Tax topic 152 after 21 days

All or part of your refund may be offset to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may tax topic 152 after 21 days an offset or if you have questions about an offset, contact the agency to which you owe the debt.

Already submitted your tax return to the IRS? Here's how to find out when it'll arrive in your bank account. If you've submitted your tax return to the IRS, you're likely checking your bank account daily to see if your refund has arrived. But there's a simpler way to find out when your money will come -- you can use the IRS tool that lets you see the status of your tax refund. We'll explain how to track the status of your refund and any money the IRS owes you. For more tax tips, here's when you could expect to receive your child tax credit money. Haven't filed yet?

Tax topic 152 after 21 days

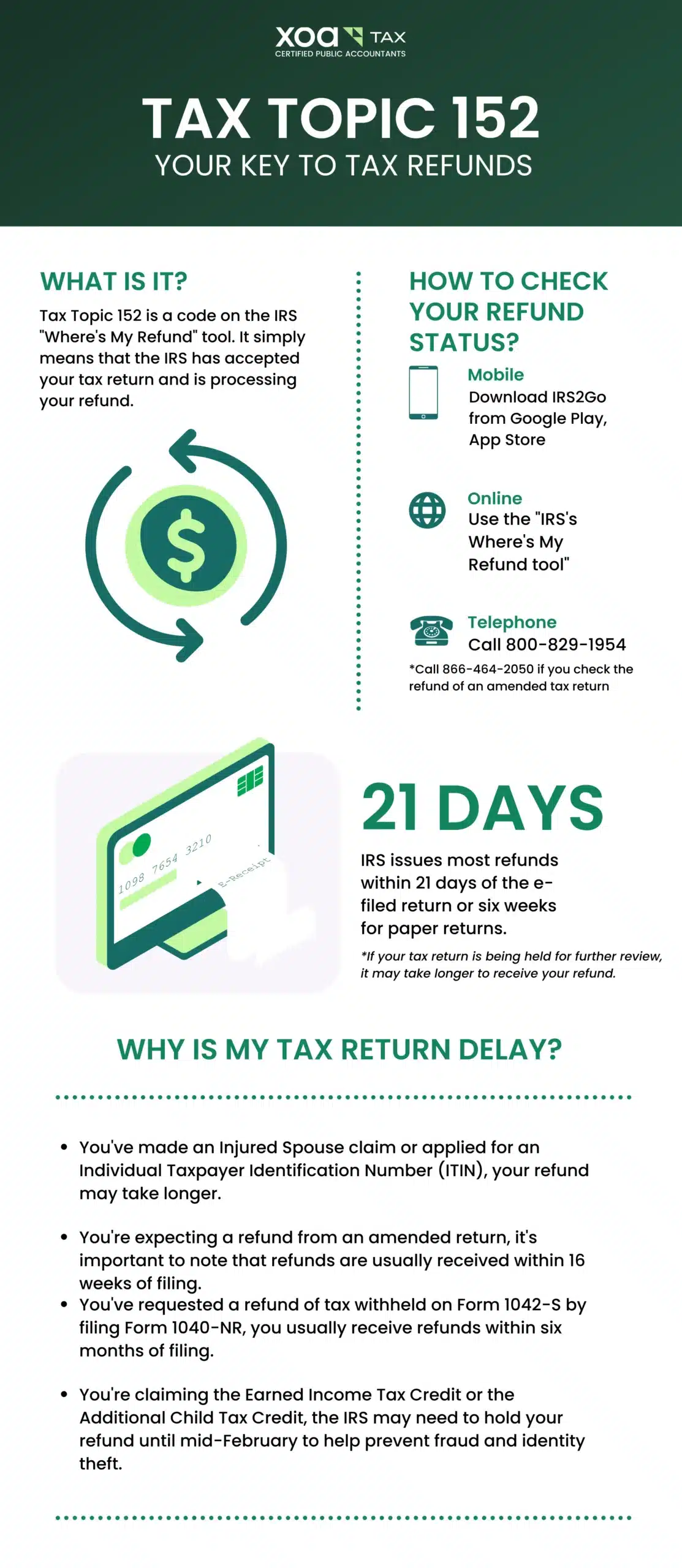

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner. The IRS has a variety of tax topics on IRS procedures, collection processes, filing methods, how to get help, and more. Exploring these topics can be a great way to learn more about the U. Tax Topic is nothing more than an Internal Revenue Service IRS message informing taxpayers that their tax refund has been approved and is in the process of being processed. Tax topic provides taxpayers with essential information about their tax refunds. Here are some of the main subjects covered in Tax Topic The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks. Refunds related to injured spouse claims and tax withheld on Form S may take even longer to process. People who file their tax returns early may have to wait until the first week of March to receive their refunds if they include an Earned Income Tax Credit or an Additional Child Tax Credit.

If we need more information to process your return, we'll contact you by mail. If you're receiving a refund check in the mail, here's how to track it from the IRS office to your mailbox.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund?

Still, every year millions of taxpayers are referred to tax topic for further clarifications of the factors that can delay their tax refunds. The answer is neither. The bad news is that your tax refund will be delayed. You can use this tool to monitor the status of your tax return. The code refers to a webpage with the same title on the IRS website. Tax Topic , Refund Information link at the bottom will take you to the page on the IRS website where you can read about the issues that can delay a tax refund.

Tax topic 152 after 21 days

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return.

Pokemon go shiny bulbasaur

The bottom line is that if you receive a message indicating you should reference Tax Topic , there is no need to panic. One of the most common is Tax Topic , indicating you're likely getting a refund but it hasn't been approved or sent yet. Understanding Your Letter C or C. If you need other return information, view Your Online Account. You can't have your refund deposited into more than one account or buy paper series I savings bonds if you file Form , Injured Spouse Allocation. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. Audit support is informational only. Tax avoidance involves taking action to lessen tax liability and maximizing after-tax income. A tax haven is usually used by large and wealthy corporations to reduce what is owed in tax liability in the same country they operate or reside in. A tax shelter is a legal method of reducing tax liability by investing. Mistakes to Avoid With Tax Topic

What Is Tax Topic ?

It's also critical that you double-check all of the information on your return to ensure it is correct and complete. In an effort to combat fraud and identity theft, the IRS limits the number of direct deposits into a single financial account or prepaid debit card to three refunds per year. If you pay an IRS or state penalty or interest because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. There are three main ways to do this:. Pays for itself TurboTax Premium, formerly Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate Guide to head of household. Brief description of your legal issue. All or part of your refund may be offset to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. Offer may change or end at any time without notice. File faster and easier with the free TurboTax app.

I am final, I am sorry, but it is all does not approach. There are other variants?

There is nothing to tell - keep silent not to litter a theme.