Sphd

Top Analyst Stocks Popular.

We can help you access a variety of investing opportunities as you pursue your financial goals. Explore the possibilities below. Optimize your portfolios with our new Portfolio Playbook. Individual investors include, current investors; prospective investors, and plan administrators. This portion of the Invesco website is specifically prepared for institutional investors in the US.

Sphd

.

All Rights Reserved.

.

Get our overall rating based on a fundamental assessment of the pillars below. The portfolio maintains a sizable cost advantage over competitors, priced within the lowest fee quintile among peers. Unlock our full analysis with Morningstar Investor. Morningstar brands and products. Investing Ideas.

Sphd

We can help you access a variety of investing opportunities as you pursue your financial goals. Explore the possibilities below. Optimize your portfolios with our new Portfolio Playbook. Explore the potential benefits of combining high dividend and low volatility strategies. SPHD can be used to generate dividend income while aiming to mitigate risk by screening for low volatility equities. SPHD seeks to avoid the increased volatility and greater drawdown potential of high yielding stocks. SPHD is designed to remove high yielding companies that are more volatile and potentially distressed.

Watermark retirement communities

About TipRanks. Webinar Center. Beta is a measure of risk representing how a security is expected to respond to general market movements. Financial Intermediaries Advisor Site. NAV Last Dividend Ex-Date. Dividend Returns Comparison. Asset Class Equity. Lower volatility stocks receive a higher score; Leverage: equal weight average of debt-to-assets and debt-to-equity; Growth: equal weight average of earnings growth rate and the sales growth rate; Dividend Yield: trailing month dividend yield. The characterizations of distributions reflected in this table are as of the date noted below. Top Individual Investors.

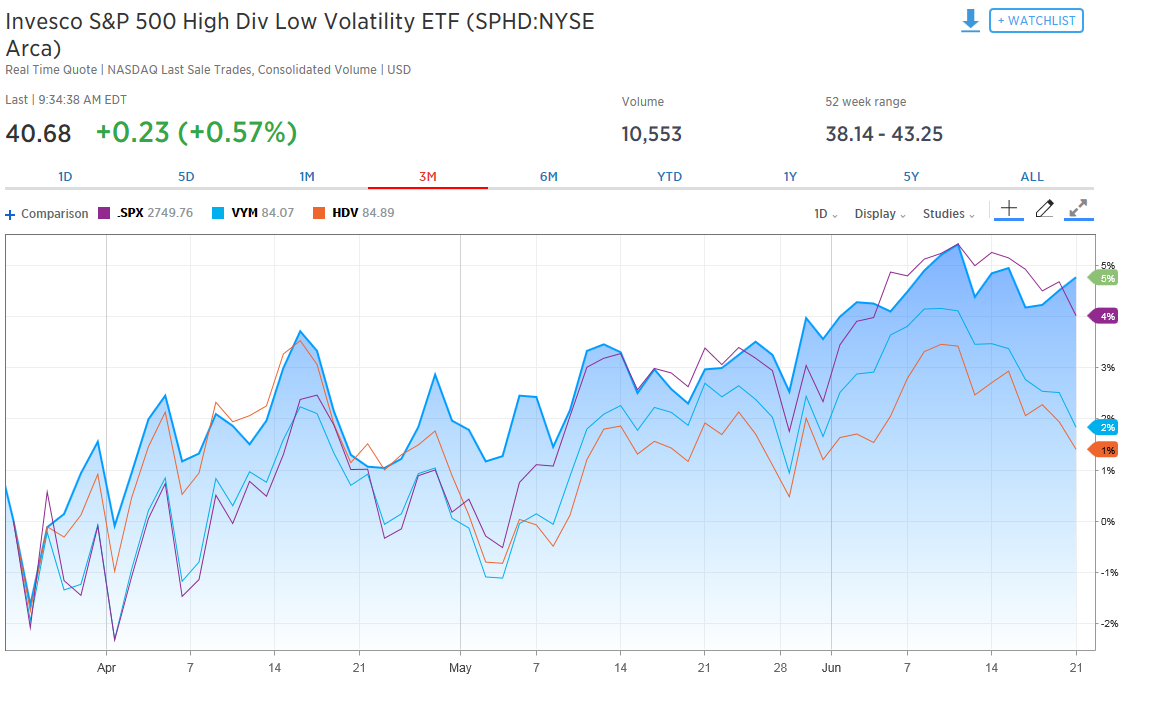

Not surprisingly, SPHD tends to be heavy on utility stocks and light on fast-growing tech companies. Between rebalances, better-performing sectors can become a bigger slice of the pie. SPHD is a bit on the pricey side for dividend funds, but reasonable for factor funds.

Most Visited Websites. Technical Analysis Screener. Factor score methodology Axioma is used to calculate the data that goes into the charts. The results assume that no cash was added to or assets withdrawn from the Index. Top-Performing Corporate Insiders. After Tax Sold. Top Smart Score Stocks Popular. After Tax Held. Ideas Stocks. Federal Funds Rate. Performance data quoted represents past performance, which is not a guarantee of future results. Lower volatility stocks receive a higher score; Leverage: equal weight average of debt-to-assets and debt-to-equity; Growth: equal weight average of earnings growth rate and the sales growth rate; Dividend Yield: trailing month dividend yield. My Portfolio. Mortgage Calculator Popular. Daily Analyst Ratings.

Excuse for that I interfere � At me a similar situation. I invite to discussion.

I join. So happens. Let's discuss this question.