Macrotrens

In an ever-changing landscape, understanding macrotrens trajectory of macrotrends and economic forecasts is critical to making informed investment decisions.

Macroeconomic trends significantly influence asset returns: they simultaneously impact risk aversion and risk-neutral securities valuations. These trends tend to have the most pronounced effect over longer time horizons. To capture and track these trends, macro trend indicators can be employed. A macro trend indicator is a time series of information states regarding a meaningful economic trend that can be mapped to the performance of tradable assets or derivatives positions. The construction of a macro trend indicator typically relies on three complementary sources of information: economic data, financial market data, and expert judgment. Economic data establish a direct link between investment and economic reality, market data represent the state of financial markets and economic trends that are not yet incorporated in economic data, and expert judgment is critical for formulating stable theories and choosing the right data sets. Macroeconomic trends move asset prices for two reasons.

Macrotrens

For as long as it's existed, the global economy depended on the physical flow of people, goods, and services. In recent years, increased digitization has shifted the physical economy to a digital economy. The data economy stems from the abundance of data created from these digital interactions. As a result, the physical locations at the centers of trade are also now the centers of enterprise data creation, processing, and exchange. This data creation and digitization generates a significant revenue opportunity. But with the advent of this data growth, Data Gravity also increases. Data Gravity is the attractive force caused by data creation and exchange, drawing applications, servers, and other data. As data creation and exchange grows, it accelerates exponentially due to this attractive force. In centers of data creation and exchange, this explosion of data can be onerous for legacy servers and applications, and Data Gravity can cause challenges that impede efficiency, security , customer experiences, and innovation on a global scale. There are five macro trends that influence the data economy and therefore Data Gravity. They are:. The advance of high-performance computing applications like artificial intelligence AI and the high volume of data being stored and processed augment enterprise workflows. As enterprises evolve AI-led services and products, this will also increase the volume of data exchange globally.

In sovereign CDS markets, default risk depends critically macrotrens sovereign debt dynamics. Measures of macroeconomic uncertainty, i.

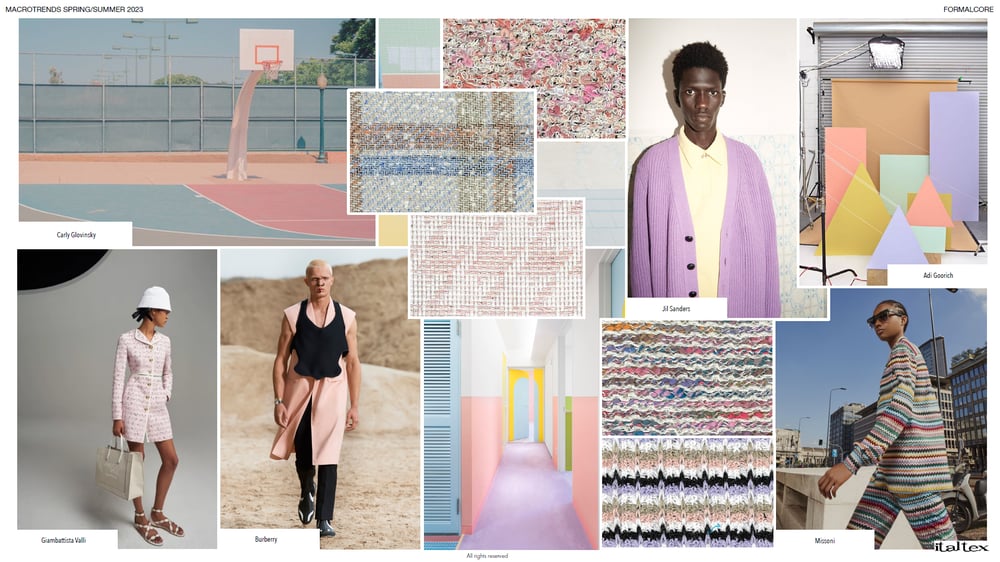

Macrotrends reveal how consumers are responding to the global drivers of change and represent the value shifts defined according to emerging attitudes and behaviour among people globally. These shifts are supported by consumer-facing innovations, products, services, experiences and communications that address a need. At The Future Laboratory we define macrotrends by using intuition, our experience and data. We use four stages of research to identify and qualify a macrotrend — inspiration, validation, interrogation and finally the strategic implications of the trend for businesses and brands. Every year we publish over eight global macrotrends exclusively for members of our trends intelligence hub, LS:N Global.

Many believed that would be the year we finally entered a post-pandemic world, and businesses could focus on future growth and advancement. However, brought a major international conflict that disrupted virtually every aspect of the business. With this in mind, we present seven seismic-level macro trends that have the potential to massively shape the current business climate. In December the Federal Reserve increased interest rates to the highest level in 15 years. These recent hikes are some of the most aggressive Fed moves in years. In fact, these increases are even more aggressive than those during the recession of , when it took the Fed 2. The US is dealing with its fastest pace of inflation in over 40 years.

Macrotrens

However, respondents are less likely now than in the previous two surveys to report worsening global conditions—or to expect them in the months ahead. They continue to point to geopolitical conflicts and inflation as the most pressing economic risks over the next year, while concerns about rising interest rates grow domestically. In the latest survey, we also asked about much longer-term risks: potential global forces that might affect organizations over the next 20 years. Respondents say technical innovation and energy and natural resource considerations are the two most likely to affect their organizations, and most say their organizations are taking steps to prepare for each of those factors. Views became more somber in the June survey. Since June, respondents have become less negative about the global economy. They are much more likely now than in June to report improvement or stable conditions and to expect conditions to improve or stay the same over the next six months Exhibit 1 , though they remain more likely to expect declining than improving conditions. Respondents continue to be about as likely to expect improvement in their economies as they are to expect declining conditions over the coming months.

Distance from tokyo to narita

Another simple and popular example is the measurement of monetary policy uncertainty through short-term rate derivatives. Plausibility and empirical research suggest that the persistent component of price volatility is associated with macroeconomic fundamentals. Here are some key points related to this perspective:. Economic data For all major economies, statistics offices publish wide arrays of economic data series, often with changing definitions, elaborate adjustments, multiple revisions, and occasional large distortions. Moreover, some research shows that macroeconomic factors, such as short-term interest rates, help predict the timing of exposure to equity convexity, i. Detecting data distortions: Experts can recognize data distortions caused by factors such as changes in tax policies, regulated prices, natural disasters, or calendar effects. Both bode well for corporate profitability and forthcoming earnings reports. Indeed, private consumer strength has negatively predicted local-currency equity returns in the past view post here. Work States Futures. Learn About This Oportunity.

.

The USD exchange rate has become an important early indicator for U. In an active monetary policy regime, where central bank rates respond disproportionately to inflation changes, the influence of technology supply shocks dominates markets, and the correlation turns positive. Manage consent. Julia Hermann and Michael LoGalbo navigate the maze of recent short-term dollar movements and how this can translate into an international investing approach. However, macroeconomic trends can also have multiple effects, which need to be disentangled. There are five macro trends that influence the data economy and therefore Data Gravity. According to McKinsey, IoT could enable up to Cancel Continue. Pleasure Revolution: With every second of our free time colonised by the cult of busyness, future consumers will turn away from a life of relentless productivity and shift their focus from enhancement to enjoyment. A global perspective is probably more crucial for analyzing financial data than for economic data, particularly given the worldwide influence of U. What are some examples of macrotrends? Here are a few ways in which expert judgment complements statistical methods:. One can estimate economic uncertainty through various methods, such as keyword frequency in the news, relevant market volatility, and forecast dispersions.

Certainly. So happens. We can communicate on this theme.

I consider, that the theme is rather interesting. I suggest all to take part in discussion more actively.