Lifestrategy 80 equity fund accumulation

Financial Times Close. Search the FT Search. Show more World link World.

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Figures for periods of less than one year are cumulative returns. All other figures represent average annual returns. Performance figures include the reinvestment of all dividends and any capital gains distributions.

Lifestrategy 80 equity fund accumulation

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. With income units, any income is paid as cash. This can be withdrawn, reinvested or simply held on your account. With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund. Generally accumulation units offer a slightly more efficient way to reinvest income, although many investors will choose to hold income units and reinvest the income to buy extra units. We believe all loyalty bonuses are tax-free and we are challenging HMRC's interpretation. If we are successful in our challenge we will return this money to clients. If we are unsuccessful we will use the money to pay over any amounts due to HMRC. If loyalty bonuses are taxable then the value of our ongoing saving to you could be reduced, depending on the rate of tax you pay.

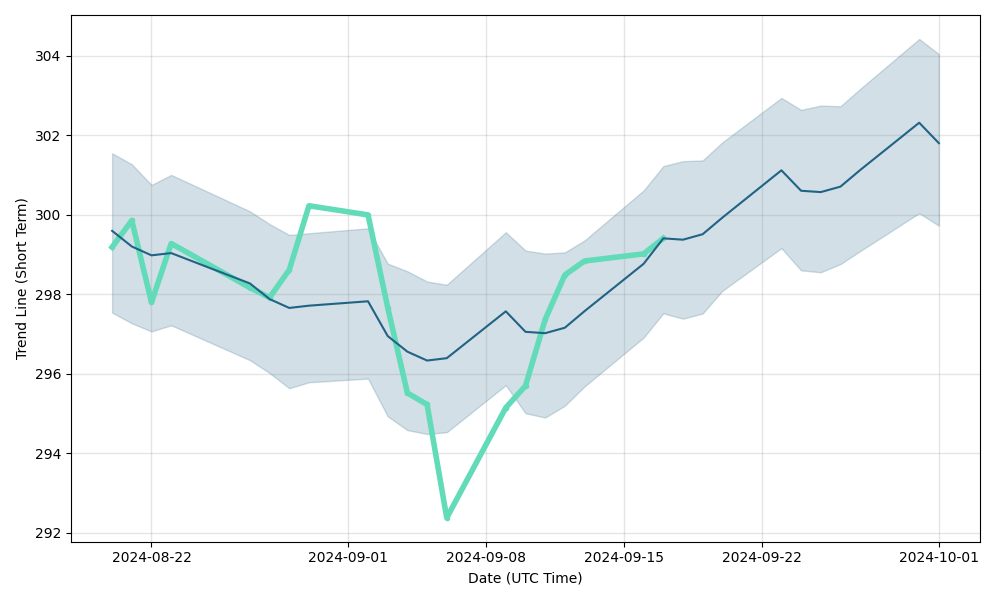

UK Reporting. There are no Historical Prices for the selected date range, please select a different date. Past performance is no guarantee of future results.

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Figures for periods of less than one year are cumulative returns. All other figures represent average annual returns.

Decide how you want to divide your money between stocks and bonds—then let the fund do the work. Asset allocation—the mix of stocks, bonds, and cash held in your portfolio—can have a big impact on your long-term returns. So why not pick a fund with an asset allocation that fits your goals, time horizon, and risk tolerance? You may be interested in this fund if you care mostly about current income and accept the limited growth potential that comes with less exposure to stock market risk. You may be interested in this fund if you care about current income more than long-term growth, but still want some growth potential with less exposure to stock market risk. You may be interested in this fund if you care about long-term growth more than current income and want more growth potential while accepting higher exposure to stock market risk. You may be interested in this fund if you care about long-term growth and are willing to accept significant exposure to stock market risk in exchange for more growth potential. Not sure which asset allocation is right for you? Investment time horizon 3 to 5 years.

Lifestrategy 80 equity fund accumulation

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

Instagram crash message copy paste

For information on the historical Morningstar Medalist Rating for any managed investment Morningstar covers, please contact your local Morningstar office. Income and accumulation units With income units, any income is paid as cash. Contact us Log in. Data provided by Broadridge, correct as at 31 December In particular, the content does not constitute any form of advice, recommendation, representation, endorsement or arrangement by FT and is not intended to be relied upon by users in making or refraining from making any specific investment or other decisions. About this fund Performance Portfolio data Prices and distribution Purchase information What's on this page. With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund. Past performance is not necessarily a guide to future performance; unit prices may fall as well as rise. Ads help us provide you with high quality content at no cost to you. Search the FT Search. Actions Add to watchlist Add to portfolio.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here.

With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund. Some short-term fixed income securities are classified as cash and are excluded from the weighted bond exposures. Please continue to support Morningstar by adding us to your whitelist or disabling your ad blocker while visiting oursite. Allocation percentages reflect the breakdown of security type. There are no Historical Prices for the selected date range, please select a different date. Financial Times Close. Show more Personal Finance link Personal Finance. This information is provided to help you choose your own investments, remember they can fall as well as rise in value so you may not get back the original amount invested. If we are successful in our challenge we will return this money to clients. NAV Price. Wednesday, February 21, Wed, Feb 21, Figures for periods of less than one year are cumulative returns. Prices and distribution.

I understand this question. Let's discuss.

You are not right. I can defend the position. Write to me in PM.