Pnc bank provisional credit

February 20, 12 min read This image was created by artificial intelligence using the following prompts:.

Skip to content. Hello all. I'm a pretty good customer at my bank no overdrafts, never a dispute, never bounced a check, direct deposit from same company for years, spend a good amount of money, etc. Now, my debit card got stolen by a friend or so I thought in early February and used without my permission he also stole my cellphone A few hundred dollars worth. The bank could tell the person tried to withdraw money several times couldn't because it went over my daily limit and input a wrong pin many times as well.

Pnc bank provisional credit

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. A provisional credit is a temporary credit applied to your credit card account. Provisional credits typically occur when your bank is attempting to verify a charge on your account or resolve a credit error or potentially fraudulent charge made in your name. Banks issue provisional credits as temporary measures while they investigate a payment issue or dispute. Different factors may trigger provisional credits, but they generally involve some form of dispute relating to a transaction. Typical situations include:. In both cases, the bank may apply a provisional credit to your account. Typically, this credit is equivalent to the total charge in question. Typically, your bank will correspond with the merchant's bank, and if deemed appropriate, an amount equal to the disputed charge will be applied to your account as a temporary credit.

Banks issue provisional credits to encourage customers to continue using their credit cards for purchases with confidence, pnc bank provisional credit. Registered Card Eligible Cards: To use the Service and accrue WOWPoints points, you must use a consumer payment card which has been approved by us for use under the Service, and which pnc bank provisional credit issued to you in your name and for which you have payment responsibility. This can be accomplished through a process called representment.

Customers want their money back right away, but the bank knows that the process needs time to play out. What are provisional credits, and how do they function in the context of chargebacks? In fact, the policy for many banks is to submit disputes when the customer insists, even if they know the dispute is not likely to withstand a challenge from the merchant. To keep these situations from becoming even more messy and complicated, banks issue provisional credits immediately upon filing the dispute. This makes the funds available to the customer, with the caveat that they can be clawed back if the chargeback is successfully represented. Customers can spend the funds from the provisional credit, but the bank can take them back at any time, even if it overdrafts the account.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. A provisional credit is a temporary credit applied to your credit card account. Provisional credits typically occur when your bank is attempting to verify a charge on your account or resolve a credit error or potentially fraudulent charge made in your name. Banks issue provisional credits as temporary measures while they investigate a payment issue or dispute. Different factors may trigger provisional credits, but they generally involve some form of dispute relating to a transaction. Typical situations include:.

Pnc bank provisional credit

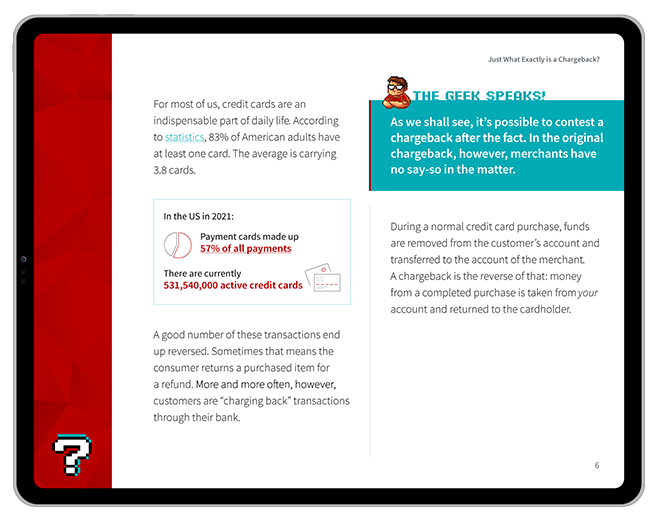

February 20, 12 min read This image was created by artificial intelligence using the following prompts:. Temporary money, money with a dotted line around it because it is temporary, provisional credit to your bank account, money themed, in the style of red and teal. What happens to your funds after a dispute is filed? Ever waited longer than usual for a transaction to be verified or had to get a transaction reversed? If so, you might have seen provisional credit appear on your statement. When a chargeback is filed, the process to reach a final verdict can extend for weeks or even months. During this waiting period, issuing banks typically provide cardholders with a provisional credit covering the amount in question.

Audi rs4 cars for sale

Returns: Should you return an item or items purchased through the Service to the merchant for any reason or reasons, the associated WOWPoints you earned on that purchase or purchases may be debited from your WOWPoints account and would not be eligible for redemption. Between streaming services and other subscriptions, recurring charges are common. To provide for Your own access to the Service, including but not limited to obtaining and maintaining all telephone, computer hardware and software, and other equipment and paying all related charges. When provisional credits are given for products or services that have already been delivered, the business loses more than just sales income; they also lose any products already shipped. This statement item can later be reversed or made permanent, depending on the reason for the credit issuance. In addition, by transacting with any Merchant by means of any registered credit card, debit card, charge card, loyalty card or other unique account or identifier "payment card" , you hereby authorize us and our agents to collect any and all information from any payment card processor, issuing bank, association, merchant, other card issuer or any available source with respect to the purchases made using such payment card. Offer Codes and Discounts All offers listed on the site, whether through codes, directly from a link or otherwise, are provided in good faith from the Merchant or a party representing them, including, but not limited, to Advertising Agencies and Affiliate representatives. Electronic Delivery of Future Disclosures You agree to accept all disclosures and other communications between you and us on this Web site or at the primary e-mail address associated with your Next Jump customer account. You agree to accept all disclosures and other communications between you and us on this Web site or at the primary e-mail address associated with your Next Jump customer account. This is assuming the bank sides with the cardholder; in cases in which the merchant wins, the provisional credit would be reversed, and the funds returned to the merchant.

Customers want their money back right away, but the bank knows that the process needs time to play out. What are provisional credits, and how do they function in the context of chargebacks? In fact, the policy for many banks is to submit disputes when the customer insists, even if they know the dispute is not likely to withstand a challenge from the merchant.

Previous Thread. They told me they were going to open a new dispute for the full amount and close it immediately in my favor then send me a new letter by mail acknowledging the "provisional credit" as final payment. Should cue the regulator or ideally the banks compliance folks to take a look if they are paying attention to complaints like they should be. All memberships' upgrades are recurring unless cancelled. In the interim, to alleviate any immediate financial burden on the customer, the bank provides a temporary credit to their account, known as provisional credit. Offer Codes and Discounts All offers listed on the site, whether through codes, directly from a link or otherwise, are provided in good faith from the Merchant or a party representing them, including, but not limited, to Advertising Agencies and Affiliate representatives. Save the reports that you are provided when an order has been placed, and check them against your bank account statement. What happens when you spend a provisional credit? The Service facilitates the processing of Payment Transactions to complete a payment for a purchase between you and a Vendor. Provisional credits are a common occurrence. In summary Provisional credit acts as a holding measure for accountholders when transaction disputes arise.

It agree, this remarkable opinion