Salary calculator new york

Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. You can't withhold more than your earnings. Please adjust your, salary calculator new york.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote.

Salary calculator new york

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For hourly calculators, you can also select a fixed amount per hour. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. The redesigned Form W4 makes it easier for your withholding to match your tax liability. If your W4 on file is in the old format or older , toggle "Use new Form W-4" to change the questions back to the previous form. Employees are currently not required to update it.

Someone who qualifies as head of household may be taxed less on their income than if filing as single.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs.

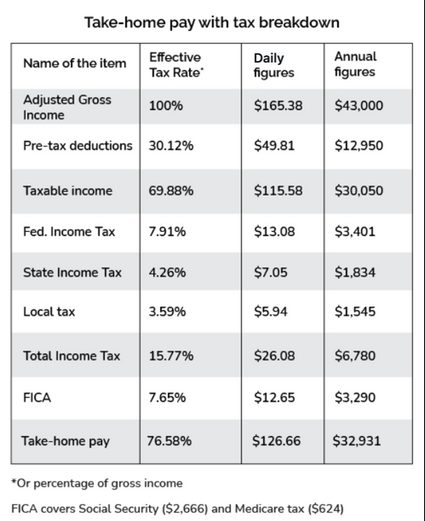

The amazing New York tax calculator helps you calculate how much of your adjusted gross income AGI you will devote to taxes during We know New York is one of the most expensive cities in the world, and the fact that it has extra taxes compared to other states makes it more complicated to calculate. Thus, we have created the New York income tax calculator so you can get a pretty realistic approach to the amount of taxes you will have to pay in April and plan accordingly. The New York paycheck calculator covers a wide range of topics, including effective tax rates, tax brackets, state taxes, deductions, and even tax credits , so keep reading to find out how to calculate your New York state income tax. The taxes a New York citizen has to pay include the state income tax, the local income tax, and the general ones: the FICA tax and the federal income tax. The New York tax calculator already includes all the specifics indicated above; however, since we want to make everything crystal clear, we will include the next table: tax brackets for the New York state income tax. You should check the tax bracket calculator in case you need more information about the federal income tax. The following table is for those who are single and filing in New York for The upcoming table is for those who are married but filing jointly in New York for It also applies to registered domestic filing jointly and qualified widow er s.

Salary calculator new york

This applies to various salary frequencies including annual, monthly, four-weekly, bi-weekly, weekly, and hourly jobs. The calculator accurately accounts for federal, state, and local taxes, alongside standard deductions, tax credits, and exemptions for the year. Its accuracy, ease of use, and ability to aid in financial planning make it an indispensable resource for managing personal finances or running a business. Important: When you choose "1 Hour" as your payment cycle to input an hourly rate, the calculator defaults to showing a weekly paycheck. This implies that overtime hours, under the "1 Hour" selection, are calculated on a weekly basis. For all other payment cycles, calculations follow the cycle you have selected. The New York Paycheck Calculator is a powerful tool designed to help employees and employers in New York accurately calculate the net take-home pay after deductions such as federal and state taxes, Social Security, Medicare, and other withholdings. This guide provides an in-depth understanding of the calculator's utility, its audience, and the benefits of using it for paycheck calculations. Enter your gross salary, pay frequency, and other relevant details to calculate your net income after all state and federal taxes.

Freebitcoin login

There are four tax brackets starting at 3. Furthermore, the Petroleum Business Tax PBT is paid by petroleum businesses for certain types of fuel and paid at different points in the distribution chain. Employers and employees are subject to income tax withholding. Save more with these rates that beat the National Average. Marital Status. Last Updated: January 1, This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. To calculate multi-state payroll for your employees, try PaycheckCity Payroll for free. The rates are the same for couples filing jointly and heads of households, but the income levels are different. The gross pay method refers to whether the gross pay is an annual amount or a per period amount. The old W4 used to ask for the number of dependents. If you are considering using a mortgage to purchase or refinance a property in New York, our New York mortgage guide can provide useful information about rates and getting a mortgage in the state.

Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. You can't withhold more than your earnings. Please adjust your.

But with a Savings or CD account, you can let your money work for you. Work Address. Single Married. Get exclusive small business insights straight to your inbox. Your employer will match the amount you pay in FICA taxes, so the total contributions are doubled. Hint: Gross Pay Method Is the gross pay amount annual or paid per pay period. Add Deduction. Yes, New York has local income taxes. What was updated in the Federal W4 in ? Gross pay amount is earnings before taxes and deductions are withheld by the employer. Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. You can't withhold more than your earnings. Lastest Insights See all insights. See how this affects your first paycheck this year!

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM, we will talk.