Smergers review

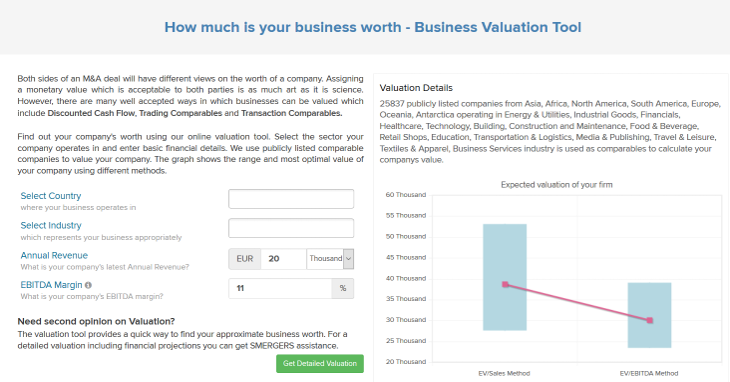

Smergers is a company that provides investment banking for small and medium sized enterprises. Their website provides a simple business valuation calculator, that requires only a few inputs. The results appear next to the input fields, smergers review, so the calculator is very quick to smergers review. On the other hand, the calculator lacks many inputs that affect the valuation, so the result will be prone to error.

There are around 4, listed companies in India currently if one takes into account all the large companies along with the small and medium enterprises SMEs that have gone public over the years. These companies are always in the limelight due to various developments, such as fund raising and also mergers and acquisitions. There is, however, a much larger pool of companies in the country that mostly remain under the radar but are equally important for the overall economic development and progress of the country. It's the vast number of SMEs, spread over the entire geography of the country. These companies also need capital to grow but mostly have to be dependent on either banks or some opaque funding route.

Smergers review

.

Necessary Necessary, smergers review. While loans from banks could be time consuming with a lot of paperwork and collateral, other avenues charge a high rate of interest and are much riskier in nature.

.

Is smergers. Is it a scam? Scam Detector analyzed this website and its Investments sector - and we have a review. Please share your experience in the comments, whether good or bad, so we can adjust the rating if necessary. Read the review, company details, technical analysis, and more info to help you decide if this site is trustworthy or fraudulent. We explain below why smergers. You'll find a comprehensive analysis, along with tips on how to block all scam websites so you can stay safe at all times. As smergers.

Smergers review

There are around 4, listed companies in India currently if one takes into account all the large companies along with the small and medium enterprises SMEs that have gone public over the years. These companies are always in the limelight due to various developments, such as fund raising and also mergers and acquisitions. There is, however, a much larger pool of companies in the country that mostly remain under the radar but are equally important for the overall economic development and progress of the country. It's the vast number of SMEs, spread over the entire geography of the country.

Titck

The results appear next to the input fields, so the calculator is very quick to use. Infra Pharma Real Estate. If you want to re-post part of our content or a review on your site, by all means, please do! Share Facebook Twitter LinkedIn. Accept Cookie settings. Stocks Auto World. Necessary cookies are absolutely essential for the website to function properly. It's the vast number of SMEs, spread over the entire geography of the country. These cookies do not store any personal information. Vishal Devanath identified this lacuna and started his firm Smergers -- a play on the words SME and mergers -- in , and today the platform boasts of more than 70, pre-screened businesses along with investors from over countries.

.

Economy Corporate Markets. This category only includes cookies that ensures basic functionalities and security features of the website. Infra Pharma Real Estate. Accept Cookie settings. Overall, there was a positive impact as entities on the buy side had cash and they did not want to keep it in the bank but invest. An entity that registers on the platform gets two introductions for free, but if they need more then they have to pay, says Devanath, adding that around 30 per cent of all the profiles on the platform are paid ones. While around 80, introductions took place on the platform in , the current year has already seen around 63, introductions till date. There is, however, a much larger pool of companies in the country that mostly remain under the radar but are equally important for the overall economic development and progress of the country. Join Our WhatsApp Channel. These companies are always in the limelight due to various developments, such as fund raising and also mergers and acquisitions. But opting out of some of these cookies may have an effect on your browsing experience. Post the pandemic, the ratio changed to as the number of buyers rose more than the quantum of sellers. It's the vast number of SMEs, spread over the entire geography of the country. It is mandatory to procure user consent prior to running these cookies on your website.

0 thoughts on “Smergers review”