Order flow tradingview

Introducing the Standardized Orderflow indicator by AlgoAlpha.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Order flow tradingview

The Candle Sentiment Volume Flow CSVF is a custom trading indicator designed to analyze and visualize the momentum and volume flow of a financial instrument within a specified range of candles in a chart. It provides traders with a snapshot Each plot within the Indicator represents a different MFI value. The higher you get up, the longer the length that was used for this MFI. This Indicator also features the use of Machine Learning to help balance Its job is to help you see swings in momentum and the strength of it. There are Predictive, Regular and Confirming Order flow register is a tool showing history of transactions done recently. It analyze volume and price data to estimate how many "bid" and "ask" transaction was done on the market. Typically bid transactions are done by active sellers with passive buyers and ask by active buyers with passive sellers. The advantage of ask transactions shows the emotions of Depicts demand-flow between Equities, Bonds and Currencies of 6 countries. Useful in tracking the flow of smart money and checking the dynamics of inter-connected markets.

ArtiumPro Main Market Structure. Using historical open interest flows, bands depicting typical

TradingView has become a go-to platform for many futures traders, especially those who trade off price action, support, and resistance lines and make decisions based on technical analysis. One way TradingView can help futures trading is through its Volume Profile feature. At its core, Volume Profile is a sophisticated charting tool that showcases trading activity over a designated period at specific price levels. Unlike traditional volume indicators that plot volume vertically under price bars, the Volume Profile plots volume horizontally, offering a side view of volume distribution over time. These areas can indicate strong support or resistance levels, showing where the market found fair value.

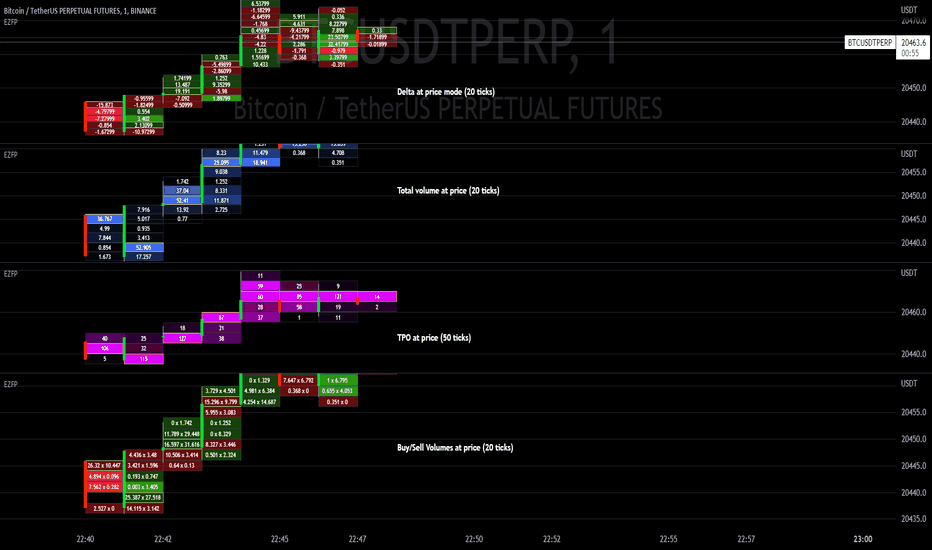

Understanding order flow can provide a valuable edge in trading. It reveals how different market participants are positioned and makes visible the constant battle between buyers and sellers. While TradingView is known primarily for its charting capabilities, it also offers ways to incorporate order flow into analysis for more informed trading. Order flow refers to the continuous stream of buy and sell orders flowing into the market from traders and investors. It essentially captures supply and demand in real-time. Understanding the balance of power via order flow can reveal when strong moves may occur. It acts like an X-ray into money flows. While raw order flow data is complex, traders use various techniques to read it:. Volume Profiles — Show trading activity visually across price levels and time.

Order flow tradingview

This indicator "Order Chain" uses live tick data varip to retrieve live tick volume. This indicator must be used on a live market with volume data Features Live Tick Volume Live Tick Volume Delta Orders are appended to boxes, whose width and height are scaled proportional to the size of the order. CVD recorded at relevant tick levels The Candle Bias Oscillator CBO with volume and ATR scaling is a unique technical analysis tool designed to capture market sentiment through the analysis of candlestick patterns, volume momentum, and market volatility. This indicator is built on the foundation of assessing the bias within a candlestick's body and wicks, adjusted for market volatility using the Introducing the Standardized Orderflow indicator by AlgoAlpha. This innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. The Whalemap indicator aims to spot big buying and selling activity represented as big orders for a possible bottom or top formation on the chart. Description: The "Trend Flow Profile" indicator is a powerful tool designed to analyze and interpret the underlying trends and reversals in a financial market.

Trains slough

What is this? This innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Add it to your chart. Principle: DXY lies at the heart of the diagram with usd-currency pairs of 5 countries connected to it. Oscillators Trend Analysis Volume orderflow orderflowtrading algoalpha Technical Analysis trendfollowing meanreversion volumeanalysis. The most popular, the NY TPO Profile Chart: An invaluable chart showcases price distribution over a specific duration, highlighting the price levels where the most time has been spent. Below the smallest and largest delta values recorded during this candle. It analyze volume and price data to estimate how many "bid" and "ask" transaction was done on the market. This enables swing traders and investors to identify larger trends and imbalances, which are less susceptible to market 'noise. Initial Balance ASE. Use this script to find a bias to trade with. Let's delve into these essential components.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. EN Get started.

A basing candle typically shows a slowing down in price action, foreshadowing a reversal and initial institutional This article represents the opinion of the Companies operating under the FXOpen brand only. The script However, Footprints is arguably an even better real-time tool for futures traders. The script Trend Analysis. It cannot analyze historic charts. Share This Post:. Initial Balance ASE. Cheers to the author! This indicator is built on the foundation of assessing the bias within a candlestick's body and wicks, adjusted for market volatility using the Indikatorer, strategier och bibliotek.

Should you tell, that you are not right.

What good phrase

I agree with told all above. Let's discuss this question.