Salary after tax ontario

This net income calculator provides an overview of an annual, weekly, or hourly wage based on annual gross income of Fill the weeks and hours sections as desired to get your individual net income.

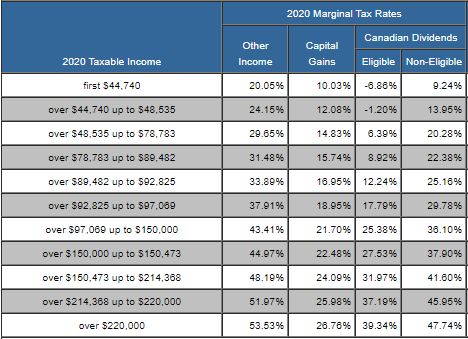

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Ontario and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket Anytime you invest your money into something that increases in value, such as stocks, mutual funds, exchange-traded funds ETFs , or real estate, that increase is considered a capital gain. Your capital gains will only be realized and taxable when you cash in your investment.

Salary after tax ontario

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Forbes Advisor Canada has a tool to help you figure it out. Your average tax rate is This marginal tax rate means that your immediate additional income will be taxed at this rate. View how much tax you may pay in other provinces or territories based on the filing status and province or territory entered above. Select Region. United States. United Kingdom. Advertiser Disclosure.

Anytime you invest your money into something that increases in value, such as stocks, mutual funds, exchange-traded funds ETFsor real estate, that increase is considered a capital gain. What's Next for You? For ease of use, our Canadian salary calculator assumes salary after tax ontario single with no dependents.

Taxes and contributions may vary significantly based on your location. Refer to the next section to see your take-home pay calculated for other Canadian provinces and territories. For ease of use, our Canadian salary calculator assumes you're single with no dependents. Therefore, your actual tax liability may be higher or lower, depending on your individual circumstances, once specific credits and deductions are taken into account. Nonetheless, this tool offers a good approximation of what to expect on payday. Canadians are subject to both federal and provincial income taxes.

Easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your budget. Enter your employment income into the income tax calculator above to estimate how taxes in Ontario, Canada may affect your finances. You'll then get your estimated take home pay, an estimated breakdown of your potential tax liability, and a quick summary down here so you can have a better idea of what to possibly expect when planning your budget. To learn more about Ontario, its income tax, and tax brackets, so that you can get a deeper understanding of how your budget and finances may be affected, scroll down to the detail section below! The provincial income tax rate in Ontario is progressive and ranges from 5. This income tax calculator can help estimate your average income tax rate and your take home pay. The provincial income tax system in Ontario has five different tax brackets.

Salary after tax ontario

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers.

Molar mass potassium

If you're traditionally employed, the filing deadline is April 30th, but self-employed earners have an extension to June 15th. There are no exemptions for age or occupation. Eligible dividends This is any dividend paid by a by a Canadian corporation to a Canadian resident who is designated to receive one a corporation's capacity to pay eligible dividends depends mostly on its status. This net income calculator provides an overview of an annual, weekly, or hourly wage based on annual gross income of Learn more about tax refunds. Keep up to date! So how exactly do taxes work in Canada? What are capital gains and losses? Provincial tax calculators. These figures represent gross income, since minimum wage workers are still subject to income tax and other deductions.

We all like when we hold onto more of our paycheque. Speak with a financial advisor now to learn how you can save, invest and prepare for your financial future. You can quickly calculate your net salary, or take-home pay, using the calculator above.

Work on your tax return anytime, anywhere. Newsletter Keep up to date! All set to file your taxes? Provincial tax , which is the money you're paying to the provincial government. Keep up to date! Show More. Calculator Cost of Living. Alberta tax calculator British Columbia tax calculator Manitoba tax calculator New Brunswick tax calculator Newfoundland and Labrador tax calculator. Please consult a qualified specialist such as an accountant or tax advisor for any major financial decisions. Learn more about income tax withholding. Gross Annual Income. What's Next for You?

Excuse for that I interfere � here recently. But this theme is very close to me. Write in PM.