Nifty max pain today

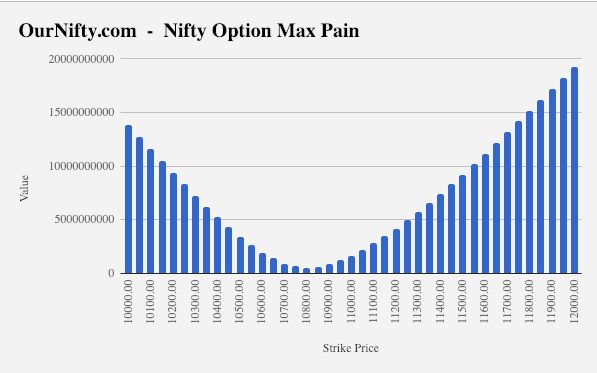

Step 2: For each Strike, nifty max pain today, assume that the Nifty contract ends at that Strike on expiry. Step 5: Identify the Strike at which the money lost by Option Sellers is least. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire.

If you find different versions of Bank Nifty Option chain, don't get confused. The way of presenting Bank Nifty Option Chain may be different but the data will always remain the same. So choose the presentation you are comfortable with and then begin with your analysis. But there are two kinds of options: puts and calls. So the Bank Nifty Option Chain is divided into two parts: Put option contracts and call option contracts. Also these options can either be in the money, or out the money or at the money. Open interest is often used as an indicator of trend strength.

Nifty max pain today

Advertise with us. Sure, Ad-blocking softwares does a great job at blocking ads, but it also blocks some useful and important features of our website. For the best possible experience, please disable your Ad Blocker. Search Stock or Index Pull Call ratio. Call Volume vs Put Volume. Related News. Collapsed View. Intraday Analysis Nifty Mid Cap Select Nifty. Bank Nifty.

This price is equivalent to max pain price. With such tools in your trading basket, you can get an extra edge to navigate the complex world of financial trading. With the help of this Nifty, Bank Nifty live chart, traders nifty max pain today have an estimate regarding the market sentiment and behavior.

Learn why to use Max Pain calculator, optimize strategies, and manage risk effectively in options trading using Max Pain live chart from NSE. In the financial world, many consider options trading as one of the complex and dynamic reasons. The reason is traders have to apply various strategies to increase their profits and manage the risk effectively. Also, they use various types of tools and software to choose the right strategy. Among them, one concept is very important for every trader to understand - Options Max Pain. It represents the price level at which the maximum number of options contracts will expire worthless, resulting in the least amount of loss for options traders.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Nifty max pain today

Step 2: For each Strike, assume that the Nifty contract ends at that Strike on expiry. Step 5: Identify the Strike at which the money lost by Option Sellers is least. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. In addition to Calculating Nifty MaxPain of Nifty , you need to analyze the Open Interest of Nifty to understand how Nifty will move on expiry day and where Nifty will close for the day. Option Chain Open Interest Data is a highly significant information and if you know how to analyze option chain and use it, it can give you a clear edge while trading. Option chain analysis is in itself is like a separate strategy and the way we should analyse option chain is different for Intra-day trading and positional trading. For more details, check out this video:.

Guadalajara to atlanta flights

Subscribe to MarketSecrets. Max Pain - Choose a symbol. For each in-the-money strike price for both puts and calls: Find the difference between stock price and strike price Multiply the result by open interest at that strike Add together the dollar value for the put and call at that strike Repeat for each strike price Find the highest value strike price. And when strike price is equal to security price, it is an at the money call option. Advertise with us. Also these options can either be in the money, or out the money or at the money. Search for:. With the help of this Nifty, Bank Nifty live chart, traders can have an estimate regarding the market sentiment and behavior. For More details, check out this video:. FnO is a zero sum game. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. Profit Potential Traders can leverage live Max Pain chart analysis to maximize their profit potential by aligning their strategies with the market's expectation to move towards the NSE max pain level.

Advertise with us. Sure, Ad-blocking softwares does a great job at blocking ads, but it also blocks some useful and important features of our website. For the best possible experience, please disable your Ad Blocker.

Open interest can be a used as a tool to measure the market activities. Bank Nifty Max Pain. Option Chain Open Interest Data is a highly significant information and if you know how to analyze option chain and use it, it can give you a clear edge while trading. Risk Mitigation A proper understanding of the Options Max pain for Nifty and Bank Nifty allows traders to better manage and mitigate the risk; they can effectively adjust their positions and strategies as per the market sentiment. Built using WordPress and the Mesmerize Theme. Traders can leverage live Max Pain chart analysis to maximize their profit potential by aligning their strategies with the market's expectation to move towards the NSE max pain level. Join Us. Likewise if PCR indicates extreme bullishness, then traders expect markets to reverse and decline. In addition, you can consider the 2 other options mentioned below. Strategic Decision-Making. Little or no open interest symbolizes that either there are no opening positions.

As it is curious.. :)