Kotak emerging equity fund morningstar

Get our overall rating based on a fundamental assessment of the pillars below. Fees are a weakness here.

Suitable For : Investors who are looking to invest money for at least years and looking for high returns. At the same time, these investors should also be ready for possibility of moderate losses in their investments. Crisil Rank Change : Fund Crisil rank was updated from 3 to 2 in the previous quarter. If sold after 1 year from purchase date, long term capital gain tax will be applicable. If sold before 1 year from purchase date, short term capital gain tax will be applicable.

Kotak emerging equity fund morningstar

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio of equity and equity related securities, by investing predominantly in mid companies. The scheme may also invest in debt and money market instruments, as per the asset allocation table. There is no assurance that the investment objective of the scheme will be achieved. The fund has an exit load of 1. The major sectors where the fund is invested are Chemical Manufacturing, Misc. Capital Goods. Kotak Emerging Equity Scheme Growth has a sharpe ratio of 1. Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image. You are now subscribed to our newsletters. Hello User. Sign in. Sign Out. My Account.

Tools and Calculators.

Get our overall rating based on a fundamental assessment of the pillars below. Unlock our full analysis with Morningstar Investor. Morningstar brands and products. Investing Ideas. Start a 7-Day Free Trial.

Suitable For : Investors who are looking to invest money for at least years and looking for high returns. At the same time, these investors should also be ready for possibility of moderate losses in their investments. Crisil Rank Change : Fund Crisil rank was updated from 3 to 2 in the previous quarter. If sold after 1 year from purchase date, long term capital gain tax will be applicable. If sold before 1 year from purchase date, short term capital gain tax will be applicable.

Kotak emerging equity fund morningstar

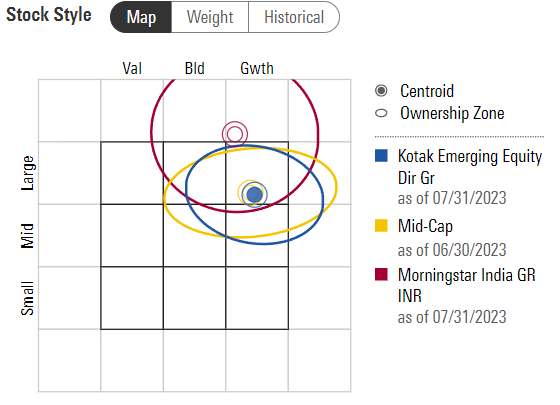

The fund stands out on many counts. Our conviction on the manager and his stock selection process leads to an overall rating of Silver Direct Plan and Bronze Regular Plan. What the Morningstar Fund Rating Indicates. Watch the Video. He has built a strong track record on the funds that he manages at the AMC. Tibrewal also gets the support of a strong and a stable research team who are well ingrained in the Kotak philosophy. The manger runs the fund with the basic premise of ensuring that the portfolio is well diversified and aims to reduce liquidity risks by investing in quality businesses that are unlevered. The focus here is on investing in growth stocks that have sustainable competitive advantages.

Badminton coaching centre

Small Blend Funds. You are not required to pay it explicitly but it is deducted from the NAV on a daily basis. Regular funds have higher expense ratio and direct funds have lower expense ratio. Very High. Better risk adjusted returns. Posted by : bhaveshnegandhi. Select your Category Query Suggestion. You have to be logged in to add this to Watchlist. Login Now. However both have different expense ratios. Infosys Ltd ADR. Foreign Large Blend Funds.

NAV as of Mar 07, Returns Annualised Returns since inception.

Looks like you have exceeded the limit to bookmark the image. Start a 7-Day Free Trial. Date : - Investment : - Value on selected date : -. Better risk adjusted returns. Consumer Cyclical. Powered by. Financial Services. Repost this message at the time of nfo meet speech was like tiger and now performance is like cat Repost Cancel. Morning Star Rating 4 Moderate. Process Pillar. Tata Consultancy Services Ltd. Taxable Bond. Cummins India Ltd. Like 1 Reply reply Cancel. Detailed Comparison.

In my opinion here someone has gone in cycles

In it something is. Thanks for the help in this question. I did not know it.