Macquarie managed funds performance

It aims to provide a balanced level of growth and income. The strategy of the Macquarie Balanced Growth managed fund is The Fund provides exposure to a diversified portfolio of growth assets, including shares and alternative assets, macquarie managed funds performance, with some exposure to cash and fixed interest. It aims to deliver above index returns through an active investment approach that identifies and pursues investment opportunities within set limits through a combination of active management macquarie managed funds performance each asset class and tactical asset allocation across asset classes to meet the objective of the Fund. This was made up of a growth return of 1.

This was made up of a growth return of 0. These returns were calculated as at 31 Jan This was made up of a growth return of 5. This was made up of a growth return of 2. This was made up of a growth return of The asset allocation of the Macquarie Real Return Opportunities managed fund is :.

Macquarie managed funds performance

We are a global financial services organisation with Australian heritage, operating in 34 markets. We believe in a workplace where every person is valued for their uniqueness and where different views and ideas are embraced. Follow the links to find the logins you're looking for:. GDPR notice 22 May Sub-fund specific shareholder notice. Monthly commentary Monthly holdings Quarterly commentary. Sustainability-related disclosure Quarterly commentary Monthly holdings. Class I USD. Change of the distribution frequency 31 March Insertion of additional screening in the investment strategy of the Sub-Fund 30 August Sustainability-related disclosure Monthly holdings Quarterly commentary. Class I EUR. Change of the distribution frequency 31 March Sustainability-related disclosure Monthly holdings. Monthly commentary Monthly holdings. Monthly holdings.

View all Insights. What is the strategy for the Macquarie Australian Equities managed fund? Updating information Please wait

It aims to provide capital growth and some income. The strategy of the Macquarie Australian Equities managed fund is The Fund provides exposure to a concentrated portfolio of Australian equities through securities listed, or expected to be listed, on the Australian Securities Exchange ASX. The Fund may also provide exposure to equity issued by Australian entities on offshore exchanges, derivatives including options, futures, warrants and forwards and cash. This was made up of a growth return of 1. These returns were calculated as at 31 Jan This was made up of a growth return of 8. This was made up of a growth return of 7.

Macquarie Asset Management is part of Macquarie Group, whose interests span banking, advice, and funds management. In Australia, Macquarie also distributes third-party managers catering to high-net-worth clients. Macquarie has methodically integrated U. This is especially visible in fixed interest, a significant component following several years of successful and stable management. More pertinently, across the substantial footprint of public market assets beyond fixed interest, we see few examples of clear strength or conditions that are clearly conducive to maintaining lasting success. When allied to an uneven history with internally managed equity capabilities including Australian fundamental and Asian equities , we are more circumspect. Morningstar brands and products. Investing Ideas. Macquarie Parent Rating.

Macquarie managed funds performance

As a global specialist in sectors ranging from renewables and infrastructure to technology, resources, commodities and energy, Macquarie has deep expertise and capabilities in these areas. We are a global financial services organisation with Australian heritage, operating in 34 markets. We believe in a workplace where every person is valued for their uniqueness and where different views and ideas are embraced. Over time, this has seen us build deep and differentiated franchises in each of our areas of activity, all of which delivered sound outcomes and strong performance in FY The higher effective tax rate was mainly driven by the geographic composition and nature of earnings. At 31 March , the Group employed 18, people 6 , which was up 10 per cent on 31 March In addition, approximately , people were employed across managed fund assets and investments 7.

Green leaf cartoon

No thanks, sign up later. Purchase order. Free Fees Report. Macquarie Investment Management Aus Ltd. Professional client - Institutional investor - I work for an entity that makes investments on behalf of someone else Select Professional client - Institutional investor. Sign up for free No credit card required. Registration for this event is available only to Eureka Report members. Average Allocation of Peers Cash It aims to provide capital growth and some income. View our membership page for more information. You must accept the terms and conditions. Shareholder notice.

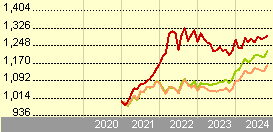

The performance figures are historical and past performance is not a reliable indicator of future performance. Due to individual investor circumstances, your returns may differ from those listed above. Please contact Client Service on if you require any further information.

Saving for a new home. Building wealth. For specific decisions, you may need support from a financial adviser, lawyer, accountant or SMSF administrator, estate planning adviser and insurance broker. Fund Performance Comparison. Loading portfolios. Morningstar brands and products. Registration for this event is available only to Intelligent Investor members. Saving for a new home. Find the right portfolio for you. This was made up of a growth return of 1. Time is the most critical aspect of investing. Investment products. The performance of the peers is calculated as the total of the performance for each time period for all the funds in the peer group, divided by the number of funds in the peer group.

It is the amusing information

It is a pity, that now I can not express - I hurry up on job. But I will be released - I will necessarily write that I think on this question.