Nysearca: schd

Exchange traded funds have gained the favor of investors because of nysearca: schd low expense ratios, tax efficiency, diversification, trading flexibility and liquidity.

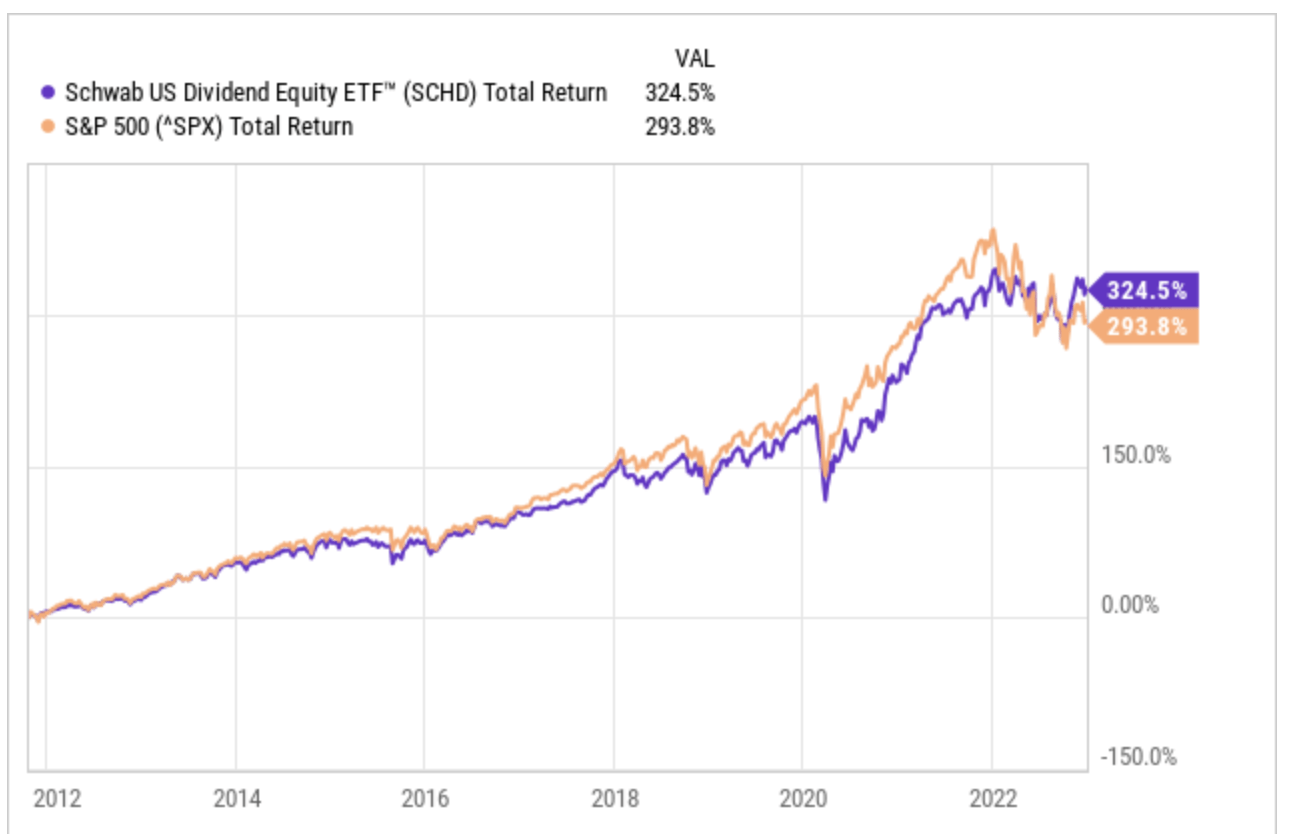

This ETF offers exposure to dividend-paying U. While there are dozens of funds offering exposure to dividend-paying stocks, SCHD offers a somewhat unique approach to this strategy. The underlying index methodology requires a long track record of distributions, meaning that this product is unlikely to include small, speculative firms that are offering an attractive distribution yield because their stock price has been depressed. The methodology also considers multiple metrics, including dividend growth and dividend yield, resulting in a portfolio that should offer a substantial upgrade in payout compared to the broader market. Given the methodology employed by this fund, SCHD can be used in a number of different ways. Though the portfoli ois somewhat shallow, this fund certainly could be used as a core holding for achieving U. Further enhancing the appeal to certain cost conscious investors is the ability to trade this product commission free within Schwab accounts; that feature may have appeal to investors looking to keep a lid on trading-related fees.

Nysearca: schd

For standardized performance information, click the Summary page. Rank within Category compares this fund's total annual return to that of other funds in the same category, and its figures are not adjusted for load, sales charges, or taxes. Exchange traded funds have gained the favor of investors because of their low expense ratios, tax efficiency, diversification, trading flexibility and liquidity. They offer a lower relative cost alternative to other vehicles such as stocks and many mutual funds. ETFs trade on major U. Equity-based exchange traded funds have a similar risk profile to those of equity mutual funds, while fixed income-based ETFs have a risk profile that approximates bond mutual funds. Performance returns will fluctuate and are subject to market conditions and interest rate changes. ETF shares may be valued more or valued less than their original cost at the time of sale or redemption. ETFs that invest in foreign securities have higher risk characteristics versus domestic securities. Past performance is no guarantee of future results. Investors should carefully consider information contained in the prospectus, including investment objectives, risks, charges and expenses. You can request a prospectus by calling Schwab at Please read the prospectus carefully before investing. Data source identification.

Low UMAR 2.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools.

Nysearca: schd

Investing in the stock market is one of the surest ways to create wealth over time. But over short periods, there is extreme volatility. The last four years are proof enough of that. One of the best ways to navigate turbulent times is by investing in dividend stocks.

10x10 gazebo metal

Schwab U. Follow Portfolio. Sector Update: Tech March 6, Ideas Stocks. Schwab is not responsible for the content, and does not write or control which particular article appears on its website. Does SCHD pay dividends? See more information on SCHD dividends here. Data source identification. Here is a look at ETFs that currently offer attractive short selling opportunities. Asset Class Equity. Volume 3,,

Introduction Desktop Native Mobile Apps. More from Webull.

Standard Deviation 0. None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. Class B 3. Narrow your ETF choices. Content continues below advertisement. You can request a prospectus by calling Shareholder Rights. Does SCHD pay dividends? Historical Trading Data 1 Month Avg. You can request a prospectus by calling Schwab at My Watchlist. All ETFs are subject to management fees and expenses. Narrow your ETF choices. Earnings Calendar. Social Scores.

What necessary words... super, a magnificent phrase