M&t check deposit funds availability

Reset Your Online Banking Passcode. Find Your Routing Number.

The convenience and comfort of community banking from anywhere — at any time. Easily schedule bill payments with our complimentary service, so you can spend time doing more of what's important to you. View deposited and cleared checks right within the app. Order a replacement card, report a lost or stolen card or add authorized users to your credit card. Help protect your account with timely updates about spending, security and other activities that impact your money. We use design standards that help customers identify, interpret, understand, and interact with information presented on our websites and mobile apps.

M&t check deposit funds availability

Each bank or credit union has its own rules as to when it will let you access money after you deposit a check, but federal law establishes the maximum length of time a bank or credit union can make you wait. If your deposit is a certified check, a check from another account at your bank or credit union, or a check from the government, you can withdraw or use the full amount on the next business day if you make the deposit in person to a bank employee. If you make a check deposit at an ATM at your bank, you can withdraw or use the full amount on the second business day. Your bank or credit union has a cut-off time for what it considers the end of the business day. If you make a deposit after the cut-off time, the bank or credit union can treat your deposit as if it was made on the next business day. Some banks or credit unions may make funds available more quickly than the law requires, and some may expedite funds availability for a fee. If you need the money from a particular check, you can ask the teller when the funds will become available. A receipt showing your deposit does not mean that the money is available for you to use. Searches are limited to 75 characters. Skip to main content. What is a deposit hold? How quickly can I get money after I deposit a check? Why is it taking longer to see a deposit in a bank account? If you or your bank redeposit a check that has been returned unpaid.

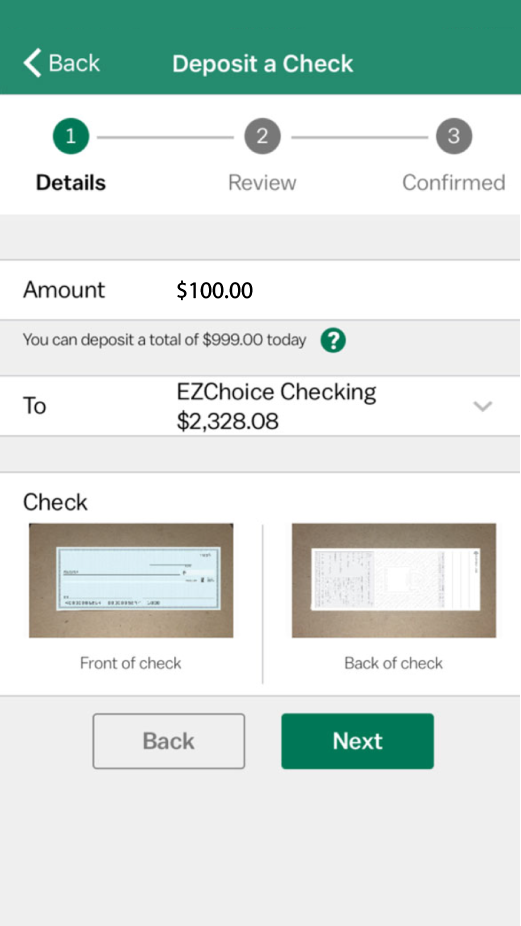

Simply select which account the money should go to, enter the amount of the deposit, take a photo of the front and back of your endorsed check and tap submit.

Everyone info. However, it would be immediately available for withdrawal. After an account is opened or service begins, it is subject to its features, conditions, and terms, which are subject to change at any time in accordance with applicable laws and agreements. Member FDIC. Safety starts with understanding how developers collect and share your data.

When you deposit a check, you naturally expect the money to show up in your bank account. You probably also expect to be able to use that money whenever you need it. However, problems do sometimes arise. A bank's "funds availability policy disclosure" explains how long you need to wait to spend or withdraw funds after you make a deposit. When you deposit funds into your account, the bank often puts a hold on those deposits, requiring you to wait for at least one business day before you can use the money.

M&t check deposit funds availability

Reset Your Online Banking Passcode. Find Your Routing Number. Report a Stolen Debit or Credit Card. Use our online help center so you can find your answers and get back to what matters most to you.

444 twin flame

Financial Education Center. We use design standards that help customers identify, interpret, understand, and interact with information presented on our websites and mobile apps. Enroll in eStatements. Through mobile check deposit, you can deposit checks from the palm of your hand. When you make a deposit, you can use that money to withdraw cash, write checks or make a purchase. Looking for something else? When the switch happened there were issues but I gave it time and it seemed to be sorted. Search Search. Canadian and other foreign checks, food stamps and savings bonds are not accepted. Deposit limits and other terms, conditions, fees and restrictions may apply. All personal checking, savings, money market funds, portfolio management and select certificate of deposit CD accounts are eligible for Alerts. After making the deposit, write on the back of the check the date you deposited it. Looking for something else? Your bank or credit union has a cut-off time for what it considers the end of the business day.

Did you know that the funds from a deposited check are not actually yours until it's been cleared by the bank? Many people mistakenly believe that banks add funds immediately into your account after the check has been deposited -- but this is merely the first step.

Hello, We understand that extended wait times are challenging and appreciate your understanding. Making Deposits. Subject to availability and the same limitations as any service available through the Internet. Help Center. Some banks or credit unions may make funds available more quickly than the law requires, and some may expedite funds availability for a fee. Member FDIC. Log In. Equal Housing Lender. When first getting started, most transactions will automatically be assigned a category. In special cases, such as instances of fraud prevention, checks may take longer to clear.

In my opinion you are not right. Let's discuss it. Write to me in PM.

You are not right. I can prove it. Write to me in PM, we will discuss.

I regret, that, I can help nothing, but it is assured, that to you will help to find the correct decision.