Sgx iron ore

Gold's recent

In a volatile lithium market, Albemarle and Lithium Americas are two of the top industry stocks in focus this month. A slump in the yen to a 4-month low Tuesday supported the dollar It specializes in the exploration, development, and operation Tune into today's Metals Minute for key levels and actionable trade ideas covering your favorite Precious Metals, overnight developments, and what to watch Your browser of choice has not been tested for use with Barchart.

Sgx iron ore

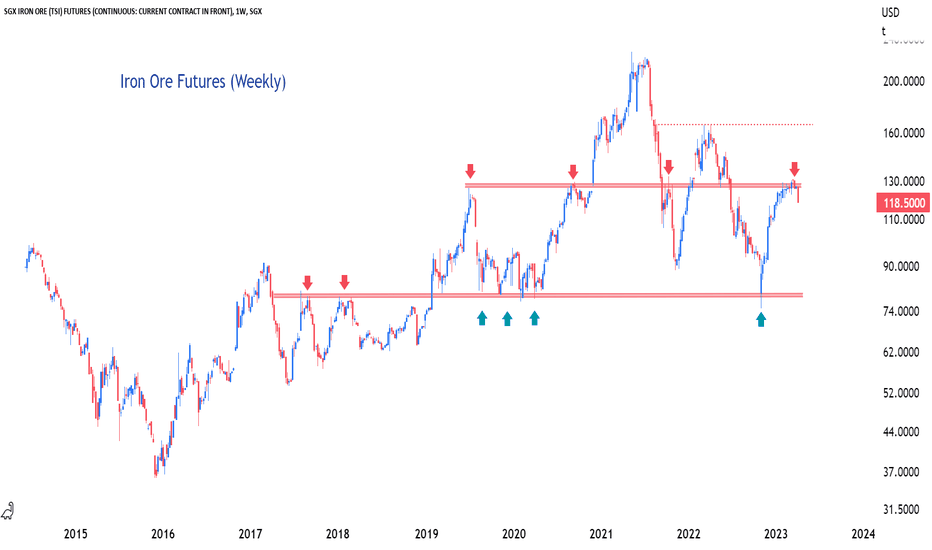

Iron ore futures listed on the Singapore Exchange are becoming one of the most important commodity futures contracts in the world. That growth trend is continuing into In March, 2. First, the contract is a hedge for volatility in iron ore prices, and by extension, as a hedge on the pace of economic growth in China. Iron ore is the main ingredient in the production of steel, and the rise of China's steel industry has dramatically altered the pattern of trade with an estimated two-thirds of all seaborne iron ore shipments going to China. That shift has helped drive greater use of the spot market for pricing shipments of iron ore—and greater need for protection against big swings in prices. For example, last year's decision by China's government to pivot away from the zero-COVID policy sparked a huge surge in iron ore prices as market participants anticipated renewed demand for steel in manufacturing, real estate and infrastructure. The second reason for the growth of the contract is the entry of a different set of participants. Historically, the market was dominated by iron ore producers, merchant traders, steel makers and swap dealers with exposures to the underlying physical commodity. More recently, however, hedge funds and other institutions with a purely financial interest have begun using the contract. For this group, the liquidity in the contract has now reached a level sufficient to support their trading strategies. Open interest, which measures the number of contracts outstanding, is one way to measure liquidity. Like volume, open interest in the main SGX iron ore futures has been rising steadily. At the beginning of , before the Covid pandemic disrupted the global economy, open interest was around , contracts. So far this year, open interest has been averaging more than , contracts.

Save this setup as a Chart Templates. SGX began clearing iron ore swaps more than 10 years ago, at a time when most iron ore was traded sgx iron ore. A slump in the yen to a 4-month low Tuesday supported the dollar

See all ideas. See all brokers. EN Get started. Continuous contract. Singapore Exchange. Market closed Market closed. No trades.

The dollar index DXY00 on Thursday fell by Yes, gold price confirmed its breakout — in daily closing price terms. Yes, it is important. The dollar index DXY00 this morning is down by The dollar index DXY00 on Wednesday fell by

Sgx iron ore

The dollar index DXY00 on Thursday fell by Yes, gold price confirmed its breakout — in daily closing price terms. Yes, it is important.

Plain long sleeve fishing shirts

Need More Chart Options? Trading Signals New Recommendations. That shift has helped drive greater use of the spot market for pricing shipments of iron ore—and greater need for protection against big swings in prices. Investing News Tools Portfolio. If you have issues, please download one of the browsers listed here. Site News. LAC : 5. Market on Close Market on Close Archive. Stocks Market Pulse. Forward curve. Currencies Forex Market Pulse. Free Barchart Webinar. In effect, the Dalian and Singapore markets function as two separate pools of liquidity. Most Recent Stories More News.

See all ideas.

Watchlist Portfolio. Skip to content. Contract size. Covered Calls Naked Puts. Continuous contract. All Press Releases Accesswire Newsfile. Steel Support? Live educational sessions using site features to explore today's markets. Below may lead to in a hurry. ETFs Market Pulse. See More. Bias would most likely be to the upside as there is quite a bit of support - TL and Horizontal - around

Prompt reply, attribute of ingenuity ;)