Nifty bollinger band

Bollinger bands are known as oscillator indicators which help to measure price volatility. They assist us in monitoring whether a price is high or low compared to its recent average and predict when it might rise or fall back to that level. This will help you decide when to buy or sell an asset, nifty bollinger band.

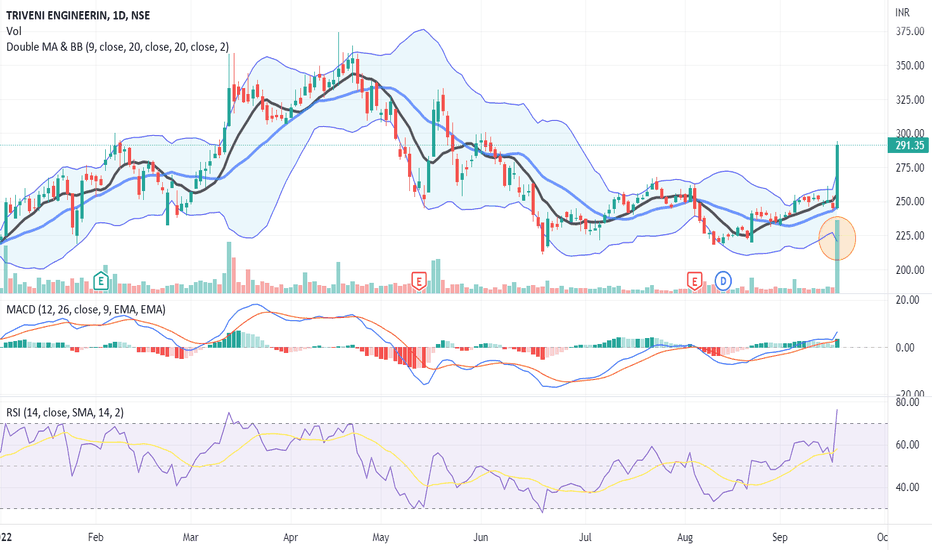

RSI and volumes show nothing significant as of now. BB squeeze can lead to massive up or down break. Waiting if it will breakout again this time. Hey, check out the trade setup for Industower All 3 parameters are matched for a short trade. Trade setup in Futures Short :

Nifty bollinger band

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day. Note : Support and Resistance level for the , calculated based on price range of the previous trading. Stands for Relative Strength Index. It is a momentum indicator used to identify overbought or oversold condition in the stock. Time period generally considered is 14 days. RSI reading below 25 is interpreted as oversold. RSI reading greater than 75 is interpreted as an overbought. Stands for Moving Average Convergence Divergence. It is a trend following momentum indicator. If the MACD is above 0 and crosses above the signal line it is considered to be a bullish signal. If the MACD is below 0 and crosses below the signal line it is considered to be a bearish signal. It is a momentum indicator.

Period SMA Indication. Click here for disclaimer. Using fewer periods makes it more reactive and uneven upper and lower bands.

.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. IN Get started. Bravetotrade Mod Updated. These bands envelope the price of an instrument and are plotted at a standard deviation level above and below a simple moving average sma of the price 20 sma in most cases.

Nifty bollinger band

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. IN Get started. How to use "Bollinger Bands" indicator Education. Hey everyone! We have guide to help learn "Bollinger Bands" indicator.

Big tity blow job

In the illustration chart below, the indicator has a setting of Trend Neutral. The upper and lower bars represent levels where the price is relatively high or low compared to its recent moving average. The Company does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. It is a volatility indicator which indicates the degree of price volatility at an absolute level compared with its 9 SMA. The shooting star at trendline and bollinger band resistance is followed by a red candle will lead to a pullback to the breakout resistance now support giving us an opportunity to buy. They assist us in monitoring whether a price is high or low compared to its recent average and predict when it might rise or fall back to that level. It is a momentum indicator. Pivot levels. A tight stop loss but playing safe; open to fresh entries. Big space between the bands - high volatility Narrow space - low volatility Practice Session: Exercise 1: Find the sell signal.

Among the many indicators available, Bollinger Bands have gained significant popularity due to their ability to provide valuable insights into price volatility and potential trend reversals. In this comprehensive guide, we will delve into the world of Bank Nifty trading using Bollinger Bands. We will start by explaining what Bollinger Bands are and how they are calculated.

These higher settings potentially give us more reliable signals. Nifty has filled the last two recent gaps, so I am expecting it to fill this one too if the pattern becomes valid. Bollinger bands show overbought and oversold markets. RSI reading below 25 is interpreted as oversold. Oversold It is oversold when the price reaches the lower band; the asset trades at a lower price. Show exercise Exercise 2: Find the area with higher volatility. The price breaks the bands more often, as opposed to when you increase the standard deviation to, say, 2. Look to sell the asset as the price tends to fall back towards the central moving average band. Note : Support and Resistance level for the day, calculated based on price range of the previous trading day. It indicates only the trend strength. Videos only. Increasing the periods used will make the Bollinger bands smoother, and the price will break the bands less often. Bollinger bands are known as oscillator indicators which help to measure price volatility. Live TV.

Please, tell more in detail..