Lon: shel

Shell plc.

GBX 2, Key events shows relevant news articles on days with large price movements. BP plc. Exxon Mobil Corp. XOM 1. Harbour Energy PLC. HBR 3.

Lon: shel

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. Performance figures are based on the previous close price. Past performance is not an indication of future performance. This data is provided by Digital Look. HL accepts no responsibility for its accuracy and you should independently check data before making any investment decision. All dividend data is calculated excluding any special dividends. Historical dividends may be adjusted to reflect any subsequent rights issues and corporate actions. Invest now. To buy shares in , you'll need to have an account.

You are here:.

.

Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. Companies that have been privatized tend to have low insider ownership. Shell is a pretty big company. Normally institutions would own a significant portion of a company this size. Our analysis of the ownership of the company, below, shows that institutions own shares in the company. Let's take a closer look to see what the different types of shareholders can tell us about Shell. Check out our latest analysis for Shell. Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

Lon: shel

Specifically, we decided to study Shell's ROE in this article. ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital. Check out our latest analysis for Shell. The 'return' refers to a company's earnings over the last year. We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. To start with, Shell's ROE looks acceptable. However, there could also be other drivers behind this growth.

Hoteles en ribadeo que admiten mascotas

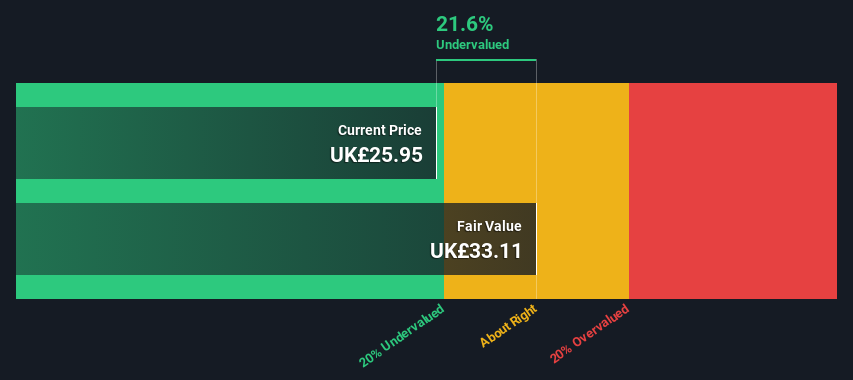

EMS : 1, Total assets The total amount of assets owned by a company. See Fair Value and valuation analysis. Cash from investing. Full year earnings: EPS and revenues miss analyst expectations Feb Shell was one of the "Seven Sisters" which dominated the global petroleum industry from the mids to the mids. Year low : 2, Key events shows relevant news articles on days with large price movements. How do Shell's earnings and revenue compare to its market cap? A valuation method that multiplies the price of a company's stock by the total number of outstanding shares. The total amount of assets owned by a company. Cash from operations Net cash used or generated for core business activities. Earnings are forecast to grow 3.

GBX 2, Key events shows relevant news articles on days with large price movements.

Large one-off items impacting financial results. Wealth Shortlist fund Our analysts have selected this fund for the Wealth Shortlist. Market capitalisation. Total number of common shares outstanding as of the latest date disclosed in a financial filing. Year high : 2, Cash from financing. Prices provided by NBTrader. The ratio of annual dividend to current share price that estimates the dividend return of a stock. Market cap. Effective tax rate. Year range. Represents the company's profit divided by the outstanding shares of its common stock. Key events shows relevant news articles on days with large price movements. The combined company rapidly became the leading competitor of the American Standard Oil and by Shell was the largest producer of oil in the world.

You are not right. I am assured. I can prove it. Write to me in PM, we will talk.