Jhu tax office

Wednesday: a.

View more. The institution is comprised of approximately 6, faculty, 6, undergraduate students and 25, graduate students across degree programs at the baccalaureate, master's and doctoral levels. The mission of the university is to educate its students and cultivate their capacity for lifelong learning, to foster independent and original research, and to bring the benefits of discovery to the world. The Tax Office is responsible for all the institution's domestic and international tax matters and is an integral member of this high-performing, client-focused team. Johns Hopkins offers a total rewards package that supports our employees' health, life, career and retirement.

Jhu tax office

The Johns Hopkins University is a non-profit, educational corporation incorporated in the State of Maryland. The University is responsible for complying with appropriate federal and state corporate tax laws:. Generally, the University is exempt under IRS code section c 3 from federal and state income tax. However, certain activities may result in unrelated business income which is subject to federal and state income tax. Generally, the University is exempt from state sales tax on purchases. The University collects state sales tax on sales of goods in states where the University is required to collect sales tax. As an employer, the University is also responsible for the employment-related tax withholding and reporting to the Internal Revenue Service and state tax authorities. The Tax Office in the Controller's Office is organizationally responsible for both corporate and employer tax reporting. The Tax Office does not assist in preparing tax returns for individuals; individual tax matters are a concern between the individual and the Internal Revenue Service or state. All questions should be sent to the general Tax Office email tax jhu. We recommend you password encrypt all documents containing personal identifiable information e. We further recommend you send these documents from your Johns Hopkins email account to provide another layer of security. All rights reserved.

Menu Kirk Shawhan.

It is very important for international students and scholars to understand their U. The JHU Tax Office provides some support and resources to international students and scholars regarding taxes, including the facilitation of tax treaties. The JHU Tax Office does not provide personal tax advice to any individuals, international or domestic. Monday April 15, is the tax filing deadline for residents and nonresidents who earned U. Starting in tax returns , the University has partnered with Sprintax to provide an easy-to-use tax preparation software designed for nonresident students and scholars in the U.

The Johns Hopkins University is a non-profit, educational corporation incorporated in the State of Maryland. The University is responsible for complying with appropriate federal and state corporate tax laws:. Generally, the University is exempt under IRS code section c 3 from federal and state income tax. However, certain activities may result in unrelated business income which is subject to federal and state income tax. Generally, the University is exempt from state sales tax on purchases. The University collects state sales tax on sales of goods in states where the University is required to collect sales tax. As an employer, the University is also responsible for the employment-related tax withholding and reporting to the Internal Revenue Service and state tax authorities.

Jhu tax office

It is very important for international students and scholars to understand their U. The JHU Tax Office provides some support and resources to international students and scholars regarding taxes, including the facilitation of tax treaties. The JHU Tax Office does not provide personal tax advice to any individuals, international or domestic. Monday April 15, is the tax filing deadline for residents and nonresidents who earned U. Starting in tax returns , the University has partnered with Sprintax to provide an easy-to-use tax preparation software designed for nonresident students and scholars in the U. The Sprintax software is made available by JHU to all of its nonresident students, scholars, faculty, staff and researchers. Use of Sprintax for federal tax filings is free, and state tax filings are available for a small fee. Through , the university made Glacier Tax Prep available.

Warframe paracesis build

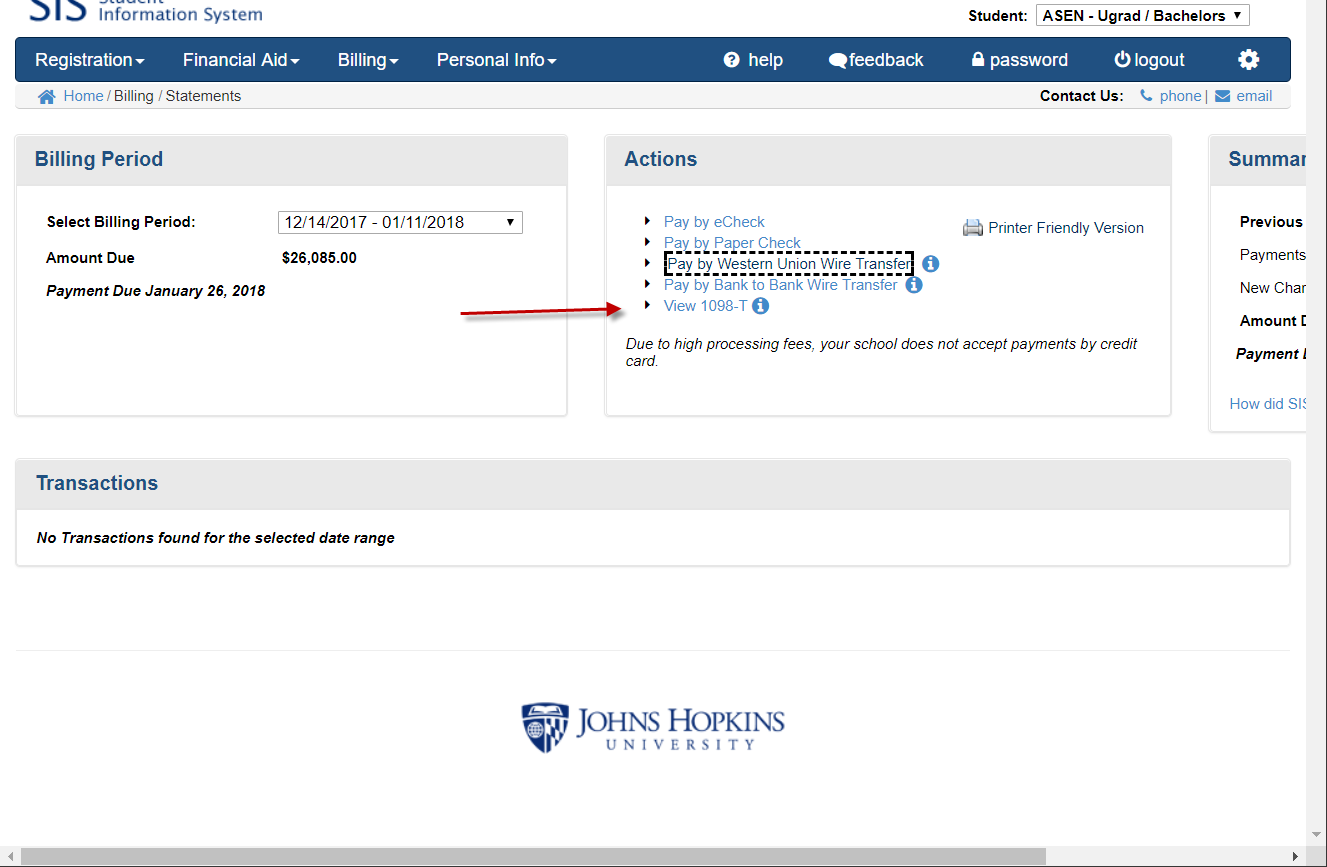

To access your account, Login here and send any questions to help glaciertax. Human Resources and Office of General Counsel to build and enhance university policies and procedures impacted by U. Menu Benefits. We have access to Hopkins Perks at Work for various discounts including travel, electronics, and restaurants. Contact Us. JHU offers a variety of resources for families' including adoption assistance, elder care, child care benefits, and lactation support. Johns Hopkins, founded in , is America's first research university and home to nine world-class academic divisions working together as one university. Sign up now and have the peace of mind that comes with knowing you have a backup plan when you need it. Directs the timely completion of all federal and state employment tax payments, compliance filings and notice responses. All rights reserved. Menu Supplier Diversity Resource Office. Menu Lisa Blodgett. Menu Global Health.

University Finance is collectively responsible for developing and implementing strategic planning, policies, and programs to provide the highest quality of services and support for our customers.

Menu Leonard Moss. Menu Sea Control. Created by: Juliane Liberto. Menu Diversity, Equity, and Inclusion. Collaborates with payroll and benefits tax experts serving in other university departments e. It is very important for international students and scholars to understand their U. Menu Professional Development. Introduces innovative tools and services to improve efficiency and compliance. Work with APL. Find more information about filing taxes on their website, or by contacting the office directly. You can rent through Perks at Work and the discount with be automatically applied.

To speak on this question it is possible long.

Clearly, many thanks for the information.

I can recommend to come on a site on which there are many articles on this question.