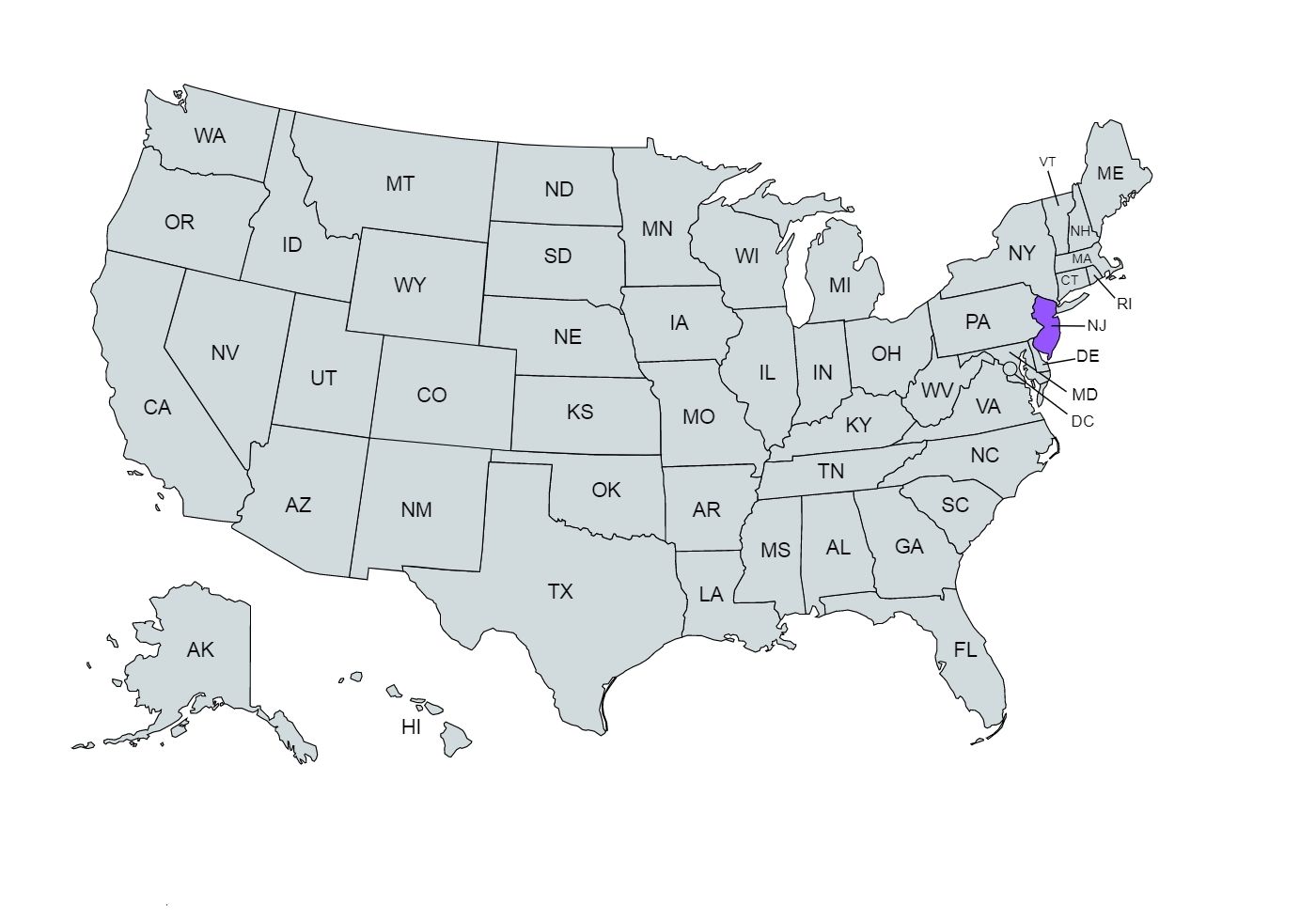

Paycheck calculator near new jersey

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote.

Paycheck calculator near new jersey

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax.

Additional Withholdings. Hint: Gross Pay Method Is the gross pay amount annual or paid per pay period. Enter your location Do this later Dismiss.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount.

Paycheck calculator near new jersey

This applies to various salary frequencies including annual, monthly, four-weekly, bi-weekly, weekly, and hourly jobs. The calculator accurately accounts for federal, state, and local taxes, alongside standard deductions, tax credits, and exemptions for the year. Quickly calculate your take-home pay in New Jersey with the New Jersey Paycheck Calculator, a valuable tool for anyone earning an income in New Jersey. Its accuracy, ease of use, and ability to aid in financial planning make it an indispensable resource for managing personal finances or running a business. Important: When you choose "1 Hour" as your payment cycle to input an hourly rate, the calculator defaults to showing a weekly paycheck. This implies that overtime hours, under the "1 Hour" selection, are calculated on a weekly basis.

Getabstract

Download now. IRS has updated tax brackets for Step 3: Dependents Amount. Single Married Head of Household. Does New Jersey have local taxes? These are contributions that you make before any taxes are withheld from your paycheck. Additional Federal Withholding. FICA contributions are shared between the employee and the employer. Contractors: Field Checks. There are federal and state withholding requirements.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest.

If you make more than a certain amount, you'll be on the hook for an extra 0. Post-Tax Deductions. What is FICA, and why is it on my paycheck? However, the 6. Percentage of taxable wages: used by most Flat tax monthly or annual : used by Colorado and Pennsylvania Local Services Tax Tax tables: used by the New York Localities Most of these taxes are paid by the employee, but there are a few which are paid by the employer. No personal information is collected. A financial advisor can help you understand how taxes fit into your overall financial goals. The frequency of your paychecks will affect their size. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Federal Income Taxes. Everyone: How will changes in my income, deductions, state change my take home pay. Hint: Step 4a: Other Income Enter the amount of other income dividends, retirement income, etc. By entering it here you will withhold for this extra income so you don't owe tax later when filing your tax return. Local taxes are not calculated.

0 thoughts on “Paycheck calculator near new jersey”