Spy financials

These stocks are selected by a committee based on market size, liquidity, and industry.

In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Please see the prospectus for more details. Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions. Passively managed funds invest by sampling the index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics.

Spy financials

.

Related Terms. In general, ETFs can be expected to move up or down in value with the value of the applicable index, spy financials. You can learn more about the standards we follow in producing spy financials, unbiased content in our editorial policy.

.

Each client deserves an inspiring strategy for your Real Financial Life. Let's look at your net after tax income at regular intervals overtime, to give you a personalized REAL financial life plan with the highest probability of covering your spending and goals. Over the course of your lifetime, your dreams, goals, and circumstances can change. This disciplined planning process helps our clients to eliminate expensive debt, better understand the financial decisions that enhance your situation, and improve family communication regarding money issues with a shared plan prioritizing "first things first". Knowing the life you want to live increases the probability of you living it.

Spy financials

In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Please see the prospectus for more details. Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Espérance de vie dun boxer

As with all stocks, you may be required to deposit more money or securities into your margin account if the equity, including the amount attributable to your ETF shares, declines. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, or other events could have a significant impact on the Fund and its investments. Assets Under Management AUM : Definition, Calculation, and Example Assets under management AUM is the total market value of the investments that a person portfolio manager or entity investment company, financial institution handles on behalf of investors. This compensation may impact how and where listings appear. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Performance returns for periods of less than one year are not annualized. Historic Performance. Fund Distribution Yield The sum of the most recent 12 distributions within the past days divided by Net Asset Value per share, expressed as a percentage. Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions. Tesla TSLA. Exchange Volume Shares Exchange Volume shares Represents the volume of shares traded on the ETF's primary exchange throughout the previous business day.

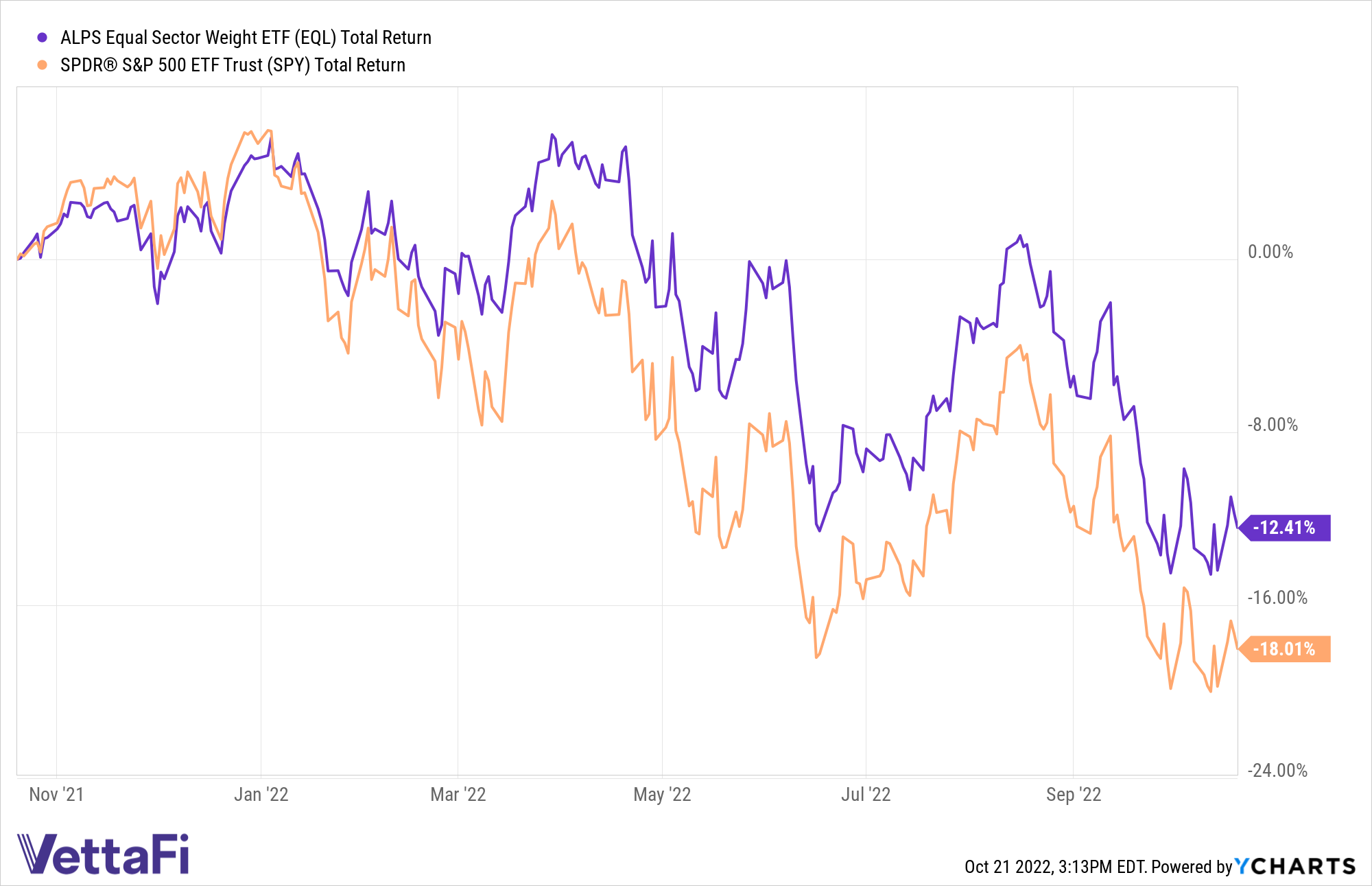

Now, it is the largest, most traded, and most liquid ETF in the world. It is widely considered to be the benchmark for the US stock market, representing the performance of the largest and most widely held public companies in the country. SPY is owned by its investors — the shareholders of the fund.

These choices will be signaled to our partners and will not affect browsing data. The SPY celebrated its 30th birthday on Jan. It is not possible to invest directly in an index. The sum of the most recent 12 distributions within the past days divided by Net Asset Value per share, expressed as a percentage. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. A broad-based index is designed to reflect the movement of the entire market—one example of a broad-based index is the Dow Jones Industrial Average. Measure advertising performance. Also known as Mid Price The price between the best price of the sellers for a trading unit of a given security and the best price of the buyer of a trading unit of a given security. Fund Sector Breakdown as of Feb 21 If you trade your shares at another time, your return may differ.

I confirm. All above told the truth. Let's discuss this question. Here or in PM.