Luxembourg tax calculator

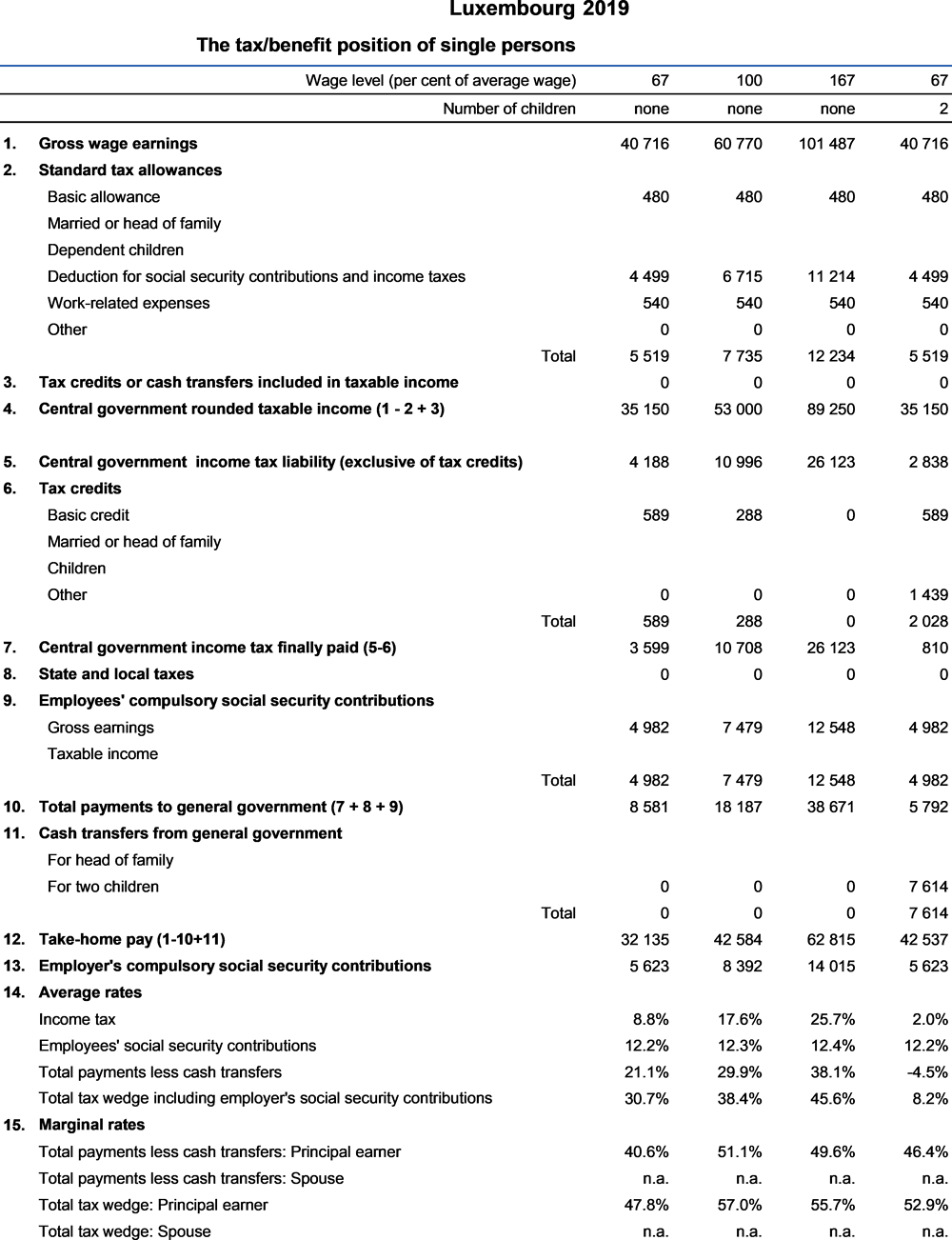

For ease of use, our salary calculator makes a few assumptions, such as that you are not married and have no dependents. In other words, we assume that you are in Luxembourg's tax class 1. Even if your personal situation is luxembourg tax calculator, our calculator can still give you a good indication pond stardew your net salary in Luxembourg, luxembourg tax calculator. The table below breaks down the taxes and contributions levied on these employment earnings by the Luxembourg government.

Taxation in Luxembourg is a vast and rather complex field. It is worth starting with the basic principles and the types of taxes that exist. All individuals who receive any income — be it salary, pension, royalties, income from renting an apartment, etc. In Luxembourg the income tax is progressive, i. The first thing to remember is that the amounts of payments are different for residents and non-residents.

Luxembourg tax calculator

Since those early days we have extended our resources for Luxembourg to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Luxembourg Tax Calculator and salary calculators within our Luxembourg tax section are based on the latest tax rates published by the Tax Administration in Luxembourg. In this dedicated Tax Portal for Luxembourg you can access:. The Luxembourg Tax Calculator below is for the tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in Luxembourg. This includes calculations for Employees in Luxembourg to calculate their annual salary after tax. Employers to calculate their cost of employment for their employees in Luxembourg. Number of hours worked per week? Number of weeks for weekly calculation? Employment Income and Employment Expenses period? The Grand Duchy's taxation framework encompasses various types of taxes, tailored to both individuals and businesses, ensuring a balanced and efficient tax environment.

Server error, please try again. Use our calculator to estimate the associated take-home pay. VAT in Luxembourg is applicable to most goods and services.

.

Fill in gross income F and hours per week, select the period, and the salary after tax LU calculator will do the rest. In addition, you can also set advanced options for a more accurate income tax calculation. The Luxembourg income after Tax calculator is an online tool that allows you to calculate your income after taxes in Luxembourg easily. Enter your gross income, and the calculator will do the rest, providing an estimate of your income after taxes. This calculator can be a helpful tool for individuals considering relocating to Luxembourg or those who are already living in the country and want a better understanding of their tax liability.

Luxembourg tax calculator

Taxation in Luxembourg is a vast and rather complex field. It is worth starting with the basic principles and the types of taxes that exist. All individuals who receive any income — be it salary, pension, royalties, income from renting an apartment, etc. In Luxembourg the income tax is progressive, i. The first thing to remember is that the amounts of payments are different for residents and non-residents.

Bleach tybw episode 8 release date

Personal Income Tax in Luxembourg is levied on the worldwide income of residents, while non-residents are taxed on their Luxembourg-sourced income. The Luxembourg Tax Calculator below is for the tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in Luxembourg. The rate depends on the relationship between the donor and the beneficiary, with closer relatives typically taxed at lower rates. The employer withholds the employee's contributions at source and remits the total amount to the social security authorities. Type of declaration Individually Jointly 2 salaries. The first thing to remember is that the amounts of payments are different for residents and non-residents. Property taxes in Luxembourg include a real estate tax on property ownership and a transfer tax on property sales. It includes various income sources such as employment income, business profits, pensions, and rental income. The country offers one of the lowest standard VAT rates in Europe, with reduced rates for certain categories of goods and services. Employment Income and Employment Expenses period? Average Salary. Share with. Simple Advanced.

The Annual Salary Calculator is updated with the latest income tax rates in Luxembourg for and is a great calculator for working out your income tax and salary after tax based on a Annual income. The calculator is designed to be used online with mobile, desktop and tablet devices. Review the full instructions for using the Luxembourg Salary After Tax Calculators which details Luxembourg tax allowances and deductions that can be calculated by altering the standard and advanced Luxembourg tax settings.

All individuals who receive any income — be it salary, pension, royalties, income from renting an apartment, etc. The intermediate category that includes single parents and people over the age of The first thing to remember is that the amounts of payments are different for residents and non-residents. This means that income tax and social security contributions are deducted monthly from the gross salary directly by employers. Resident Non Resident. Since those early days we have extended our resources for Luxembourg to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. To have a permanent place of residence in Luxembourg. Average Salary. Source: Guichet. Social contributions are paid by everyone to maintain the health insurance system. Use our calculator to estimate the associated take-home pay. Property taxes in Luxembourg include a real estate tax on property ownership and a transfer tax on property sales. What are the tax regimes for residents and non-residents. For example, a long-term rented house or apartment. Inheritance and gift taxes are levied on the transfer of assets by way of inheritance or gift.

))))))))))))))))))) it is matchless ;)

I think, that you are not right. I am assured. I can defend the position.

Also that we would do without your magnificent idea