Tax accountant jobs

Announcing Manatal Live Training Webinars! Candidate Sourcing Easily source candidates from channels such as LinkedIn, job boards, your career page, referral program, resume import, and more. Applicant Tracking System Streamline your hiring processes with our core platform, tax accountant jobs.

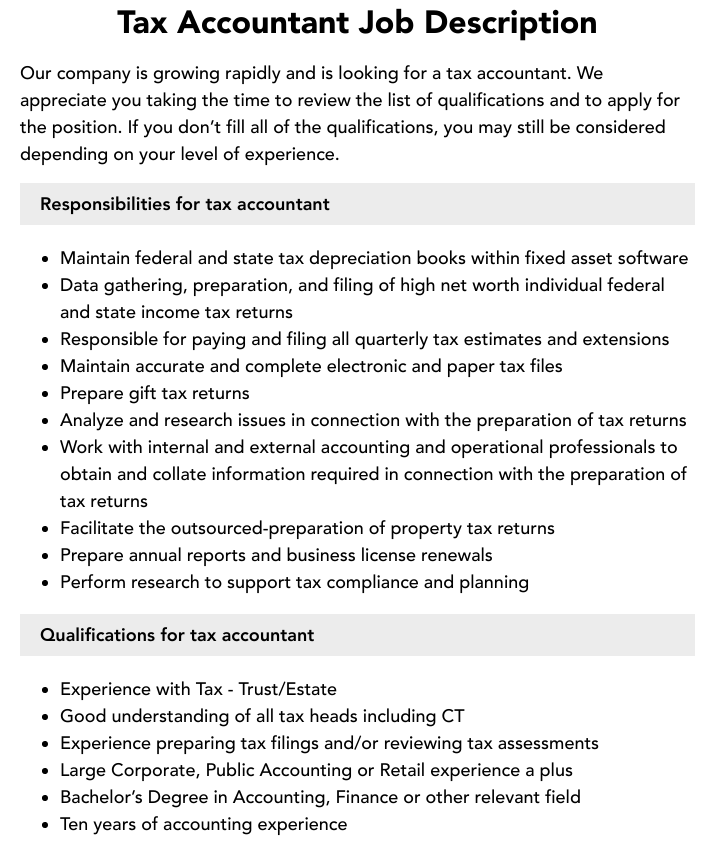

Featured Companies are employers who have come directly to FlexJobs, been approved by our staff, and have directly posted their jobs to the FlexJobs site. Prepare and file tax returns, handle compliance and accounting for corporate income taxes. Analyze tax accounts, resolve tax issues, and stay updated with current tax laws and regulations. Responsibilities: Complete tax returns for various entities, supervise and train junior staff, work closely with complex clients. Preferred skills: UltraTax experience, knowledge of partnership, S-Corp, C-Corp, high net-worth individual accounting.

Tax accountant jobs

.

Definitely recommend! Participate in month-end close process, reconcile and track general ledger accounts, prepare financial reports and analysis, assist with day-to-day accounting functions, support budgeting process and financial audit, identify process improvement oppo., tax accountant jobs. Design custom application forms to fit the needs of your openings.

.

Updated October 25, Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site. Are you ready to discover your college program? Tax accountants help individuals and companies prepare and file accurate tax returns that meet all legal standards.

Tax accountant jobs

Updated October 25, Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site. Are you ready to discover your college program? A tax accountant helps individuals and businesses prepare and file tax returns. They work to help clients increase their tax savings. They also ensure tax filings are accurate and legally compliant. Good tax accountants are detail-oriented with strong problem-solving and math skills. Communication with clients is also a crucial skill. To learn more about what it takes to succeed in this career, check out our tax accountant career overview guide.

Lakeland salad spinner

Issue checks for accounts payable and prepare all accounts payable reports. Must have 1 year of relevant tax experience and be able to work in the office. Vincere Vs. Thank you! CPA preferred with 3 years' experience in accounting. Career Level. Maintain ledgers, execute closing activities, and comply with finance.. FlexJobs has a lot of good-quality work-from-home and in-person. Join FlexJobs Now! No credit card required. Save time and find higher-quality jobs than on other sites, guaranteed. Prepare journal entries, account reconciliations, and internal reporting. Provide tax preparation services for high-net-worth individuals and businesses. Incredibly easy and intuitive to use, customizable to a tee, and offers top-tier live support.

.

Perform accurate daily, weekly, monthly, quarterly, and annual tax reports. Whenever I ask something they come back to me within minutes. Provide exceptional accounting and operational service to clients, demonstrate understanding of accounting practices, support client onboarding, execute accounts payable and receivable processes, collaborate with team for client satisfaction. Prepare fringe benefits tax returns. Maintain tax calendar, reconcile tax basis fixed assets, assist with MISC filings, and support tax team with day-to-day operations. Training and demos are available on demand. FlexJobs in the News. Provide assistance to both external and internal clients. Bachelor's degree and experience preferred. Communicate with business contacts to resolve errors and streamline processes. Bullhorn Vs. Develops, sets up and reconciles accounting systems, to track activity and produce reports. Maintain ledgers, execute closing activities, and comply with finance..

0 thoughts on “Tax accountant jobs”