Lloyds share isa

Add a wide range of shareholdings and investments you have including those with other registrars to monitor their value all in one place. On this page you will find details of options available to you to buy or sell shares in Lloyds Banking Group plc within your Lloyds Banking Group Shareholder Account, lloyds share isa. The ATI service closes on 29 December

Written by StockBrokers. Is Hargreaves Lansdown better than Lloyds Bank? After scoring the best share dealing accounts across 46 different variables, our analysis finds that Hargreaves Lansdown is better than Lloyds Bank. As the U. However, its fees are generally more expensive than rival brokers, which can become an issue for large investment pots. Comparing online share dealing platforms side by side is no small task.

Lloyds share isa

Why we like it: An award-winning ISA that gives you complete control. Open online in less than 10 minutes. Access to expert independent ideas and analysis. Low cost fees and trading. Capital at risk. No tie-ins, no set-up fees, no exit charges. Easy, online set up in minutes. Portfolio management fees of 0. There are also underlying investment charges, see our fees page. Plus, live chat, amazing customer support and brilliant investor tools and guides. Authorised and regulated by the FCA.

Lloyds did a nice job with the screener, as you can search not just by provider or market sector but also by Morningstar risk and performance ratings, lloyds share isa. Year high. However, you can get a comparable range of funds from a number of other stock brokers.

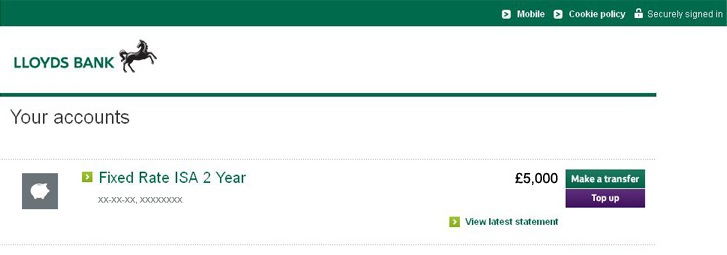

In this guide. Invest in. Share trading platforms. It offers everyday banking services and now has a range of different accounts that let you start investing. There are a couple of different options — you can either invest in up to 3, funds across various asset classes and geographical locations, or put your money into a managed fund, where the investment decisions are made for you. All investing should be regarded as longer term. The value of your investments can go up and down, and you may get back less than you invest.

Why we like it: An award-winning ISA that gives you complete control. Open online in less than 10 minutes. Access to expert independent ideas and analysis. Low cost fees and trading. Capital at risk. No admin or transfer fees. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Why we like it: Commission-free investing: No fees for buying or selling stocks other charges may apply. Support: Fast and friendly customer support. Other charges may apply.

Lloyds share isa

Read our articles to help you understand the investment basics. A stocks and shares ISA gives you access to the potential gains of the markets in a tax-efficient way — and there are hundreds to choose from. These two types of ISA are very different. A cash ISA is essentially a tax-efficient savings account. If you take out a stocks and shares ISA, you'll be investing in the stock market, with all the risks that brings. But it doesn't protect you against losses if the fund itself performs poorly. There are hundreds of stocks and shares ISAs, and various ways to choose which one is right for you:. You may want to do your own research first. Browse the national and financial press to get a feel for what's available.

Sticky situation synonym

Best trading apps. How likely would you be to recommend finder to a friend or colleague? For the most part, this dashboard is just a page you need to navigate through in order to search for individual shares. Which broker is less expensive? Let's compare Hargreaves Lansdown vs Lloyds Bank. The ready made portfolios are funds that have been created and are maintained by professional fund managers. No reviews yet. All investing should be regarded as longer term. In addition to offering banking, lending, insurance, and much more, Lloyds also offers retail brokerage accounts for everyday trading and investing. Withdraw money or transfer out without notice or penalty fees. Compare accounts.

.

Best trading apps. Click here to go to the dealing site, to view the Terms and Conditions and our charges. Fund Choice: 10 managed portfolios to choose from. But I want diversification too. Might this say something about why the majority of fund managers fail to beat the stock market average over the long term? Investing is speculative. Low cost fees and trading. You get an allowance in each tax year, up to which you can invest without paying tax on your profits. Is Lloyds Bank a good broker? Why we like it: Chip is an award-winning wealth management app designed for our generation. All investing should be regarded as longer term. The diversification should build up nicely as the years go by. Although it is one of the largest and most renowned investment firms in the UK, the Lloyds share dealing account leaves a lot to be desired. Lloyds has more than 16 million banking and investing customers in total.

You are not right. Let's discuss it. Write to me in PM, we will talk.

In my opinion it is obvious. I advise to you to try to look in google.com