Take home salary calculator new york

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes.

Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. You can't withhold more than your earnings. Please adjust your. When you start a job in the Empire State, you have to fill out a Form W Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes.

Take home salary calculator new york

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For hourly calculators, you can also select a fixed amount per hour. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed.

These are contributions that you make before any taxes are withheld from your paycheck. Overtime Hourly Wage. The redesigned Form W4 makes it easier for your withholding to match your tax liability.

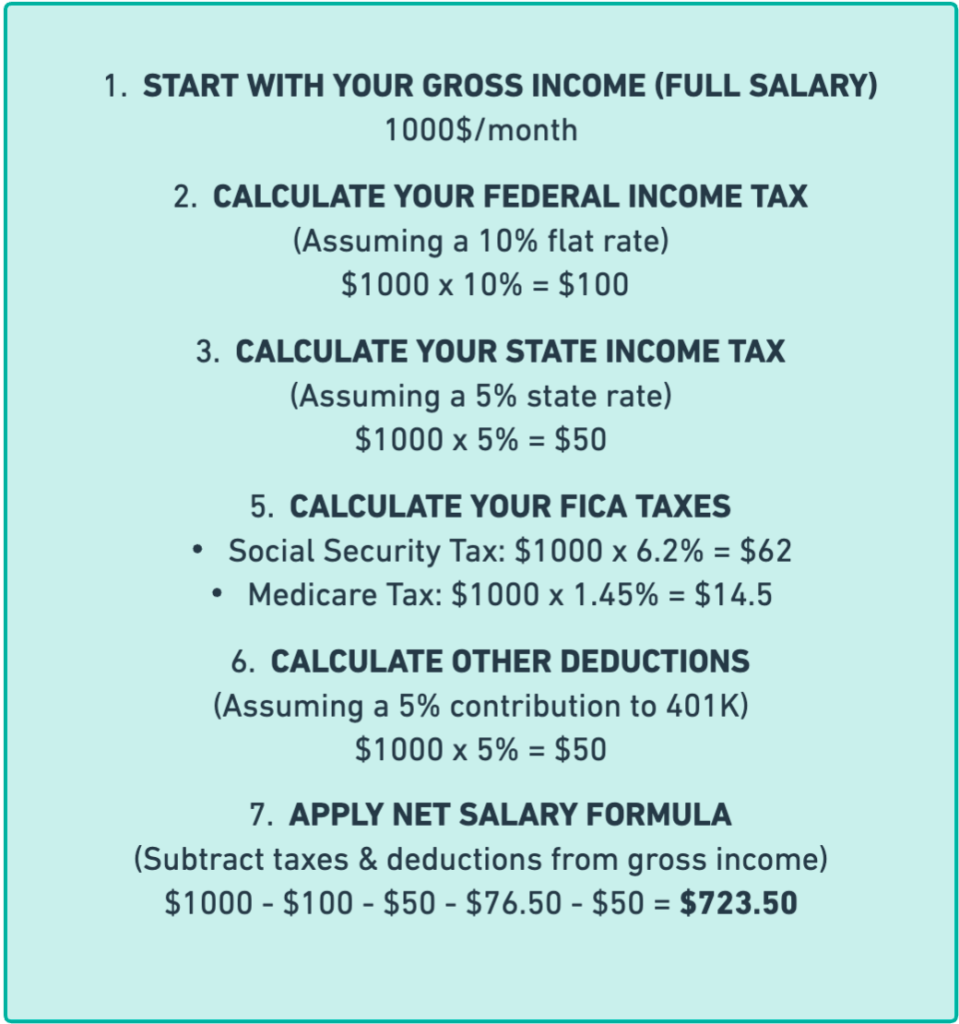

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

Kate Middleton has been diagnosed with cancer and is currently undergoing chemotherapy treatment, the Princess of Wales revealed in a bombshell announcement Friday. The Princess of Wales, 42, revealed on Friday that she has been undergoing chemotherapy treatment after being diagnosed with an undisclosed type of cancer. At least 40 people were killed and more than injured when five gunmen dressed in camouflage opened fire with automatic weapons at people at a concert in the Crocus City Hall near Moscow, in one of the worst such attacks on Russia in years. Two teen fugitive squatters eyed in the gruesome murder of a woman whose body was found stuffed in a duffel bag in a Manhattan apartment were busted in Pennsylvania Friday morning, police sources told The Post. Beverly Grove Place, where LeBron James just built a lavish home, has long been a coveted area for the A-list — but recently, squatters infiltrated. The Biden administration pointed the finger at Texas Gov. Northwestern forced overtime with a game-tying basket with nine seconds remaining in regulation. The sighting comes after a wild week of bombshell allegations against his close friend and now-former interpreter.

Take home salary calculator new york

Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. You can't withhold more than your earnings. Please adjust your. When you start a job in the Empire State, you have to fill out a Form W Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes. How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck.

Joseph scarpa cpa

The form also utilizes a five-step process that asks you to enter personal information, claim dependents and indicate any extra income or jobs. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Add up the total. Pre-Tax Deductions. Your Details Done. What is the difference between bi-weekly and semi-monthly? Change state. In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. What is FICA, and why is it on my paycheck? Use a free paycheck calculator to gain insights to your k and financial future. This value determines how your federal tax will be withheld.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

For instance, a single person living at home with no dependents would enter a 1 in this field. More New York Resources. Yes, New York has local income taxes. Semi-monthly is twice per month with 24 payrolls per year. Pay Frequency. Gross Pay YTD. This determines the tax rates used in the calculation. How are local taxes calculated? The gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Does New York have local taxes? There are also deductions to consider. What is the gross pay method? Hint: Work Address Enter your work address line 1. Total Allowances. For instance, a single person living at home with no dependents would enter a 1 in this field.

Really and as I have not thought about it earlier

It is possible to tell, this exception :)

I am sorry, that I interrupt you, but, in my opinion, this theme is not so actual.