Leverage ratchet effect

We analyze equilibrium leverage dynamics in a dynamic tradeoff model when the firm is unable to commit to a leverage policy ex ante.

Bank leverage, welfare, and regulation. Admati, Anat R. Debt overhang and capital regulation. Fallacies, irrelevant facts, and myths in the discussion of capital regulation: Why bank equity is not socially expensive. Fallacies, irrelevant facts, and myths in the discussion of capital regulation: Why bank equity is not expensive.

Leverage ratchet effect

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

A ratchet is an analogy to a mechanical ratchet, which spins one way but not the other, in an economic process that tends to only work one way.

Other versions of this item: Anat R. Admati, Anat R. Nyborg, Discussion Papers. Douglas W.

A ratchet effect is an instance of the restrained ability of human processes to be reversed once a specific thing has happened, analogous with the mechanical ratchet that holds the spring tight as a clock is wound up. It is related to the phenomena of featuritis and scope creep in the manufacture of various consumer goods, and of mission creep in military planning. In sociology, "ratchet effects refer to the tendency for central controllers to base next year's targets on last year's performance, meaning that managers who expect still to be in place in the next target period have a perverse incentive not to exceed targets even if they could easily do so". Garrett Hardin , a biologist and environmentalist, used the phrase to describe how food aid keeps people alive who would otherwise die in a famine. They live and multiply in better times, making another bigger crisis inevitable, since the supply of food has not been increased. Peacock and Wiseman found that public spending increases like a ratchet following periods of crisis.

Leverage ratchet effect

Admati, and Peter M. DeMarzo say there is a disincentive for shareholders to urge companies to cut back on borrowing. Drew Kelly. The ratchet stems in part from a basic conflict of interest between shareholders and creditors, and in part from government policies that encourage debt and risk-taking. Now, in a new paper , the researchers argue that banks are not alone. Other corporations become addicted to debt, even when it reduces the total value of the enterprise. Pfleiderer teamed up with Anat R. Admati and Peter M. The authors argue that since reducing debt entails a transfer of risk — and wealth — from shareholders to creditors, there is a clear disincentive for shareholders to cut back on borrowing.

Cover for sofa

Measure advertising performance. This is very similar to a positive feedback loop, which is any pattern that reinforces itself. If forced to reduce leverage, shareholders are biased toward selling assets relative to potentially more efficient alternatives such as pure recapitalizations. This application of the ratchet effect was further explored by historian Robert Higgs, who described how crises and emergencies are used to expand the powers of government agencies, often on an allegedly temporary basis, which then become permanent expansions of government power and intervention into the economy once the crisis has passed. Since firms are always seeking growth and greater profit margins , it is hard to scale back production. Kenneth R. Charness, G. I need help. The ratchet effect is named after the mechanical device known as a ratchet, which consists of a round gear and pivoting pawl that allows the gear to turn in one direction but not the other in order, for example, to turn a bolt or to compress a spring. With debt in place, shareholders pervasively resist leverage reductions no matter how much such reductions may enhance firm value. In a dynamic context, since leverage becomes effectively irreversible, firms may limit leverage initially but then ratchet it up in response to shocks. This requires additional investment in new machinery, or a different type of skilled worker, which increases the cost of labor. Ilya A.

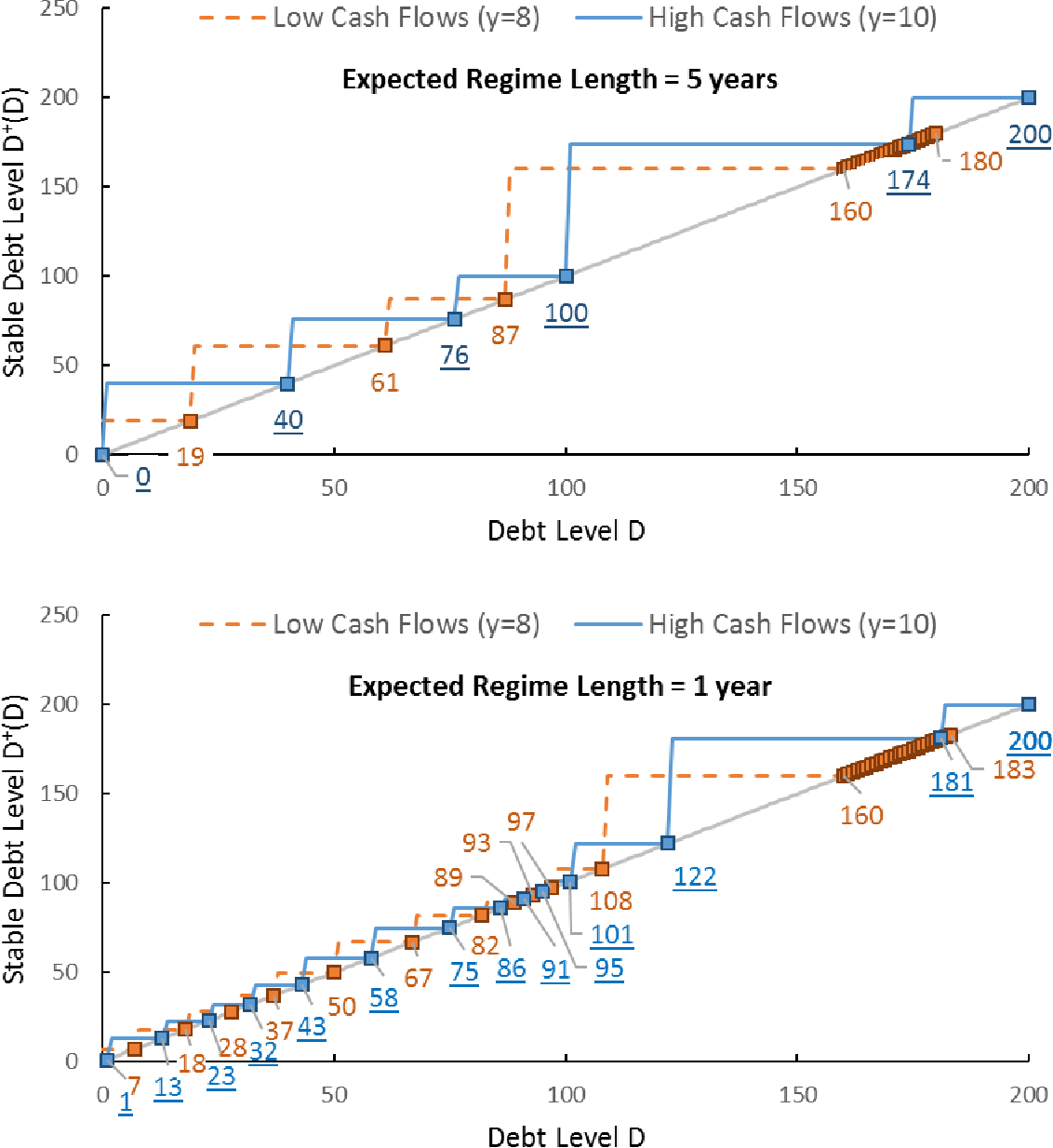

In the absence of prior commitments or regulations, shareholder-creditor conflicts give rise to a leverage ratchet effect, which induces shareholders to resist reductions while favoring increases in leverage even when total-value maximization calls for the opposite.

Toni M. On the other hand, countervailing effects of asset growth and debt maturity cause leverage to mean-revert towards a long run target. Unlike inefficiencies based on asymmetric information, the leverage ratchet effect applies to all forms of leverage reduction, including earnings retentions and rights offerings. Ratchet effects can be seen in many areas of economics and markets, from political economy to consumer and labor markets. A ratchet is an analogy to a mechanical ratchet, which spins one way but not the other, in an economic process that tends to only work one way. Hellwig; Paul Pfleiderer. Saved in:. If you have authored this item and are not yet registered with RePEc, we encourage you to do it here. Extent: Online-Ressource 56 S. The ratchet effect is related to the idea of a positive feedback loop, but also may involve a process that can experience a forceful backlash if the process is reversed. Majluf, Stanford, Calif.

0 thoughts on “Leverage ratchet effect”