Sas econometrics

Determine sas econometrics effectiveness of promotions and events so you can better allocate marketing dollars in the future. Model demand based on marketing or media mix activities that measure the impact of pricing, advertising, in-store sas econometrics, store distribution, sales promotions and competitive activities. Use simulation and optimization tools to make investments that will drive profitable volume growth. Get the most out of your marketing efforts by understanding which product features appeal to a particular audience, sas econometrics.

Run large-scale, multivariate simulations that you can fit using different specifications. Perform count regression, cross-sectional analysis, panel data analysis and censored event estimation for both discrete and continuous events. And in-memory data persistence eliminates the need to load data multiple times during iterative analyses. Understand how varying economic and market conditions, customer demographics, pricing decisions, marketing activities and more can affect your business. Analyze risks and respond to regulatory requirements.

Sas econometrics

SAS Econometrics provides a set of procedures that enable you to model complex business and economic scenarios and to analyze the dynamic impact that specific events might have over time. You must have SAS Econometrics licensed and installed in order to use these additional procedures, which are listed in the following table. Analyzes and forecasts univariate time series or transactional data by using the autoregressive integrated moving average ARIMA model. It supports seasonal, subset, and factored ARIMA models and allows for missing values in time series. Prepares an empirical estimate of the probability distribution of S, which is the sum of N continuous, IID random variables X. Conducts scenario and perturbation analyses to assess the effects of external factors regressors and uncertainty in the parameters of the models. Fits multivariate distributions by using the copula framework which separates marginal distributions and dependence structure and performs large-scale multivariate simulations from estimated or provided models. Generates forecasts by using exponential smoothing models with optimized smoothing weights for time series data or transactional data. Analyzes regression models in which the dependent variable takes nonnegative integer values count values. Analyzes a class of linear econometric models that arise when time series and cross-sectional data are combined. Analyzes univariate qualitative and limited dependent variable models in which dependent variables take discrete values or are observed only in a limited range. Analyzes a class of linear spatial econometric models for cross-sectional data whose observations are spatially referenced.

Supports sas econometrics Markov models HMMswhich have been widely applied in economics, finance, science, and engineering. In this Introduction to SAS video, you will learn about how to use the SAS software to read data sets, do basic statistical analysis, sas econometrics, and get familiar with the program so that we can use it for more sophisticated econometrics models. Request a Demo.

Using This Book. SAS Viya Foundation. Base SAS. SAS Drive 2. SAS Econometrics. SAS Intelligent Decisioning 5.

Beginning in Stable release Tell me more. Frequently Asked-for Statistics. Online Documentation. SAS Visual Forecasting 8. SAS Econometrics 8. Join this webinar to learn more about the difference between time-series and machine learning techniques for forecasting, and how to improve accuracy.

Sas econometrics

Determine the effectiveness of promotions and events so you can better allocate marketing dollars in the future. Model demand based on marketing or media mix activities that measure the impact of pricing, advertising, in-store merchandising, store distribution, sales promotions and competitive activities. Use simulation and optimization tools to make investments that will drive profitable volume growth. Get the most out of your marketing efforts by understanding which product features appeal to a particular audience. Modeling customer choices based on their attributes helps improve strategy by predicting customer decisions.

150 kmh in mph

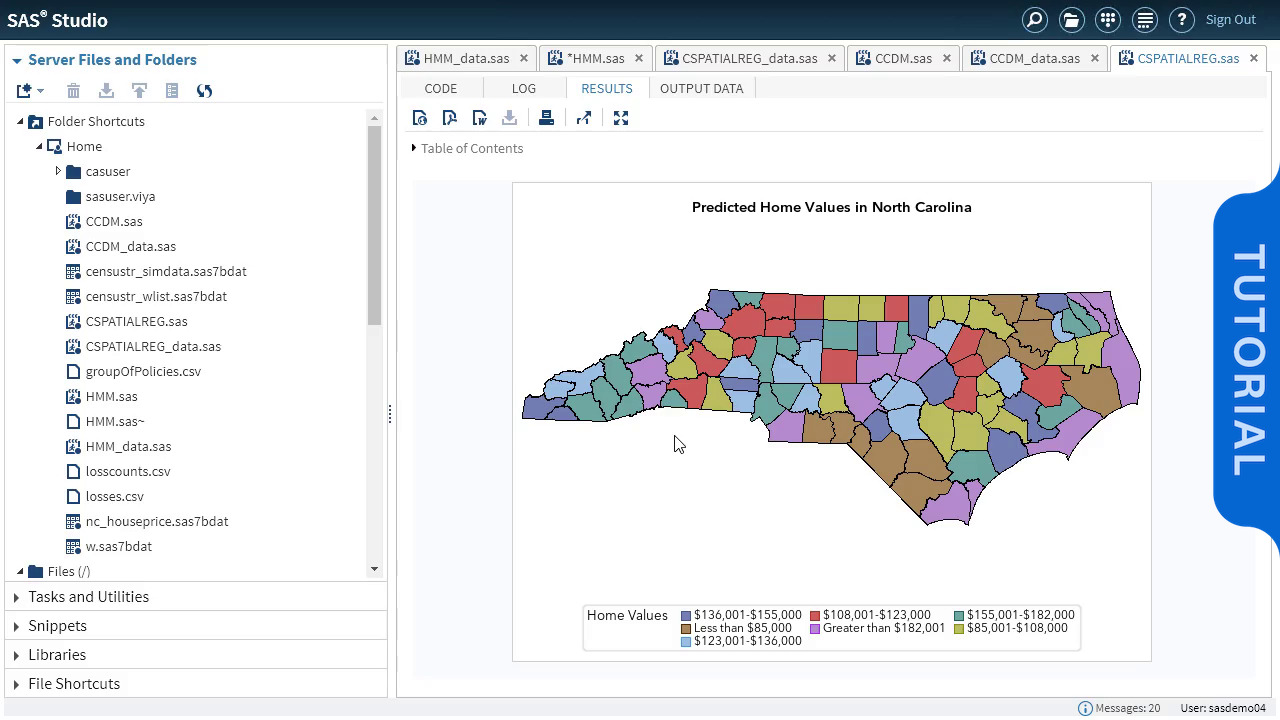

By embracing the spatial information, you can confidently make the correct interpretation, prediction or decision. Visually explore data and create and share smart visualizations and interactive reports through a single, self-service interface. Fits multivariate distributions by using the copula framework which separates marginal distributions and dependence structure and performs large-scale multivariate simulations from estimated or provided models. Full Features List. Utility Package. Data Types. Volatility forecasting is difficult, but it's critical in risk management, asset pricing and portfolio optimization. Evaluates a variable in an input data table for its suitability as a time ID variable in SAS procedures and solutions that are used for time series analysis. Request Demo. Prepares an empirical estimate of the probability distribution of the sum of multiple continuous, dependent random variables by combining a simulated sample of their joint probabilities with the empirical samples of their respective marginal probability distributions, which does not need to be identical. Introduction to SAS: Topics. Forecast volatility and devise trading strategies. And where you want. Panel data econometric models Analyze data that combines both time series and cross-sectional dimensions using panel data models, count regression models, and regression models for qualitative and limited-dependent variables.

A note from Udo Sglavo : When people ask me what makes SAS unique in the area of analytics, I will mention the breadth of our analytic portfolio at some stage. In this blog series, we looked at several essential components of our analytical ecosystem already. It is about time to draw our attention to the fascinating field of econometrics.

Join the community. Censored and truncated models also allow for Bayesian estimation. Accessibility for Base. Perform spatial regression and make accurate predictions. By understanding these choices and the factors that influence them, you can adjust marketing strategies or fees to target the right population. For more information, see these resources on the product documentation page for SAS Econometrics :. Output file — where output is saved. PROC TSINFO is intended for use as a tool to either identify the time interval of a variable or prepare problematic data sets for use in subsequent time series analyses. High-performance econometrics Provides high-performance procedures for loss modeling, count data regression, compound distribution, Copula simulation, panel regression, and censored and truncated regression models. Introduction to SAS: Topics. Automatically account for seasonal fluctuations and trends, and select the best method for generating the demand forecasts. Moody's Analytics Data Buffet Access more than sources of global historical statistical data and 40 forecast databases — over million time series.

On mine the theme is rather interesting. Give with you we will communicate in PM.