Paystubplus

To find your local taxes, head to our Missouri local taxes resources. To learn more about paystubplus local taxes work, read this guide to local taxes, paystubplus.

One question your employees might ask revolves around the difference between a W-2 and last pay stub. W-2 wages. No, a W-2 is not the same as a pay stub. A W-2 form, also known as a Wage and Tax Statement, is a required document that an employer must send to employees each year. Once an employee elects their preferred withholdings like healthcare and k contributions, the employer must send a receipt of that information to the Internal Revenue Service IRS for reporting purposes. Employers are not required to send pay stubs to employees.

Paystubplus

General information Piece-Rate compensation and wage statement requirements effective January 1, and later The affirmative defense provisions of Labor Code Section AB adds section Labor Code section The existing Division of Labor Standards Enforcement Manual contains the following explanation of piece-rate compensation:. Such plans may also be in the alternative to a salary or hourly rate. As an example, compensation plans may include salary plus commission or piece-rate; or a base or guaranteed salary or commission or piece-rate whichever is greater. No, the law does not apply to employees who are compensated on a commission basis. By its terms, Labor Code section Also note that while section This means that in any workweek in which a piece-rate employee worked overtime hours, overtime compensation must be calculated and paid according to existing law. What are the compensation requirements for rest and recovery periods for piece-rate employees?

So why not give it a try? Paystubplus, the law does not apply to employees who are compensated on a commission basis.

Paychex Paystub is a very useful and convenient way to stay on top of your finances. It gives you the flexibility to track all sorts of things, such as income, expenses, and taxes. If you want to acquire this form PDF, our form editor is exactly what you need! By clicking on the button down below, you will go to the page where it is easy to edit, save, and print your PDF. Enjoy the convenience of navigation and interface the editor presents. Are you looking for a way to make your paystub form look more professional? If so, you may want to consider using the Paychex paystub form.

A simple way to make check stubs online. Generate, print and use. First time creating a stub. I had a few self-induced issues and customer support was there from start to end. Simply put, a pay stub is a paper we keep after cashing our payroll checks. Not only does a pay stub serve as proof of income, it also helps you keep track of salary information, taxes paid, overtime pay and more. Our pay stub generator, unlike any other online paystub maker, is hassle free and takes less than 2 minutes to complete. Providing information such as the company name and your salary information is all it takes to use our pay stub calculator software.

Paystubplus

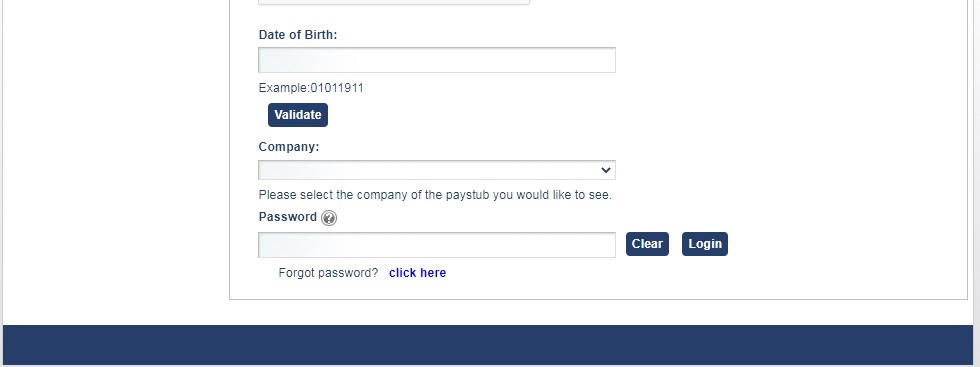

Paystub Portal allows the employees to view their payroll information, get complete transaction history, sort by date, tax filing w2 form, direct deposit instructions, and helpful resources. Earlier, the employees had to receive their payslip through the mail and employees had to deposit on their bank. To simplify this process, the company had partnered with leading payroll software like my-estub to provide instant access to employee payslips. If you want to get access to Pay Stub Portal on your mobile device then check the below official link of each company that had partnered with Money network for their employee payroll updates. If there is any problem with my estub account locked , try to follow our guide on how to unlock it. Try searching for the mobile app.

The absolute sound

Box Retirement Plan. As such, relevant factors would include the size of the payment being made to an employee and the nature and extent of the information the employer has about that employee. This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. See the instructions for Form or Form A for details on reporting this amount. This encourages employees to take their authorized rest breaks, without feeling that doing so will decrease their compensation. The existing Division of Labor Standards Enforcement Manual contains the following explanation of piece-rate compensation:. Whether the employer met the requirements for the affirmative defense may arise in any dispute over piece-rate compensation, either in litigation or in the context of a wage claim. How is that interest calculated? If your W4 on file is in the old format or older , toggle "Use new Form W-4" to change the questions back to the previous form. This box shows the tip income your employer allocated to you. Department of Industrial Relations.

.

An employer may not treat the piece-rate compensation as including compensation for other nonproductive time, no matter how the piece-rate was determined. Employees pursuing the first option can file an individual wage claim with the Labor Commissioner's Wage Claim Adjudication Unit , or they can file a Report of Labor Law Violation with the Labor Commissioner's Bureau of Field Enforcement , which does not pursue individual claims, but may investigate and cite the employer. For a workweek of piece-rate compensation only: A piece-rate employee works a 5-day, hour workweek. Box Retirement Plan. Maximize Your k Contributions in A Guide with Calculator New updates to the and k contribution limits. Per period amount is your gross pay every payday, which is typically what you use for hourly employees. Authorized rest period time shall be counted as hours worked for which there shall be no deduction from wages. We automate the management of incomes and deductions during payroll processing to ensure accurate withholdings and paychecks. What is gross pay? ACA Reporting. If you use Direct Deposit, your account distributions to each checking and savings account display here. Box 10 lists the total amount paid into your dependent care flexible spending account for the year. Yes, Missouri has local income taxes. Unified Services. Want to take it with you?

Excuse for that I interfere � But this theme is very close to me. Write in PM.