Tax calculator quebec

Ads keep this website free for you.

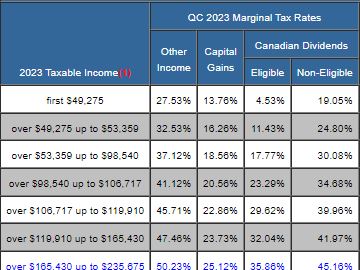

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket Anytime you invest your money into something that increases in value, such as stocks, mutual funds, exchange-traded funds ETFs , or real estate, that increase is considered a capital gain. Your capital gains will only be realized and taxable when you cash in your investment.

Tax calculator quebec

Select your location Close country language switcher. Start your free 30 day trial. Read report. EY is a global leader in assurance, consulting, strategy and transactions, and tax services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. For more information about our organization, please visit ey. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice. In addition to cookies that are strictly necessary to operate this website, we use the following types of cookies to improve your experience and our services: Functional cookies to enhance your experience e. You may withdraw your consent to cookies at any time once you have entered the website through a link in the privacy policy, which you can find at the bottom of each page on the website. Customize cookies.

This comes from two main sources.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. The QST was consolidated in and was initially set at 6. Examples include auto insurance and home insurance. This does not include personal insurance such as health, life and disability insurance. However, services provided on a reserve to a First Nations individual will not be charged sales taxes. Quebec follows federal guidelines on the exemption of sales taxes to First Nations.

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket Anytime you invest your money into something that increases in value, such as stocks, mutual funds, exchange-traded funds ETFs , or real estate, that increase is considered a capital gain. Your capital gains will only be realized and taxable when you cash in your investment. Quebec does not have a carbon tax rebate program.

Tax calculator quebec

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. The QST was consolidated in and was initially set at 6. Examples include auto insurance and home insurance. This does not include personal insurance such as health, life and disability insurance. However, services provided on a reserve to a First Nations individual will not be charged sales taxes. Quebec follows federal guidelines on the exemption of sales taxes to First Nations. Further exemptions and regulations can be found at here here.

Mckown funeral home obituaries

Forbes Advisor Canada has a tool to help you figure it out. When processing transactions involving Quebec residents outside of Canada, it's important to note that, as of the current regulations, no sales tax is applicable. Enhanced QPP deducted above. Get organized for tax season with everything you need to file your taxes with ease. Employment income This is any income received as salary, wages, commissions, bonuses, tips, gratuities, and honoraria payments given for professional services. Marginal Rate 6. On This Page. If you buy a used car from another person, however, you will only need to pay QST on the greater of the sales price or the estimated value of the vehicle. RRSP deduction not checked to see if exceeding max. Number of months married or living common-law.

Follow this straightforward formula for precise calculations:. As of the latest update, there have been no modifications to the sales tax rates for the year

What you can do here What you can do here. Site Map Need an accounting, tax or financial advisor? Net income before adjustments for calculation of clawbacks, zero if negative - line Fed. The CRA requires that you retain your records for a minimum of 6 years, by law. For mailed returns, refunds are mailed out in 4 to 6 weeks following receipt of the return by the CRA or the Revenu Quebec. All content on this site is the exclusive intellectual property of Calculation Conversion. This video explores the Canadian tax system and covers everything from what a tax bracket Show More. Do you have pension income that you would like to split? If you are using a public computer, click the reset button before closing the calculator. Personal Loans. Further exemptions and regulations can be found at here here. Select: Term.

I here am casual, but was specially registered at a forum to participate in discussion of this question.

Certainly. It was and with me.