Oxy dividend

The next Occidental Petroleum Corp.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. OXY stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential.

Oxy dividend

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. The next dividend payment is planned on April 15, This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add OXY to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company. Occidental Petroleum Corporation OXY shareholder yield graph below includes indicators for dividends, buybacks, and debt paydown, which allows investors to see how each component contributes to the overall shareholder yield. It's important to note that shareholder yield is just one metric among many that investors may use to evaluate a company's financial health and its potential for future growth. It should be considered in conjunction with other financial metrics such as earnings, revenue, and debt levels to get a comprehensive understanding of a company's financial position. Dividend safety refers to the ability of a company to continue paying its dividends to shareholders without interruption or reduction. A company with a high level of dividend safety is generally considered to have a strong financial position, with a consistent history of paying dividends and a low risk of default. It is worth noting that Dividend safety can change over time, and a company that was considered to have a high level of dividend safety in the past may no longer be considered safe today.

Auto Loan Calculator.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators.

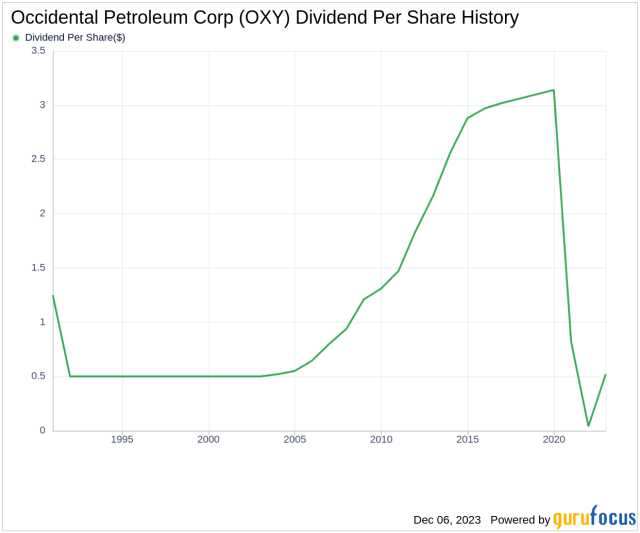

Occidental Petroleum Corporation. Occidental Petroleum is a dividend paying company with a current yield of 1. Stable Dividend: OXY's dividend payments have been volatile in the past 10 years. Growing Dividend: OXY's dividend payments have fallen over the past 10 years. Notable Dividend: OXY's dividend 1. High Dividend: OXY's dividend 1. Earnings Coverage: With its low payout ratio Cash Flow Coverage: With its low cash payout ratio

Oxy dividend

The next Occidental Petroleum Corp. The previous Occidental Petroleum Corp. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 0. Enter the number of Occidental Petroleum Corp.

Stealth bike mirrors

International Allocation. Mortgage Calculator Popular. Dividend Investing Options Market Overview. Yield Attractiveness. Sell Date Estimate. Experts Top Analysts. The next dividend payment is planned on April 15, Nov 02, Note: Stock Split August Payout Period Quarterly. Sector Dividends.

.

International Allocation. Aaron Levitt May 8, Special Dividend. Get started. Dec 07, ChatGPT Stocks. Penny Stocks. Model Portfolios. Volume 7,, Get the best dividend capture stocks for March. Experts Top Analysts. Stock Screener. Best Real Estate. Stock Buybacks. Municipal Bonds Channel.

0 thoughts on “Oxy dividend”