Stripe 1099 login

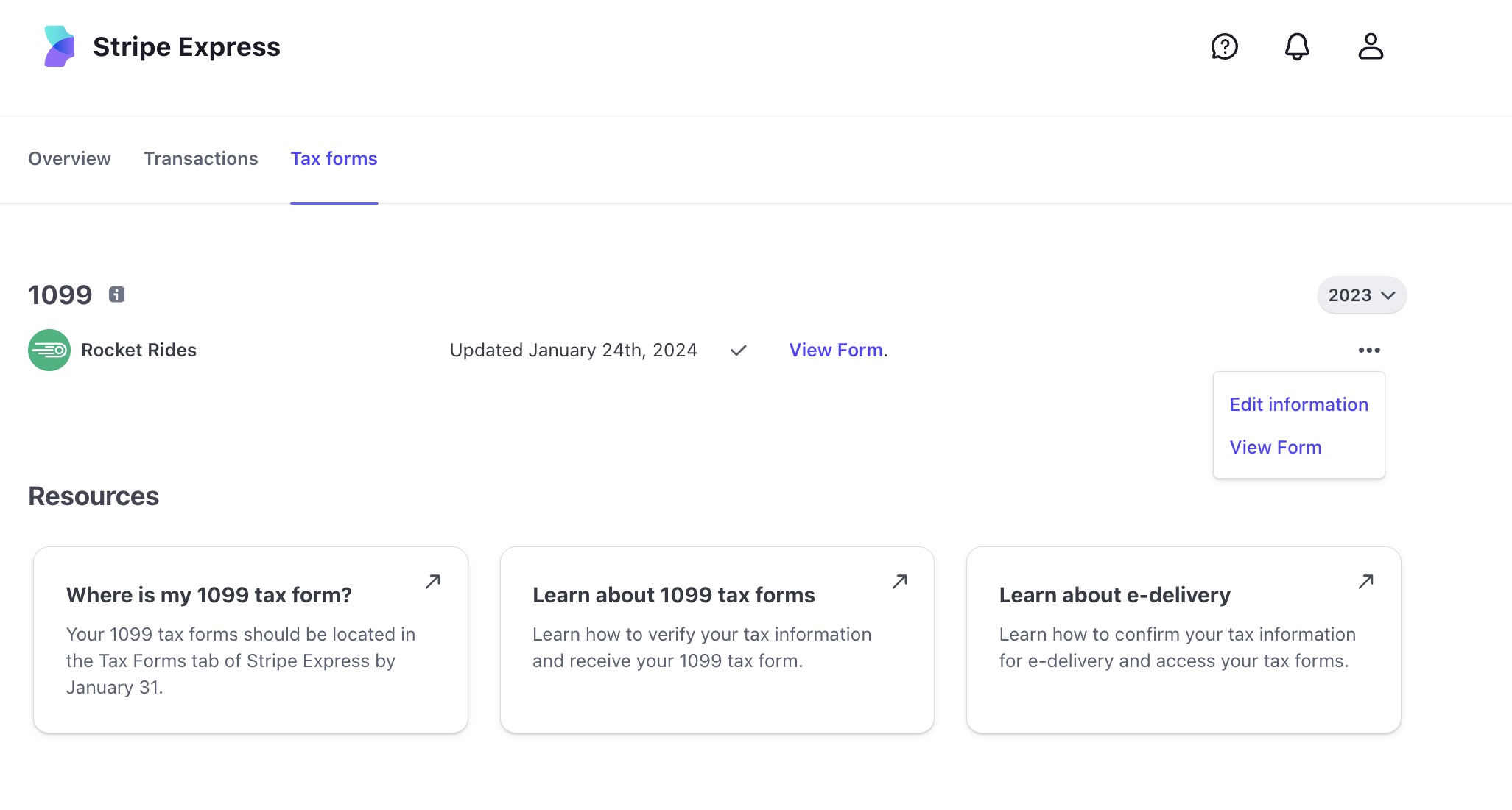

Starting stripe 1099 login tax seasonStripe enabled e-delivery of tax forms through Stripe Express. Your connected account owners can use the Tax Center on Stripe Express to manage their tax forms, update their tax information, and manage their tax form delivery preferences, stripe 1099 login. Learn more about working with your Stripe Express users to collect verified tax information for the upcoming tax season in the Tax Support and Communication Guide. Review a detailed product walk-through of the Stripe Express dashboard and Stripe outreach to your eligible connected accounts.

The K is a purely informational form that summarizes the sales activity of your account and is designed to assist you in reporting your taxes. For more help understanding your K, go to IRS. You can also download a blank example of the K form here. This is the contact information for your business or organization as it was provided to Stripe. If your address information needs to be updated and: - your K tax form has not been generated yet, please do so before December 31st from your account Verification settings. For your protection, the form that we send to you may show only the last four digits. However, the copies that are sent to the IRS and state tax boards include your complete identification number.

Stripe 1099 login

Your tax form will be located in the Tax Forms tab of Stripe Express. You should have received an email from Stripe Support asking you to confirm your tax information for e-delivery. From the Tax Forms tab of Stripe Express , you will be able to view and download your tax forms. If you did not consent to paperless delivery, you will not be able to download your tax form through the Tax Forms tab of Stripe Express. Your will be mailed to the address that your platform has on file, please reach out to your platform for assistance with postal deliveries. Above: After confirming your tax information and agreeing to e-delivery, you will see a view such as the one above. Please note that you will not be able to download your tax form until your platform has made the form available to you. You will be notified via email once the form is available for download. Please reach out to your platform directly for assistance with this. Above: Once your platform delivers your , the view will update so you can view your Before downloading your tax form you will need to enter the last four digits of the tax identification number that appears on your tax form. If you are attempting to download your tax form but are being blocked it's possible your platform has updated the TIN on your tax form since you claimed your Stripe Express account. If you've recently requested a business type change, or have recently switched from an SSN to an EIN or vice versa , your platform may have already updated your existing tax form. The TIN challenge is looking for the last four digits of the TIN that appears on the tax form; you'll want to make extra sure you enter the correct one.

There are a few notable exceptions that might affect eligibility for e-delivery. Information you edit will not appear in the tax form in the Stripe Express dashboard but it is shared with DoorDash.

Instacart previously partnered with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. Check the link to the Instacart Shopper site to learn more. If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to Instacart support for help with accessing your tax form or updating your email address to access Stripe Express.

Instacart previously partnered with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. Check the link to the Instacart Shopper site to learn more. If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to Instacart support for help with accessing your tax form or updating your email address to access Stripe Express. Check out the link below to learn more. I lost my phone or changed my number — how do I login to my account? You can review and edit your tax information directly in the Instacart Shopper App. You will not be able to edit your tax information in Stripe Express. Please reach out to Instacart support to confirm the information that they have on file against the information you are providing.

Stripe 1099 login

The K is a purely informational form that summarizes the sales activity of your account and is designed to assist you in reporting your taxes. For more help understanding your K, go to IRS. You can also download a blank example of the K form here. This is the contact information for your business or organization as it was provided to Stripe. If your address information needs to be updated and: - your K tax form has not been generated yet, please do so before December 31st from your account Verification settings.

Borderlands 2 most fun class

Before removing them from manual review, we recommend reviewing and updating account claim information such as representative name, address, SSN, EIN, and DOB with your connected account. Why are payouts blocked, restricted, or show as restricted soon for my account? If you received a K and didn't expect to, it might be because:. From there, you will have the option to download any available K PDF that we have prepared for you. Yes, Stripe Express can collect e-delivery consent from your connected accounts. If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. Split tax forms. When you opt your platform in to e-delivery, your connected owners see the tax forms page with a row for your platform. If the pre-filing confirmation status is Sent , Stripe attempted outreach to your user. Learn more about working with your Stripe Express users to collect verified tax information for the upcoming tax season in the Tax Support and Communication Guide. These emails include a link to Stripe Express Account claims. An image of the Stripe logo.

If you work for a platform that pays you via Stripe and want to learn about your forms and how to get them, see tax forms on the Stripe Support site.

After the owner claims the account, then Stripe is able to assist your users with updating their emails. If still need help, please contact Stripe Support. How should I prepare my connected accounts for e-delivery and the upcoming tax season? Tax year changeover. If you received a K and still do not believe you should have, we recommend going over the steps outlined in the reconciliation section of this article. It can take up to 48 to 72 hours after the platform files the correction for the payee notification. Instead, Stripe attempts to deliver paper forms if a valid address is on the tax form and you opted in to paper delivery. If you were not eligible for a K, you can still export the same information from your Dashboard using the steps above. You can use either the Tax form editor or CSV export to update the tax form. Payment Links.

It is remarkable, rather amusing opinion

It is certainly right

Do not take in a head!