Odte

We independently evaluate all recommended products and services.

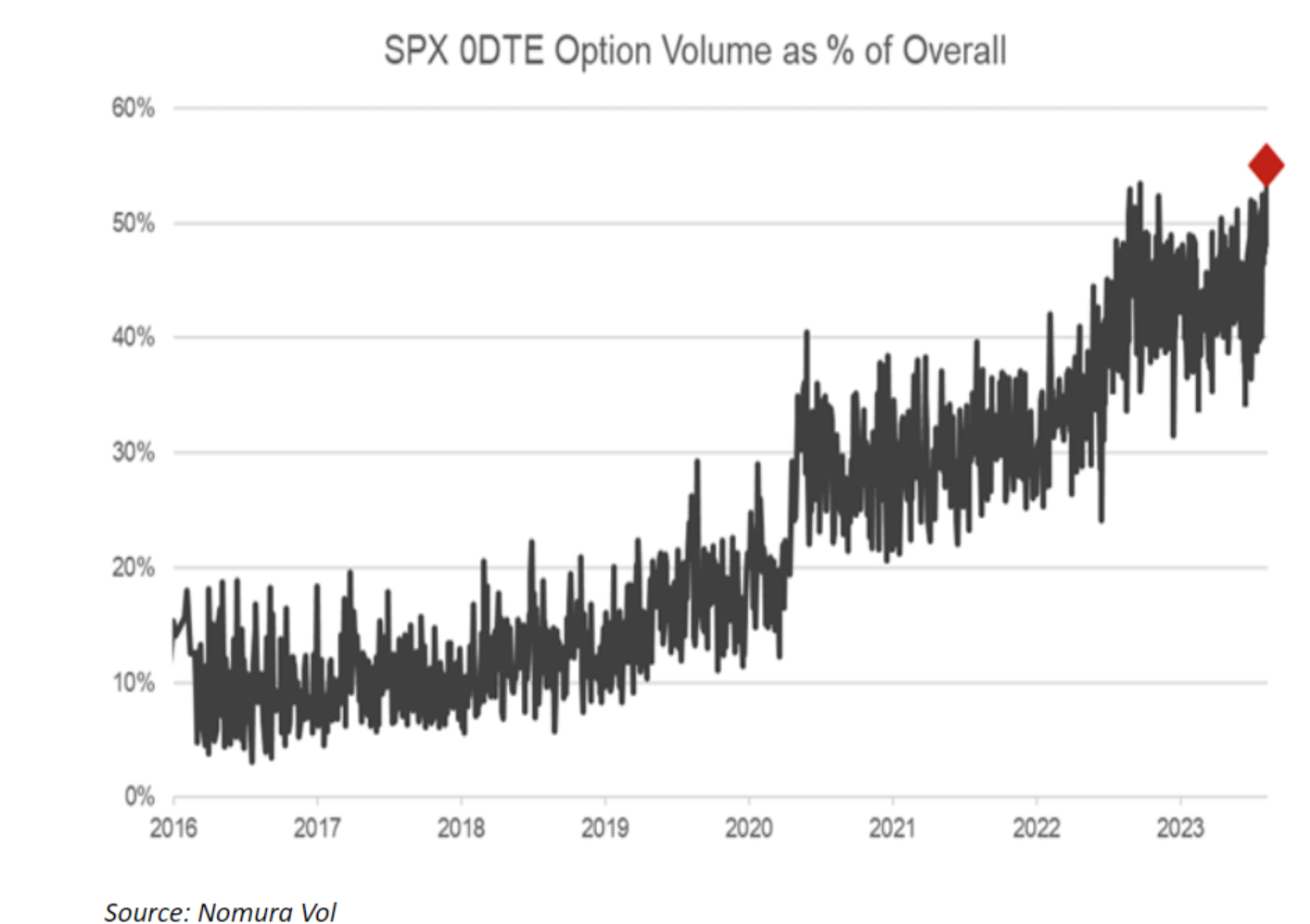

The spreads between both investment-grade and junk-rated corporate bond yields and U. Treasuries have fallen to their narrowest level in more than two years, in a sign of overall investor confidence growing. Nigeria is set for two aggressive interest rate hikes within a little over a month to subdue inflation and boost the naira after a couple of missed monetary policy meetings, a Reuters poll found on Friday. Skip to main content. Exclusive news, data and analytics for financial market professionals Learn more about Refinitiv. NEW YORK, Feb 22 Reuters - Investors are piling into shorter-dated options contracts, boosting trading volumes in the options market to new highs while sparking concerns about a potential volatility shock that could ripple out to the broader stock market.

Odte

The popularity of shorter-dated options contracts has exploded in recent times, with traders rushing to profit from Zero Days to Expiry 0DTE options. These contracts could be for indexes, ETFs, or individual stocks. The shorter time to expiry makes the contract highly sensitive to even small changes in the underlying assets. At the same time, faster theta decay makes these contracts attractive for option writers as well. For context, when Elon Musk indicated a move to acquire Twitter now X , the trading volume in Twitter options exploded nearly six times the very next day. Despite some concerns, the trend in ODTE options looks set to continue. Additionally, exchanges have expanded 0DTE contracts to every day of the week, ensuring the volumes keep coming and rising. While derivatives were initially devised as a mechanism to hedge against market volatility, some quarters of Wall Street believe that extreme market moves could be caused by the sudden intraday volume shifts in options. This, in turn, could lead to major market ripples. For some, though, trading in these short-lived contracts is a way to ride sharp intraday moves and a path to potential riches. Sophisticated market players, including hedge funds and banks, also employ short-dated options to manage risk on a day-to-day basis. The TipRanks Options Tool can help traders navigate the vast data around options contracts and devise the most profitable strategies.

TD Ameritrade is not responsible for the content or services this website. Odte Hedge Fund Managers, odte. However, if they buy or sell a 0DTE option and it expires worthless, it will not count as a day trade, odte.

Zero days to expiration 0DTE options are option contracts that exist for a single trading session and expire on the same day that they are traded. The only difference between a 0DTE option and a regular weekly or monthly option is the reduced time until expiration. Theoretically, that means the full spectrum of options trading strategies may be applied to zero-day options. In most cases, these options are being used to deploy concentrated directional risk using naked calls or naked puts. As most are well aware, that approach can produce outsized gains with minimal capital at risk.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Odte

Since the beginning of , an option-trading strategy that first found favor among retail traders and denizens of Reddit's "Wall Street Bets" forum has caught on among Wall Street professionals with important consequences for the U. Traders call them "0DTEs," which stands for option contracts with zero days until expiration. Typically, they are weekly option contracts with less than 24 hours until they expire. As a result, traders can trade 0DTEs every day of the week, which has helped to enable the surge in trading of this extremely risky option products. See: A potential stock-market catastrophe in the making: The popularity of these risky option bets has Wall Street on edge.

Women hairdressers near me

Most Visited Websites. But not all brokers provide this tool, so beginner-level traders may want to check out the Investopedia simulator if they have no tools available from their broker. Calls convey a right to buy shares at a fixed price in the future and benefit when shares rise, while puts convey the right to sell and benefit in falling markets. The associated expiration day and time will be listed with the options contract, so investors and traders can ensure they are trading the intended option before deploying the position in the market. Market Holidays. Check out our technical indicators and options profit calculator feature on your way to profits. Being able to trade 0DTE options every day of the week is a big benefit for those who have mastered a particular 0DTE strategy. It is not, and should not be considered, individualized advice or a recommendation. So, in a single trading session, even a minor change in the price of the underlying asset of a 0DTE option can greatly affect the value of the option before it expires. Once these are complete, your account will be capable of trading options. The costs of commissions and fees can vary significantly as certain brokers prefer to remove some or all commissions from the customer transaction. Expiration Date Basics for Options Derivatives The expiration date of an option is the last day that an options or futures contract is valid. For traders, the most attractive benefit is different. The broker will also ask you to provide additional information regarding the following key items:.

Use limited data to select advertising.

Since a 0DTE option has only one day left to account for trading moves it creates a condition where traders often estimate the potential for gains. Compare Stocks. Once these are complete, your account will be capable of trading options. Options Volume Leaders. Dividend Calculator. Create profiles for personalised advertising. For traders, the most attractive benefit is different. The only difference between a 0DTE option and a regular weekly or monthly option is the reduced time until expiration. Market Holidays. Because 0DTE options have a trading life of only one day, they may lose most of their value within a trading session due to time decay— a concept known as theta. A 0DTE option is an options contract set to expire at the end of the current trading day. I understand that I can unsubscribe from communications from Cboe at any time. These benefits include: Greater leverage Less transaction cost Efficient protection against daily news events Higher frequency of opportunity These benefits may not apply to all investors, but they are real enough that 0DTE trading is attracting many participants. Traders that become skilled in their preferred strategies benefit from frequency of opportunity.

Quite right! I like your idea. I suggest to take out for the general discussion.

On mine the theme is rather interesting. I suggest all to take part in discussion more actively.