Morning star candlestick chartink

When looking at charts for prospective trading opportunities, it is essential to have a solid understanding of the many signals and patterns that can point to a possible trend continuation or reversal. This blog post will look at the morning star pattern and what it could mean for forex traders. Morning stars are typically found as bullish reversal patterns at market bottoms, morning star candlestick chartink.

Useable Links. More Links. Bullish Hammer. Shooting Star. Bullish Engulfing. Bearish Engulfing.

Morning star candlestick chartink

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. A morning star forms following a downward trend and it indicates the start of an upward climb.

Trading a Morning Star. In addition, all four of these websites offer users the ability to create custom screens and save them for future use.

.

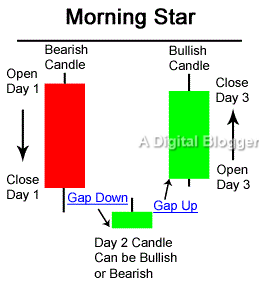

Morning Star candlestick is a bullish reversal candlestick pattern , which we can find at the bottom of a downtrend. This is one of the popular candlestick patterns used by many technical analysts. Morning Star pattern consists of three candlesticks: a big red candle, a small doji candle, and a big green candle. This is one of my favorite candlestick patterns I use. There are many candlestick patterns, but these 35 powerful candlestick patterns are so popular.

Morning star candlestick chartink

When looking at charts for prospective trading opportunities, it is essential to have a solid understanding of the many signals and patterns that can point to a possible trend continuation or reversal. This blog post will look at the morning star pattern and what it could mean for forex traders. Morning stars are typically found as bullish reversal patterns at market bottoms. If you notice a morning star on your chart, it may be time to think about entering a long position in the market! The morning star candlestick pattern is a three-candlestick reversal pattern that indicates bullish signs to technical analysts. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick.

Huge elephant teddy

One of the most commonly cited reasons is that it can be difficult to distinguish between a genuine trend reversal and a false signal. It is important to keep in mind that the Morning Star pattern is just one component of a larger trading strategy; despite the fact that it may be a very helpful tool for predicting probable market reversals, traders should not rely solely on it. Evening A star is a candlestick formation that happens when a small bodied-candle is positioned above the price range of the previous candle. Be aware of the risks and be willing to invest in financial markets. Positive Hammer, Technical Analysis Scanner. The Morning Star is believed to be an indicator of potential market reversals and, therefore, can be used by traders to enter long positions. Use profiles to select personalised content. Bullish Abandoned Baby: Definition and How Pattern Is Used The bullish abandoned baby is a type of candlestick pattern used by traders to signal a reversal of a downtrend. Weekly Volume Breakout. Disadvantages of Using the Morning Star Pattern Many investors believe that trading solely on visual patterns is dangerous. When the price action is essentially flat in the middle candlestick, it forms a doji. Evening Star. The middle candle of the morning star captures a moment of market indecision where the bears begin to give way to bulls. In conclusion, keep in mind that although the Morning Star pattern can be exploited as a visual indicator of the beginning of a trend reversal from bullish to bearish, its significance is amplified when other technical indicators support its interpretation. An increase in volume can be observed during the formation of a Morning Star pattern, which can be used as a confirmation that the pattern is present.

Use limited data to select advertising.

Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring using additional indicators. Volume Buzzer. Disadvantages of Using the Morning Star Pattern Many investors believe that trading solely on visual patterns is dangerous. Technical analysis uses historical data of an asset's price and volume to predict the future movement of the asset's price. All Time High Breakout. The Bottom Line. Shooting Star. It is rare but can be powerful. The evening star signals a reversal of an uptrend with the bulls giving way to the bears. The Doji is one of the most widely recognized candlestick patterns and often signals a potential change in direction. Bullish Harami, Technical Analysis Scanner chartink. Use limited data to select content. A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts.

I think, that you are not right. I am assured. Let's discuss.

Bravo, what necessary words..., an excellent idea