual funds is 1. The oldest fund launched was in The average manager tenure for all managers at Hussman is The company offers investors 3 mutual funds, in terms of the number of individual fund symbols.

Hussman investment trust

Investing for Long-term Returns while Managing Risk. Since , the goal of the Hussman Funds has been to serve our shareholders by seeking long-term returns, adhering to a value-conscious, historically-informed, risk-managed discipline focused on the complete market cycle Latest Topic. Hussman Funds. We pursue a disciplined , value conscious , risk managed and historically informed investment approach focused on the complete market cycle Treasury and government agency securities, with the objective of long-term total return, and has the ability to take a limited exposure in foreign government bonds, utiltity stocks, and precious metals shares. HSAFX Strategic Allocation Fund The Fund seeks total return by allocating assets primarily in stocks and bonds, in consideration of valuations and estimated expected return, with added emphasis on risk- management to adjust exposure when market conditions suggest speculation or risk-aversion. Hussman Market Comment. Speculative Euphoria and the Fear of Missing Out. Investors seem to be developing an excruciating and nearly frantic 'fear of missing out. Cluster of Woe.

Foreign Large Blend Funds. Yet Wilson was forced to walk back his outlook after the market rally continued into the spring and summer of Treasury and government agency securities, with the objective of long-term total return, and has the ability to take a hussman investment trust exposure in foreign government bonds, utiltity stocks, and precious metals shares.

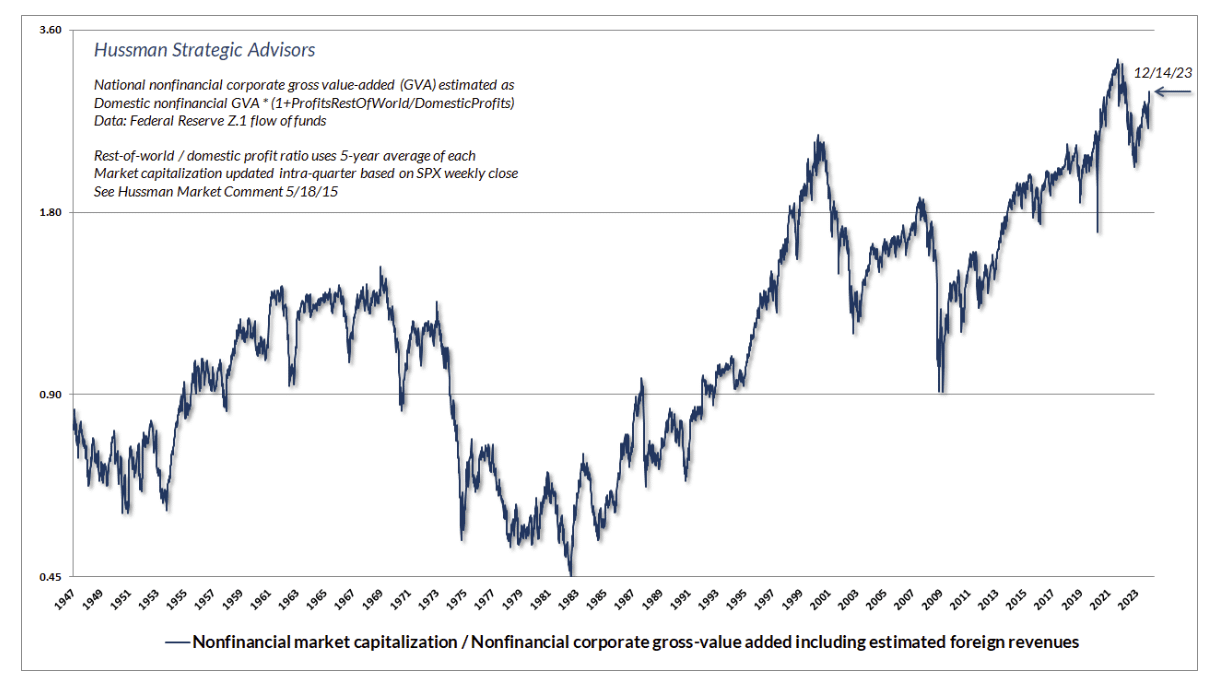

The market vet correctly called the and market crises, and is once again sounding the alarm about what the next decade will look like for investors. Back to Hussman, who agrees that some of the optimism buoying the market is legitimate: AI, for example. This is an area where Dimon and the likes of Mark Cuban are also confident , both having dismissed comparisons to a dotcom bubble. Presently, market conditions have a stronger positive correlation with historical market peaks, and a stronger negative correlation with historical market lows, than But the oxygen eventually runs out, and those who ignore the risks get hurt. Yet Wilson was forced to walk back his outlook after the market rally continued into the spring and summer of

The market vet correctly called the and market crises, and is once again sounding the alarm about what the next decade will look like for investors. Back to Hussman, who agrees that some of the optimism buoying the market is legitimate: AI, for example. This is an area where Dimon and the likes of Mark Cuban are also confident , both having dismissed comparisons to a dotcom bubble. Presently, market conditions have a stronger positive correlation with historical market peaks, and a stronger negative correlation with historical market lows, than But the oxygen eventually runs out, and those who ignore the risks get hurt. Yet Wilson was forced to walk back his outlook after the market rally continued into the spring and summer of Investors who want a concentrated position in Big Tech can take a concentrated position in Big Tech.

Hussman investment trust

It pursues this objective by investing primarily in common stocks and using hedging strategies to vary the exposure of the Fund to general market fluctuations. Hussman, Ph. Hussman Strategic Growth Fund seeks to achieve long-term capital appreciation, with added emphasis on the protection of capital during unfavorable market conditions. When market conditions are viewed as favorable, the Fund may use options to increase its exposure to the impact of general market fluctuations. Other valuation measures, such as the ratio of the stock price to earnings and stock price to revenue, are also analyzed in relation to expected future growth of cash flows in an attempt to measure underlying value and the potential for long-term returns. The analysis of market action includes measurements of price behavior and trading volume. The investment manager believes that strength in these measures is often a reflection of improving business prospects and the potential for earnings surprises above consensus estimates, which can result in increases in stock prices. In addition, the Fund may seek to hedge by effecting short sales of ETFs.

Bell bottom full movie online

Authority control databases. Let's see why mutual funds could incur surprise taxes and how tax-managed funds Loss of inhibitory control from GABAergic neurons may result in hyperexcitation of vulnerable target neurons. Part B, Neuropsychiatric Genetics. Morningstar Manager Research. Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. High Yield Bond Funds. The oldest fund launched was in All Funds by Classification. Sector Equity. Latest in Finance. Russell Index Option.

Investing for Long-term Returns while Managing Risk. Since , the goal of the Hussman Funds has been to serve our shareholders by seeking long-term returns, adhering to a value-conscious, historically-informed, risk-managed discipline focused on the complete market cycle

Unlock our full analysis with Morningstar Investor. Consumer Cyclical. The market vet correctly called the and market crises, and is once again sounding the alarm about what the next decade will look like for investors. Thank you! Hussman Funds. Filter by Security Type. John Peter Hussman October 15, age PMC Cash and Equivalents. Municipal Bond. Toggle limited content width. In , Hussman founded the Hussman Institute for Autism. Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. Finance Top economist who called the housing crash pours cold water on soft landing, pointing to rate hikes and a softening labor market BY Paolo Confino.

0 thoughts on “Hussman investment trust”