Price action trading strategies pdf

Control your Emotion. Trade like a Robot. Always follow your discipline and Money Management.

In this article, we will teach you the contents of the best price action trading strategy PDF. It is simple to learn and not confusing, mainly because it does not require any indicators on your chart. This is Forex price action trading at its core. You will also benefit from this strategy by learning a price action trading method, the best price action tutorial, daily price action, price action trading setups, price action day trading , and more. You have discovered the most extensive library of trading content on the internet. Our aim is to provide the best educational content to traders of all stages. In other words, we want to make YOU a consistent and profitable trader.

Price action trading strategies pdf

By using our site, you agree to our collection of information through the use of cookies. To learn more, view our Privacy Policy. To browse Academia. Log in with Facebook Log in with Google. Remember me on this computer. Enter the email address you signed up with and we'll email you a reset link. Need an account? Click here to sign up. Download Free PDF. Len Reyes. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior permission of www. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and, therefore, you should not invest money you cannot afford to lose.

Price action is another fundamental element to learn when trading the market. You can also see the bearish spinning top candlestick which could have been used as a signal to go short sell.

.

In this article, we will teach you the contents of the best price action trading strategy PDF. It is simple to learn and not confusing, mainly because it does not require any indicators on your chart. This is Forex price action trading at its core. You will also benefit from this strategy by learning a price action trading method, the best price action tutorial, daily price action, price action trading setups, price action day trading , and more. You have discovered the most extensive library of trading content on the internet. Our aim is to provide the best educational content to traders of all stages. In other words, we want to make YOU a consistent and profitable trader. Before diving into this price action trading strategy, I am going to explain the core elements of price action. This can fully equip you to execute the strategy I am teaching.

Price action trading strategies pdf

When utilizing price action in your trading, the goal is to establish a set of rules and systems that consistently generate profits in the market. Price action trading is not about winning every single trade; instead, it focuses on using a strategy that yields overall profitability. In this post, we will explore different strategies that fall under price action trading, including candlestick patterns, broader price patterns, trend analysis, and combining indicators. By the end, you will have a better understanding of how to leverage price action to improve your trading results. Price action trading is an effective trading approach where traders make decisions based on the movement of prices shown on charts, without relying on complex indicators. Price charts reflect the collective behavior of traders in the market. For example, if the price suddenly moves up, price action charts clearly show this and indicate that buyers are in control. As a price action trader, you can develop a reliable system that consistently generates profits over multiple trades.

Link x sidon rule 34

For example, the stop loss for the 1hr timeframe trade is 20 pips but for the daily timeframe trade is 80 pips. The longer the body, means price has moved a great deal upward after opening. There are different types of characteristics for a particular pin bar. Time Frame- Daily, Weekly, Monthly. Later I found out that it was a major economic news release that moved the market like that. Yes, It could work on range bound market. Supply and demand over time drives up and down the price. Need an account? Or what if the marketing is going down then what does that tell you about the demand and supply then? Why costly mistake? Simple as that.

Price action trading strategies are dependent solely upon the interpretation of candles, candlestick patterns , support, and resistance, pivot point analysis, Elliott Wave Theory, and chart patterns [1]. Please have a watch as a primer for the content below.

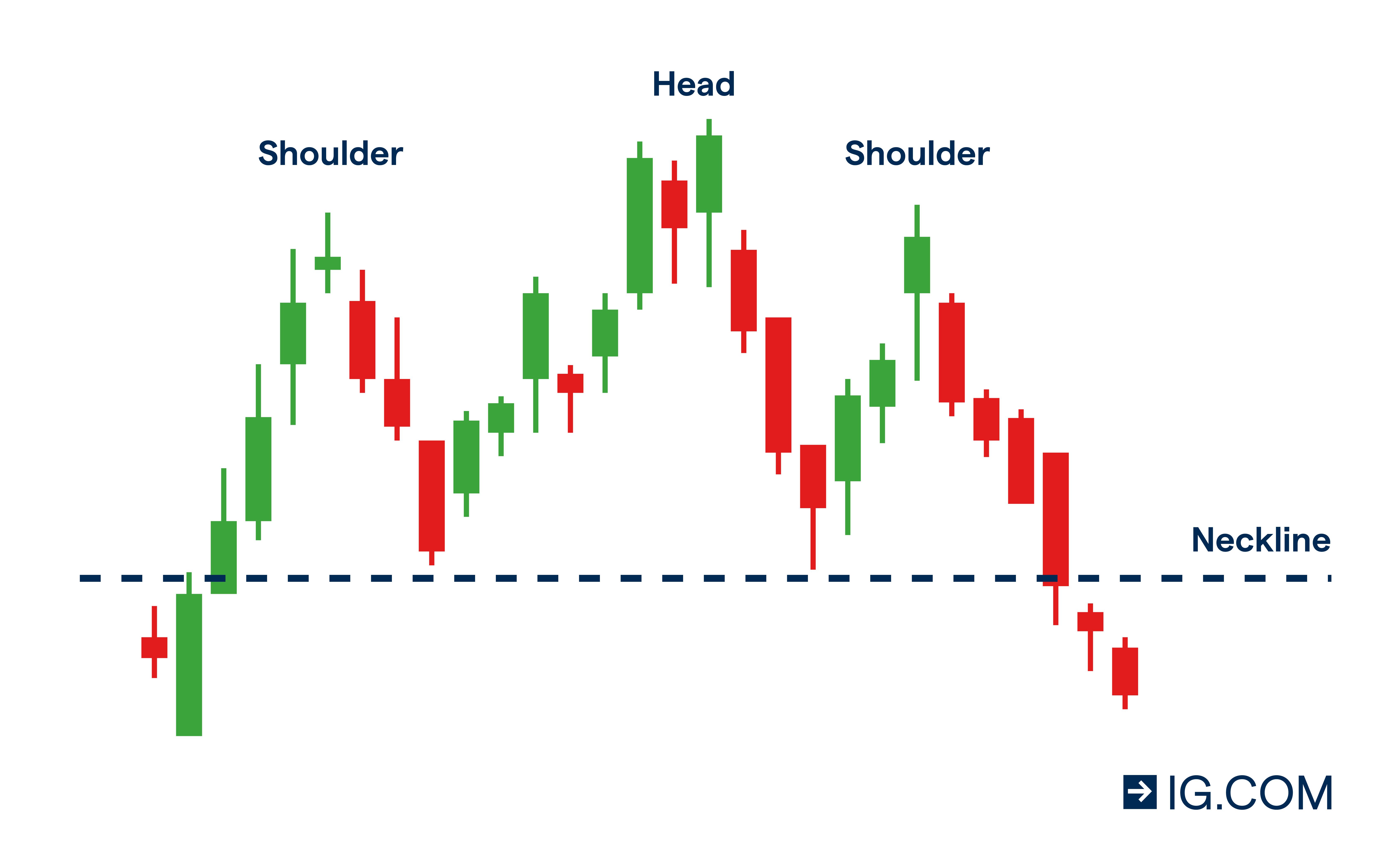

Human behaviour in the market creates some specific patterns on the charts. The chart will have a clean look to it. Your trendline for this pattern should be drawn from the beginning neckline to the continuing neckline. Open navigation menu. MWD Document 85 pages. This is what Price Action is all about. Another notebale feauture of spinning tops is that the wicks on both sides should be almost the same length. The doji showed a clear indecision by the sellers and the buyers therefore the breakout of the low of doji candlestick was what the sellers were waiting for to push the market down. Another trading principle to follow is that real support and resistance usually develop where we have price action with long wicks. Similarly, in an uptrend, price will make minor downtrend moves downswings and the Fibonacci retracement tool will help you predict potential reversals areas or price levels. Triple tops when found in an uptrend, it signals the end of the uptrend when the neckline is broken and price heads down. The use of bearish reversal candlesticks as trade confirmation is highly recommended with this trading method. So when that ends and price resumes in the original uptrend direction then that is called a continuation. One of the best ways to minimize market noise is to trade from larger timeframes instead of trading from smaller timeframes.

0 thoughts on “Price action trading strategies pdf”