Sg warrants

Market Turnover.

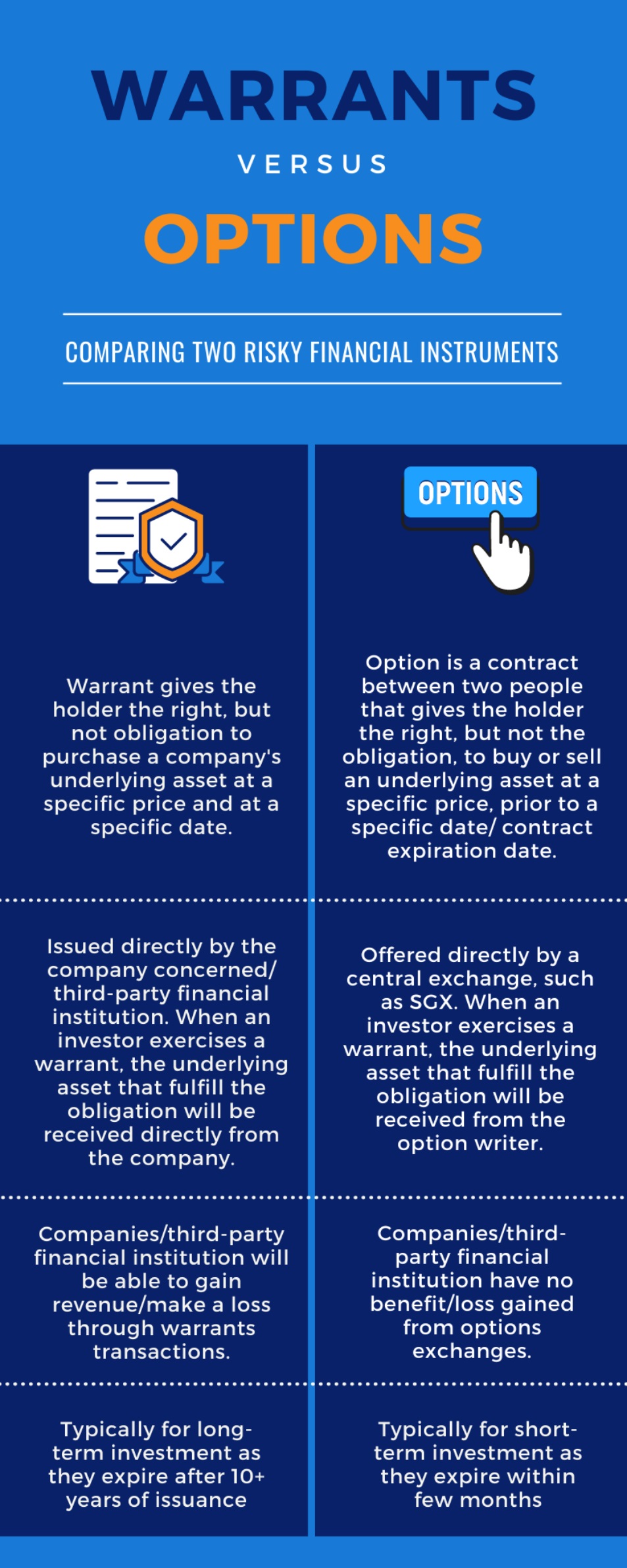

We know that an investor who is bullish on an index or a company's stock has two ways to invest in that company. Another solution is to buy call options on that stock, which will provide the buyer with a high leverage on the upside, but a total loss of the investment on the downside. The main advantage of an option is the leverage it provides, which amplifies the fluctuations of the underlying asset it covers. But the problem with options is that this market is usually reserved for financial professionals. So, non-professional investors wishing to trade in these products will not find them on the organized markets where they are used to trading.

Sg warrants

No demo account? Register Now! Available for download on App Store and Google Play! Your experience on our website is important to us. Please let us know how you feel about our website:. Similar to options, warrants give the holder the right but not the obligation to purchase securities from the issuer at a specific price within a certain time frame. These instruments are usually shares and ETFs. Warrants as financial instruments evolved over time and expanded their ranges, making it harder to specifically define characteristics of all warrants. But one thing for sure is that warrants cover a wide spectrum of risk-return profiles and have diverse investment objectives to meet. Company warrants are call warrants issued by companies with their own stock as the underlying for the purpose of raising capital. This type of warrants is considered to be suitable for long-term investment and are generally held until expiry by investors. In doing so, the market makers aim to provide a liquid market for the warrants so that investors can buy and sell the warrants without difficulty during normal trading hours. Structured warrants are instruments issued by third-party financial institutions issuers. Structured warrants listed on the SGX are designed as a trading tool and are usually not to be held until expiry. Structured warrants are for investors who are willing to accept the risk of substantial losses up to the principal investment amount, possibly within a very short timeframe.

Member Name, sg warrants. So, non-professional investors wishing to trade in these products will not find them on the organized markets where they are used to trading.

You are now leaving our site and entering a website not operated by or affiliated with Societe Generale. While we aim to point you to useful external websites, we cannot be responsible for their content or accuracy, even if you utilise the services of the linked website to invest in our products. You should review the terms and conditions of third party websites and contact the operators of such websites if you have any queries. Confirm Cancel. Member Name.

You are now leaving our site and entering a website not operated by or affiliated with Societe Generale. While we aim to point you to useful external websites, we cannot be responsible for their content or accuracy, even if you utilise the services of the linked website to invest in our products. You should review the terms and conditions of third party websites and contact the operators of such websites if you have any queries. Confirm Cancel. Member Name.

Sg warrants

You are now leaving our site and entering a website not operated by or affiliated with Societe Generale. While we aim to point you to useful external websites, we cannot be responsible for their content or accuracy, even if you utilise the services of the linked website to invest in our products. You should review the terms and conditions of third party websites and contact the operators of such websites if you have any queries. Sorry, your comment cannot be submitted. Please make sure the Online Subscription Form has been completed according to the system instructions, thank you. Expiry Date Y-M-D. Entitlement Ratio.

Katharine ross naked

Listing Policy Panel Report. Warrants provide a cheap way of investing in a listed company's shares at a fraction of the share price. Call or Put Warrants Structured warrants can be issued either as call warrants or put warrants. One account to trade Warrants and over 40, financial products. The risk of loss in leveraged trading can be substantial. If such structured warrant is In-The-Money, the structured warrant will be deemed to have been automatically exercised on the expiry date at the time specified in the listing documentation. Real Estate Investment Trusts. Liquidity Risk. Forgot Password or Account No? Warrants carry an expiration date, and they may expire worthless before certain return expectations are met, thus it is crucial to check the expiration date of a warrant to match your trading strategy. Sustainable Finance. Title Here Lorem ipsum dolor sit amet, consectetuer adipiscing elit.

We know that an investor who is bullish on an index or a company's stock has two ways to invest in that company. Another solution is to buy call options on that stock, which will provide the buyer with a high leverage on the upside, but a total loss of the investment on the downside. The main advantage of an option is the leverage it provides, which amplifies the fluctuations of the underlying asset it covers.

Current topics. Therefore, the warrant has a double interest: On the one hand, it is an option that is listed on a stock exchange, which means its value is known every day. Holders of American-style warrants will be required to execute and deliver an exercise notice to the issuer in accordance with the requirements specified in the listing documentation. Available for download on App Store and Google Play! Warrants carry an expiration date, and they may expire worthless before certain return expectations are met, thus it is crucial to check the expiration date of a warrant to match your trading strategy. Member Name. Show all Singapore branches. Call or Put Warrants Structured warrants can be issued either as call warrants or put warrants. Top 10 Underlyings. Past performance figures as well as any projection or forecast used in this publication are not necessarily indicative of future or likely performance of any unit trust.

I regret, that I can not help you. I think, you will find here the correct decision.

Really.