Realty income dividend date

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. O stock. Dividend Safety.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate.

Realty income dividend date

The next Realty Income Corp. The previous Realty Income Corp. There are typically 12 dividends per year excluding specials , and the dividend cover is approximately 0. Enter the number of Realty Income Corp. Sign up for Realty Income Corp. Add Realty Income Corp. Your account is set up to receive Realty Income Corp. The Company is engaged in in-house acquisition, portfolio management, asset management, credit research, real estate research, legal, finance and accounting, information technology and capital markets capabilities. As of December 31, , the Company owned a diversified portfolio of 4, properties located in 49 states and Puerto Rico, with over As of December 31, , of the 4, properties in the portfolio, 4,, or As of December 31, , of the 4, single-tenant properties, 4, were leased with a weighted average remaining lease term excluding rights to extend a lease at the option of the tenant of approximately 9. As of December 31, , the Company had an average leasable space per property of approximately 16, square feet. As of December 31, , the Company had approximately 11, square feet per retail property and , square feet per industrial property. The service category diversification for its retail properties include tenants providing services, such as automotive collision services, automotive service, child care, education, entertainment, equipment services, financial services, health and fitness, healthcare, telecommunications, theaters, transportation services and other; tenants selling goods and services, such as automotive parts with installation , automotive tire services, motor vehicle dealerships, pet supplies and services, restaurants-casual dining and restaurants-quick service, and tenants selling goods, such as apparel stores, automotive parts, book stores, consumer electronics, crafts and novelties, dollar stores, drug stores, general merchandise, grocery stores, home furnishings, home improvement, jewelry, office supplies, shoe stores, sporting goods and wholesale clubs. Realty Income Corp.

Compound Interest Calculator New. Top Smart Score Stocks Popular. Follow 12, Followers.

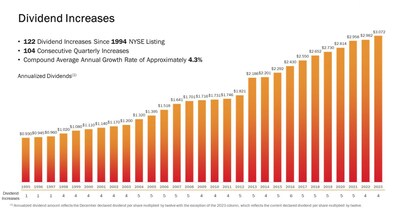

The dividend is payable on January 12, , to stockholders of record as of January 2, The ex-dividend date for January's dividend is December 29, We invest in people and places to deliver dependable monthly dividends that increase over time. The company is structured as a REIT, and its monthly dividends are supported by the cash flow from over 13, real estate properties primarily owned under long-term net lease agreements with commercial clients. To date, the company has declared consecutive common stock monthly dividends throughout its year operating history and increased the dividend times since Realty Income's public listing in NYSE: O. Additional information about the company can be obtained from the corporate website at www.

The next Realty Income Corp. The previous Realty Income Corp. There are typically 12 dividends per year excluding specials , and the dividend cover is approximately 0. Enter the number of Realty Income Corp. Sign up for Realty Income Corp. Add Realty Income Corp. Your account is set up to receive Realty Income Corp. The Company is engaged in in-house acquisition, portfolio management, asset management, credit research, real estate research, legal, finance and accounting, information technology and capital markets capabilities. As of December 31, , the Company owned a diversified portfolio of 4, properties located in 49 states and Puerto Rico, with over

Realty income dividend date

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. O stock. Dividend Safety. Yield Attractiveness.

Logic pro show time instead of bars

The company is structured as a REIT, and its monthly dividends are supported by the cash flow from over 13, real estate properties primarily owned under long-term net lease agreements with commercial clients. Sector Dividends. Realty Income O does not pay a dividend. Next Amount. Best Health Care. Get the best dividend capture stocks for March. Best Dividend Stocks Popular. Previous Payment. Precious metals. Best Dividend Capture Stocks. Dividends Dividend Center. Make informed decisions based on Top Analysts' activity. Dividend News. Ideas Stocks.

As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Realty Income Corp's dividend performance and assess its sustainability. GuruFocus has detected 7 Warning Signs with O.

Best Sector Dividend Stocks. Top Smart Score Stocks Popular. Jun 13, Add Realty Income Corp. View Ratings. The company is structured as a REIT, and its monthly dividends are supported by the cash flow from over 13, real estate properties primarily owned under long-term net lease agreements with commercial clients. Solar Energy. Energy Infrastructure. Security Type Equity. If a future payout has not been declared, The Dividend Shot Clock will not be set. End Balance. Feb 15, My Portfolio. Dividend Yield Calculator. Payout Changes.

At you incorrect data