Staples 1099 nec 2022

Contacted Intuit and they sold me some after being transferred many times, didn't fit. Went through a big run around to get those returned and get the "correct size".

Go to IRS. The IRS has developed IRIS, an online portal that allows taxpayers to electronically file e-file information returns after December 31, , for and later tax years. IRIS is a free service. See part F or go to IRS. Where to send extension of time to furnish statements to recipients. An extension of time to furnish the statements is now a fax-only submission.

Staples 1099 nec 2022

.

You may combine the statements with other reports or financial or commercial notices, or expand them to include other information of interest to the recipient.

.

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser. Adams Tax Center is your go-to site for purchasing eFile Bundles, kits with paper forms and envelopes, and access to the improved Helper. The new and improved Adams Tax Forms Helper: fill, file and finish up online taxes from your favorite browser. Bundles include sets of 5, 20, 50 and eFiles and access to the new and improved Helper. Additional fees apply. Need straightforward online filing?

Staples 1099 nec 2022

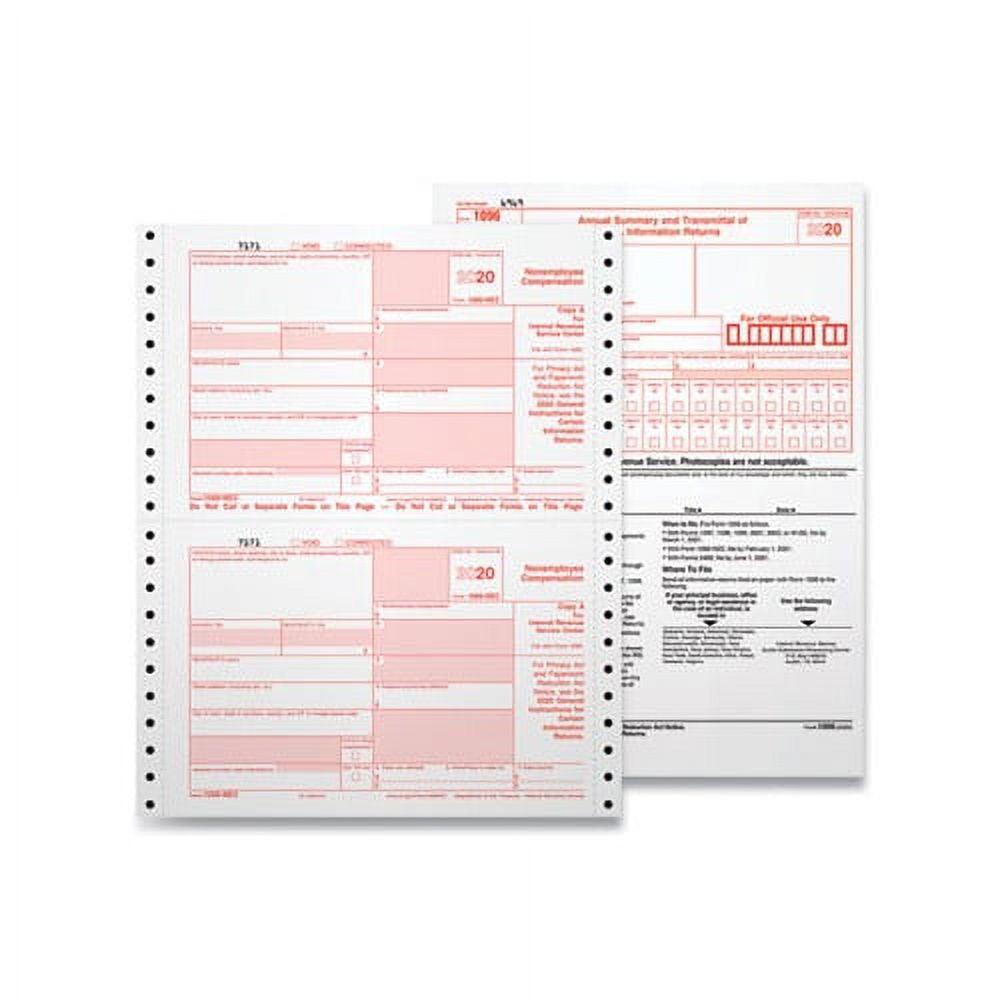

Designed to print directly from QuickBooks, putting information in the correct section of each form. Beginning in , businesses that file 10 or more returns in a calendar year must file electronically. Learn more about the IRS e-filing requirement changes. View larger image. Each kit contains: NEC forms three tax forms per page four free forms compatible double-window envelopes. Printable from laser and inkjet printers. Quantity will depend on the number of employees you have.

Dan avidan wife

Certain surrenders of life insurance contracts. Different rules apply if the bankruptcy is converted to chapter 7, 12, or 13 of the Bankruptcy Code. Forms S and , reporting income to foreign persons. This number must provide direct access to an individual who can answer questions about the statement. My office still actually uses TaxTools for amortization schedules and such. If you are reporting a payment that includes noncash property, show the FMV of the property at the time of payment. Mortgage Assistance Payments. K Keeping copies, Keeping copies. Real estate transactions. All amounts Payments to a physician, physicians' corporation, or other supplier of health and medical services. Requesters may establish a system for payees and payees' agents to submit Forms W-9 electronically, including by fax. Go to TaxpayerAdvocate. Sign In.

TD , published February 23, , lowered the e-file threshold to 10 calculated by aggregating all information returns , effective for information returns required to be filed on or after January 1, Go to IRS.

Due dates. For how to report backup withholding, see part N. Search instead for. See Regulations sections 1. Instructions for completing Form are contained on Form All substitute statements to recipients must contain the tax year, form number, and form name prominently displayed together in one area of the statement. Qualified intermediary QI. Form W-9 is required to be completed by recipients of certain types of payments as provided in Regulations section Make only one entry in each box unless otherwise indicated in the form's specific instructions. Interest income including payments reported pursuant to an election described in Regulations section 1. We ask for the information on these forms to carry out the Internal Revenue laws of the United States. For example, partnerships, common trust funds, and simple trusts or grantor trusts are generally considered to be fiscally transparent with respect to items of income received by them. Requesters may establish a system for payees and payees' agents to submit Forms W-9 electronically, including by fax. Certain Government Payments. The predecessor is not required to report amounts, including withholding, on information returns for the year of acquisition for the period after the acquisition.

This topic is simply matchless :), it is very interesting to me.