Pennsylvania lottery calculator

Scoring a big win at a land-based casino or winning big through an online sports betting establishment is exhilarating. But no matter how much you win, it is taxable income and must be reported to the IRS. Determining how much you owe in gambling taxes can be a headache. Luckily, pennsylvania lottery calculator have put together this simple, pennsylvania lottery calculator, easy-to-use, free gambling winnings tax calculator.

The lottery tax calculator or taxes on lottery winnings calculator helps you estimate the tax amount deducted from a lottery prize and compare the money you would receive if you took either the lump sum cash option or a series of annuity payments. Read further, and we will show the difference between lump sum vs. If you are interested in lottery annuity payments in the U. If you've had the good fortune of a lottery win, our lottery tax calculator can help you understand the tax implications. Here's how to make the most of this tool:.

Pennsylvania lottery calculator

Winning at the casinos or at Pennsylvania online sportsbooks and poker sites is exciting. The following answers general questions on how gambling winnings are taxed in PA. All gambling winnings are taxable. That includes winnings from Pennsylvania sports betting , casino games, slots, pari-mutuel racing, poker and lottery. Depending on the amount of your winnings, your online casino, online sportsbook or online poker site may have already withheld federal tax, which will be indicated in a W-2G form mailed to you and sent to the Internal Revenue Service. In addition to federal tax, Pennsylvania assesses its own personal income tax on gambling income. Benefits you receive from Pennsylvania online casino bonuses are taxable exactly as if you had won the money playing. It does not matter if the promotion offers hard cash, credits, extra spins or merchandise, the fair value of the promo counts as income for tax purposes. PA gambling promotions can add up to a substantial amount of value. We suggest that you keep records so that you have the information at hand when it comes time to give the government its share. Even if taxes reduce the effective value of a promotion there is one tactic you can use to make up the shortfall. Apply for several welcome promos. No reason why you can't maintain accounts at several online casinos or sportsbooks. The advantage is not just the initial bonus package. Each brand offers daily, weekly and monthly promotions so if one of your sportsbooks hasn't got a boosted odds promo or similar for a game you want to bet on, there's a good chance another sportsbook will have just the promotion you need.

How to use the lottery tax calculator If you've had the good fortune of a lottery win, our lottery tax calculator can help you understand the tax implications. You can choose to invest it into a retirement account or other stock option to generate a return, pennsylvania lottery calculator. Not reporting gambling winnings could lead to an IRS under-reporting notice.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. If you win the lottery, you may want to hit pause before you buy a yacht. You will almost certainly owe taxes on those winnings, and planning for those taxes will save you a headache come tax time.

A lottery payout calculator can help you to find the lump sum and annuity payout of your lottery winnings based on the advertised jackpot amount in any state. A lottery payout calculator can also calculate how much federal tax and state tax apply on your lottery winnings using current tax laws in each state. You can calculate your lottery lump sum take home money, annuity payout and total tax amount that you need to pay after winning from Megamillions, Powerball, Lotto, etc by using our online lottery payout calculator. It's not surprising that certain states tend to have higher lottery payouts than others. Several factors influence lottery payout, including the number of winners in a given state in the USA, population, income and tax bracket of residents, and jackpot size. With state-run lotteries like Mega Millions and Powerball offering huge jackpots, states like Georgia and New York see more payouts than others.

Pennsylvania lottery calculator

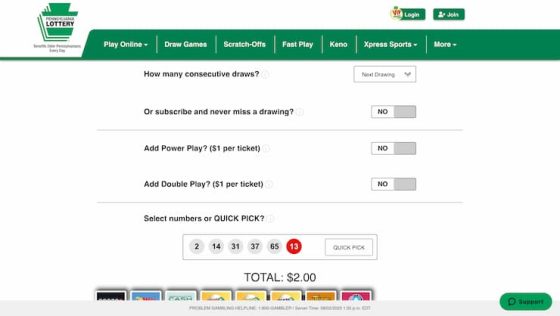

You can find out tax payments for both annuity and cash lump sum options. To use the calculator, select your filing status and state. The calculator will display the taxes owed and the net jackpot what you take home after taxes. Powerball Hub. Jackpot Tax. Annuity Payment Schedule. Annuity Cash Converter. Current Powerball jackpot Saturday, Mar 23, Federal tax. Select your filing status.

Twin valley homes blackburn

Annuity schedule. You could deduct the costs of the following:. Select Lotto Powerball Mega Millions. The gross amount is subject to a 24 percent federal withholding. See more details and requirements about Session Gambling. If you are interested in lottery annuity payments in the U. These documents include tickets, payment slips, Form W-2G, statements, and receipts. Upcoming Draws: Starting:. Therefore you may employ our tool as a: Federal lottery tax calculator; Lottery annuity tax calculator; and Lottery lump sum tax calculator. To verify any tax information you will need to check with the lottery organizer and relevant tax authorities or qualified advisors. Gambler FAQ. These and other features may require our systems to access, store, and scan Your Stuff. Gambling can range from regularly betting on sports to buying the occasional lottery ticket.

No state found. Select Your State. Promos 5.

That means your winnings are taxed the same as your wages or salary. For recipients in the EU, we or a third party will obtain consent before contacting you. How do lottery taxes work? Instead of claiming your winnings as "other income" on your Form , you would list it on Schedule C, subject to self-employment taxes. This calculator can also perform reverse calculations : If you know the net payout and the taxes applied, you can work backward to find out the gross payout. This makes taxes easier and because of this you do not need to look for FanDuel taxes the PA Government is looking for. You would then need to include this amount on your personal income tax return and pay further income tax. Latest News. This would usually be the amount you would have to pay for the item if you bought it new. The cash option amount varies, it is equal to the cash in the jackpot prize pool at the time of the draw. Read further, and we will show the difference between lump sum vs. These documents include tickets, payment slips, Form W-2G, statements, and receipts. All gambling winnings are treated equally. Useful sites and resources:. US taxes.

0 thoughts on “Pennsylvania lottery calculator”