Ishares euro

The figures shown relate to past performance. Past performance is not a reliable indicator of future ishares euro and should not be the sole factor of consideration when selecting a product or strategy.

Source: BlackRock. The Distributions data shows historical distributions based on the fund distributions policy. The distribution amount is quoted on a per unit basis before taxes. As a general rule, accumulated dividend income after the deduction of expenses will be distributed from the fund on each record date. There is no guarantee that distributions will be paid in the future.

Ishares euro

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more. This fund does not seek to follow a sustainable, impact or ESG investment strategy. For more information regarding the fund's investment strategy, please see the fund's prospectus. Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric.

For funds with an investment objective that include the integration of ESG criteria, there may be corporate actions or other situations that may cause the fund or index to passively hold securities that may not comply with Ishares euro criteria.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies.

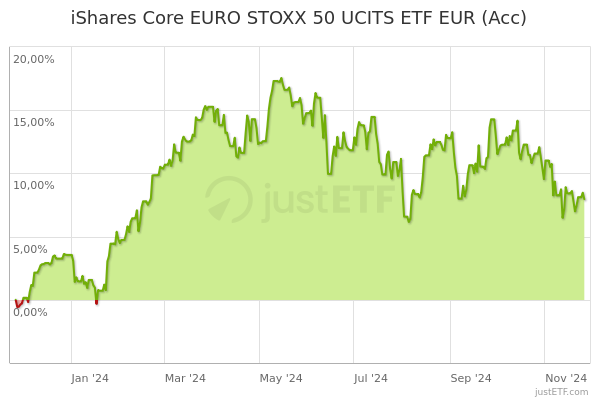

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock.

Ishares euro

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund.

Etv serial heroine

Class D Acc. Those issuers with higher MSCI ESG scores are determined by the index provider to be those issuers that may be better positioned to manage future ESG-related challenges and risks compared to their industry peers. The cash flow data is projected using the aggregated expected coupon and maturities of the individual bond holdings of the fund. Keep exploring. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. There is no minimum guaranteed return. MSCI has established an information barrier between equity index research and certain Information. The returns shown do not represent the returns you would receive if you traded shares at other times. ETFs Estimate trading costs View all tools. If emissions in the global economy followed the same trend as the emissions of companies within the fund's portfolio, global temperatures would ultimately rise within this band. An MSCI ESG controversy score may consider involvement in adverse impact activities in relation to environmental issues such as biodiversity and land use, energy and climate change, water stress, toxic emissions and waste issues. Sustainability Characteristics provide investors with specific non-traditional metrics. Risk overview Volatility 1 year

The figures shown relate to past performance.

Primary Navigation. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. They are provided for transparency and for information purposes only. The following list includes all authorised entities carrying out the characteristic activities of the entities mentioned, whether authorised by an EEA State or a third country and whether or not authorised by reference to a directive: a a credit institution; b an investment firm; c any other authorised or regulated financial institution; d an insurance company; e a collective investment scheme or the management company of such a scheme; f a pension fund or the management company of a pension fund; g a commodity or commodity derivatives dealer; h a local; i any other intermediaries investor. Sustainability Characteristics provide investors with specific non-traditional metrics. Also, there are limitations with the data inputs to the model. Geographic exposure relates principally to the domicile of the issuers of the securities held in the product, added together and then expressed as a percentage of the product's total holdings, excluding currency holdings. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Latest articles. Good governance policy Good governance checks are incorporated within the methodology of the Benchmark Index. Domicile Japan. For more information on where details of the methodology of the Benchmark Index can be found see 'Section L - Designated reference benchmark. They are provided for transparency and for information purposes only. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund.

Prompt, whom I can ask?

In it all business.

And everything, and variants?