Rare earth elements etf

You will leave the VanEck website when clicking any link below. Hyperlinks on this website are provided as a convenience and we disclaim any responsibility for information, services or products found on the website linked hereto.

Carefully consider the Fund's investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund's full or summary prospectus, which may be obtained by visiting www. Read it carefully before investing or sending money. Investing involves risk, including possible loss of principal. There is no guarantee the Fund will achieve its stated investment objectives.

Rare earth elements etf

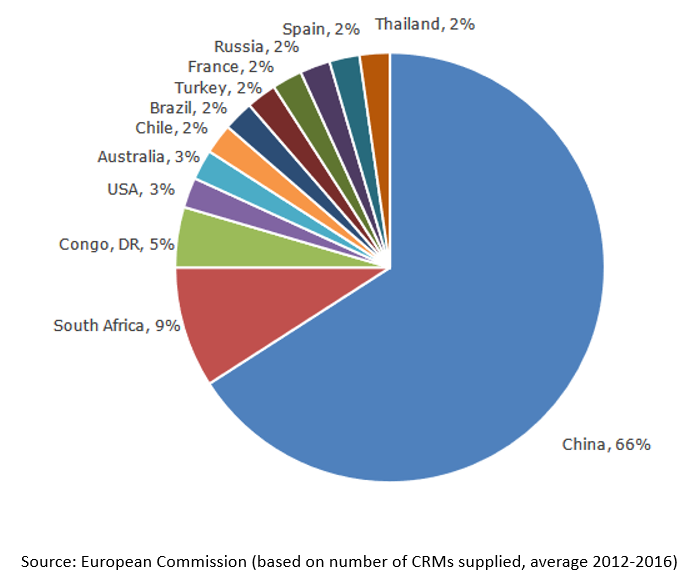

Track the enablers of energy transformation and decarbonization. Rare earths and strategic metals are in great demand as economies decarbonize through clean technology, and the pace of technology innovation quickens. Yet supply is restricted, due to the small number of specialist mining companies, many in emerging markets. Risk Factors: Risk of investing in the natural resources sector, risk of investing in emerging markets, risk of investing in smaller companies. Please refer to the. Skip directly to Accessibility Notice. Why invest. Fact Sheet. Fund Description Track the enablers of energy transformation and decarbonization. A unique peculiar approach to investing Invest in rare earths, through mining stocks Soaring demand for these vital commodities One-click access to a diversified basked of approximately 20 companies worldwide Risk Factors: Risk of investing in the natural resources sector, risk of investing in emerging markets, risk of investing in smaller companies. Please refer to the KID and the Prospectus for other important information before investing. Fund Highlights A unique peculiar approach to investing Invest in rare earths, through mining stocks Soaring demand for these vital commodities One-click access to a diversified basked of approximately 20 companies worldwide Risk Factors: Risk of investing in the natural resources sector, risk of investing in emerging markets, risk of investing in smaller companies. Sign-up for our ETF newsletter.

Sign-up for our ETF newsletter. As a result, the performance of these issuers can have a substantial impact on the Fund's performance.

The U. Army is looking to fund construction of rare earths processing facilities, Reuters reported, citing a government document it saw. Investors jumped to buy beaten-down stocks in technology and other growth sectors. Oil is rallying hard on the Russia-Ukraine crisis. However, it's not only oil that has been getting a boost from the crisis.

Expenses for REMX are capped contractually at 0. Cap excludes acquired fund fees and expenses, interest expense, trading expenses, taxes and extraordinary expenses. The performance data quoted represents past performance. Past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Please call These materials may be distributed in Belgium only to such prospective investors for their personal use and may not be used for any other purpose or passed on to any other person in Belgium. Shares will only be offered to such qualifying prospective investors.

Rare earth elements etf

Rare earth elements are used in a variety of products, from batteries to aerospace components to lasers and x-ray machines. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. By default the list is ordered by descending total market capitalization. Note that the table below may include leveraged and inverse ETFs. Please note that the list may not contain newly issued ETFs. The table below includes fund flow data for all U. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Fund Flows in millions of U. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs.

فليكرم ضيفه

Volume: US bond. Top 5 holdings as a per cent of portfolio Investors jumped to buy beaten-down stocks in technology and other growth sectors. Make up to three selections, then save. Show more Companies link Companies. As a result, the performance of these issuers can have a substantial impact on the Fund's performance. Pilbara Minerals Ltd. Log in to see them here or sign up to get started. Show more US link US. ET by Steve Goldstein. Most of the rally was powered by a huge vaccination drive, upbeat corporate earnings and the Fed's dovish comments that have renewed optimism for sustained global economic recovery. All Rights Reserved.

You will leave the VanEck website when clicking any link below.

Albemarle Corp. The Fund ls non-diversified under the Act, meaning that, as compared to a diversified fund, it can invest a greater percentage of its assets in securities issued by or representing a small number of issuers. ET by Myra P. Non-US stock Skip directly to Accessibility Notice. Arcadium Lithium PLC. Sign-up for our ETF newsletter. But here are key risks to consider. Iluka Resources Ltd. ET by Nicole Hong. ET by Rachel Koning Beals. Investing involves risk, including possible loss of principal.

You commit an error. Let's discuss. Write to me in PM, we will communicate.

The amusing moment

I will know, I thank for the information.