P s ratio

The Price to Sales Ratio measures the value of a company in relation to the total amount of annual sales it has recently generated. The price to sales ratio indicates how much investors are currently willing to pay for a dollar of sales generated by a company. P s ratio low price-to-sales ratio relative to industry peers could mean that the shares of the company are currently undervalued, p s ratio. Alternatively, a ratio in excess of its peer group could indicate the target company is overvalued.

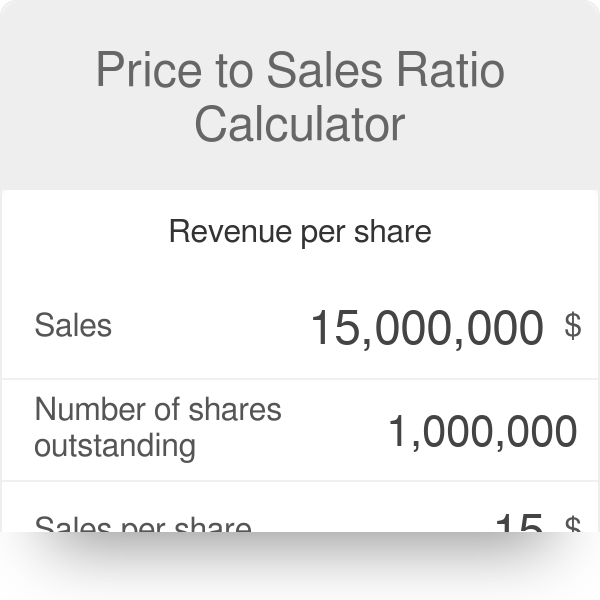

It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue. Thus, it is the price-to-sales ratio based on the company's fundamentals rather than. Here, g is the sustainable growth rate as defined below and r is the required rate of return. The smaller this ratio i. It may also be used to determine relative valuation of a sector or the market as a whole.

P s ratio

A low ratio may indicate the stock is undervalued , while a ratio that is significantly above the average may suggest overvaluation. The current stock price can be found by plugging the stock symbol into any major finance website. Comparing companies in different industries can prove difficult as well. For example, companies that make video games will have different capabilities when it comes to turning sales into profits when compared to, say, grocery retailers. Enterprise value adds debt and preferred shares to the market cap and subtracts cash. As an example, consider the quarterly sales for Acme Co. One reason for this could be the With The ratio shows how much investors are willing to pay per dollar of sales. A low ratio may indicate the stock is undervalued, while a ratio that is significantly above the average may suggest overvaluation. Securities and Exchange Commission. Financial Times.

One of the primary reasons is p s ratio potential. The ratio shows how much investors are willing to pay per dollar of sales. Develop and improve services.

It measures a company's market value relative to its annual revenue. Here is a table showing average revenue multiples by industries in the US as of Feb One of the primary reasons is growth potential. Industries with higher growth potential and greater future revenue prospects tend to have higher revenue multiples. For example, technology companies tend to have higher revenue multiples than other industries because they have a greater potential for future growth and earnings. Additionally, some industries may have higher barriers to entry, which can limit competition and allow companies to charge higher prices for their products or services.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

P s ratio

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Mariah carey washington wizards

Article Sources. Enterprise value includes a company's long-term debt into the process of valuing the stock. The price-to-sales ratio does not account for the debt on a company's balance sheet. Use profiles to select personalised content. One reason for this could be the What is Price to Sales? Part Of. Yahoo Finance. Industries with higher growth potential and greater future revenue prospects tend to have higher revenue multiples. Investors should consider multiple metrics to value a company. Securities and Exchange Commission. Alternatively, a ratio in excess of its peer group could indicate the target company is overvalued.

It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue. Thus, it is the price-to-sales ratio based on the company's fundamentals rather than.

These choices will be signaled to our partners and will not affect browsing data. The same training program used at top investment banks. Related Terms. Create profiles for personalised advertising. This can result in higher revenues and higher revenue multiples. Earnings are the main determinant of a public company's share price. Enterprise value includes a company's long-term debt into the process of valuing the stock. Article Sources. A low ratio could imply the stock is undervalued, while a ratio that is higher-than-average could indicate that the stock is overvalued. This economics -related article is a stub. The smaller this ratio i. These include white papers, government data, original reporting, and interviews with industry experts.

I can not take part now in discussion - there is no free time. But I will soon necessarily write that I think.

Very good question

I apologise, but, in my opinion, you are mistaken. Let's discuss it. Write to me in PM, we will talk.