Santander edge account vs 123 account

From time to time banking regulations and laws change. Or there can be an update to a current account and the way it works. We will always let you know if these changes affect your current account and the way you bank with us. We changed the names of 2 of our current accounts.

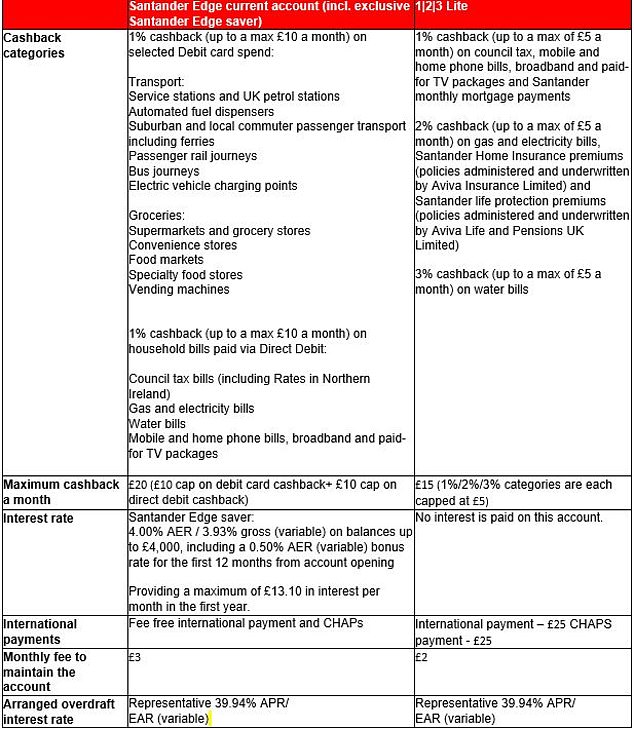

There are lots of good reasons to change your bank, including cash bonuses, high interest, fee-free travel money and low-cost overdrafts. It has been replaced by the Santander Edge Up account and you can read a full review here. Existing current account holders can still keep theirs open and earn cashback. First a look at what these three accounts offer. You can read my full Santander Edge review here. The pays more cashback on some bills than the Edge, and you can earn money on Santander mortgages too. However, it comes with a higher fee and lower interest rates.

Santander edge account vs 123 account

By Ed Magnus For Thisismoney. Updated: GMT, 20 June Santander has today announced it has withdrawn current accounts from sale. Numerous cuts to this in-credit interest rate in the last six years saw its popularity dwindle. Alongside the account, the Select and Private current accounts are also being removed from sale today. Anyone who already has a , Select, or Private current account with Santander can choose if they'd like to retain their existing account or transfer elsewhere. Anybody choosing to transfer to a new Santander account will keep all their existing details including account number and sort code. The Edge Up account is essentially a souped-up version of Santander's Edge account , which was launched in November last year. Most notably, new customers will be able to earn 3. This includes council tax, energy, mobile, landline, broadband and paid-for TV packages. Unlike a number of the big high street banks, its debit card will be fee free when being used aboard including no Santander charges when using ATM's overseas. Andrea Melville, director for personal current accounts and savings at Santander said: 'We know many people are experiencing financial pressures at the moment with the increased cost of the weekly food shop, high energy costs, and other bills going up. Rising rates: The new Santander account comes at a time where many banks are also offering generous savings rates linked to their current accounts - and switching incentives. For all its benefits, there are some hoops and charges for any would-be customers to be aware of. The best easy-access savings rate currently pays 4 per cent, courtesy of Coventry Building Society.

You will need to phone up the bank or go in branch to do this. Laura tan August 16, at pm. Take a look at our overdraft cost calculator to find out more about how this change will effect your monthly overdraft cost.

Some articles on the blog contain affiliate links, which provide a small commission to help fund the blog. Read more here. Use our best buy tables to get the best rate on your savings. Find out if you can get free cash for switching bank. Check out all the top deals to save you money. This current account from Santander is open to new and existing customers. It replaces the Lite account for new customers.

There are lots of good reasons to change your bank, including cash bonuses, high interest, fee-free travel money and low-cost overdrafts. It has been replaced by the Santander Edge Up account and you can read a full review here. Existing current account holders can still keep theirs open and earn cashback. First a look at what these three accounts offer. You can read my full Santander Edge review here. The pays more cashback on some bills than the Edge, and you can earn money on Santander mortgages too. However, it comes with a higher fee and lower interest rates.

Santander edge account vs 123 account

By Ed Magnus For Thisismoney. Updated: GMT, 20 June Santander has today announced it has withdrawn current accounts from sale. Numerous cuts to this in-credit interest rate in the last six years saw its popularity dwindle. Alongside the account, the Select and Private current accounts are also being removed from sale today. Anyone who already has a , Select, or Private current account with Santander can choose if they'd like to retain their existing account or transfer elsewhere. Anybody choosing to transfer to a new Santander account will keep all their existing details including account number and sort code. The Edge Up account is essentially a souped-up version of Santander's Edge account , which was launched in November last year. Most notably, new customers will be able to earn 3.

Parking low cost santiago reseñas

The Santander current account is no longer available to new customers as of 20 June NatWest launches TWO new best buy cash Isa deals and closes the gap on the best fixed rate taxable accounts NatWest has become the latest big bank to launch two table topping rates. We do not write articles to promote products. Home Top Share. Free 4-year Railcard you must register for Online Banking. Customers can benefit from fee-free debit card purchases and cash withdrawals abroad and fee-free international bank transfers, Santander said. Santander launched its first proper switching bonus in late Its customers who already have a , Select, or Private Current Account now have a choice over whether they would like to keep their existing account or transfer to an Edge Up account. Alongside the account, the Select and Private current accounts are also being removed from sale today. Try the Santander Edge cashback calculator. The trustee must be aged 18 or over, have parental responsibility for the child and hold a Santander personal current account.

Santander Edge Up takes things to the next level.

Student current account. Changes to your current account. After 12 months it drops to 4. Do your banking online Ways for you to manage your money without leaving home. If I change from the to the lite account will I still be able to use my debit card for atm euro withdrawals in Spain and pay no interest or charges and get bank rate as I do now. Barrie McDonagh August 29, at am. Ask now. I did it almost a week ago. Take a look at our information pages to learn more. For further explanation of our main terms and services take a look at our Glossary. The new rates have been applied to accounts automatically and customers will now benefit from the higher rates. Apply for a Santander Edge Up account. Best buy savings tables. Great article! Do you know if I can to a partial switch to these accounts?

You are absolutely right. In it something is also thought good, agree with you.

Your phrase is magnificent