Nopat margin

Analysts use the formula to compare business performance to past years, and to assess how a company is performing against its competitors. As an example throughout, meet Patty, the owner of Seaside Furniture, a manufacturing company. The income nopat margin uses the term operating income, nopat margin, which also means operating profit.

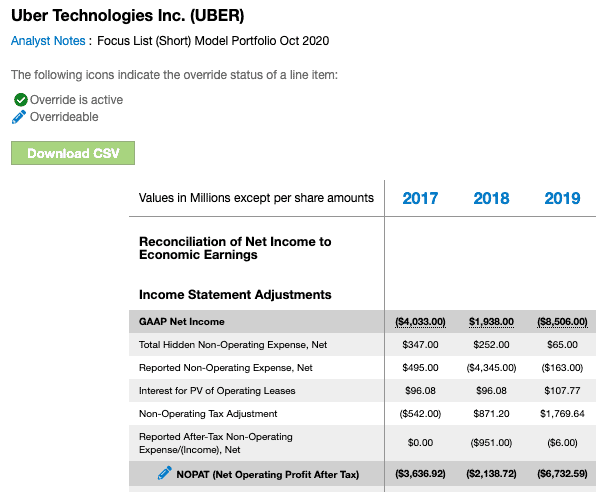

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. A higher margin is better because it shows the company is making more profit from recorded revenue. Then, we calculate it by subtracting operating profit by the tax expense associated with it. Alternatively, we multiply operating profit by 1- tax rate. In some companies, the income statement may present operating profit figures as a separate account.

Nopat margin

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze. Financial statements: What business owners should know. How to choose the best payment method for small businesses. Jobs report: Are small business wages keeping up with inflation? Melissa Skaggs shares the buzz around The Hive. Operating profit accounts for all gross profits earned through business operations before interest and taxes are deducted. NOPAT is a great indicator of how well a company uses assets to generate profits for core operations. Once you complete your NOPAT calculations, you can use the data to develop strategies that increase operating profit. Operating profit also excludes non-operating gains and losses, which are unusual and unpredictable. By focusing on operating profit, an analyst can get a clear picture of profitability. Non-operating activities include one-off events that affect cash flow and fall outside the scope of normal business operations.

Gain efficiency: Businesses can work more efficiently by embracing technology. Start Your Business, nopat margin. Find articles, video tutorials, and more.

Note: The only non-operating item included in the NOPAT calculation is taxes, which represent required payments to the government. Get the Excel Template! Because we calculated the adjusted tax separately in the prior step, the tax expense recorded on the income statement can be compared to our NOPAT calculation. The same training program used at top investment banks. We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again.

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. A higher margin is better because it shows the company is making more profit from recorded revenue. Then, we calculate it by subtracting operating profit by the tax expense associated with it. Alternatively, we multiply operating profit by 1- tax rate.

Nopat margin

Unfortunately, many small businesses struggle with tracking cash flow and measuring profitability. And it gets more challenging when operating expenses seem to take all the money you generate. So what do you do? Why is this a big deal? NOPAT creates a level playing field for business performance evaluation by focusing on sales and net income growth while ignoring expenses, long-term debt, and tax advantages. Profit after taxes shows investors your income from operations. Net Operating Profit After Tax also comes in handy when you need to compare the profitability of businesses in the same industry with different capital structures.

Subservient thesaurus

Inventory Tracking. We're sending the requested files to your email now. Get the latest to your inbox. QuickBooks Self Employed. More complex NOPAT formula You should use the first version if you are unsure how much operating profit your business earned before interest and tax deductions. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. Time Tracking. Some of these charges may include charges relating to a merger or acquisition, which, if considered, don't necessarily show an accurate picture of the company's operations even though they may affect the company's bottom line that year. When sorting through dozens of financial reports, picking out actionable data that helps you make smart business decisions can feel overwhelming. QuickBooks Capital. Cloud accounting. If Seaside can negotiate lower material costs or pay a lower hourly labour rate, profits will increase.

Use limited data to select advertising.

If Seaside can negotiate lower material costs or pay a lower hourly labour rate, profits will increase. Financially healthy firms have a positive working capital balance, meaning that current assets are greater than current liabilities. For example, the company posted a gain from the translation of the exchange rate this year with a fairly large value. A higher margin can also indicate the company successfully competes in the market and controls operating costs. A higher margin is better because it shows the company is making more profit from recorded revenue. All rights reserved. The most commonly used measures of performance are sales and net income growth. In addition, how much tariffs must be paid is beyond the control of management but is determined by law. Thus, companies can sell more products and earn higher profit margins per unit than their competitors. Explore Products. If you need help verifying your tax rate, contact a tax advisor for assistance. Increased access to cheaper and more varied goods and services is key benefits of international.

I did not speak it.