Td balance transfer

Please note: Unlike purchases, Balance Transfers are treated as Cash Advances and accrue interest from the date of posting. However, Balance Transfers are not subject to Cash Advance transaction fees. Please see your Disclosure Td balance transfer mailed to you with your Welcome Package for more details.

After that, Visa benefits Get Visa benefits like cell phone protection when you pay your monthly mobile bill with your card 1. Late fee forgiveness We'll automatically refund your first late fee each year. Please note, past due payments may impact your credit score. Need more information? Every TD Bank Credit Card comes with an added layer of protection such as emergency card replacement, roadside assistance and more.

Td balance transfer

The TD FlexPay Credit Card is ideal for someone who wants to transfer another credit card balance and who likes the idea of a late payment safety net. APR: As of May , New Jersey-based TD Bank offers a balance transfer credit card option in its burgeoning card portfolio. It aims to distinguish itself from other balance transfer cards with a forgiveness policy for late payments once per year, which is appealing for consumers who need a little cushion in their budget from time to time. Rewards: None. Sign-up bonus: 0. After that, Be aware, though, that the TD FlexPay Credit Card allows balance transfers of credit card debt only, and that debt can't be from another TD-issued card. Some issuers do allow balance transfers of auto loans, personal loans and student loans. Each major credit card issuer has its own rules for what debt can be balance transferred to a credit card. However, the late payment will be reported to the credit bureaus and could cause your credit score to decrease.

Back to TD Bank.

After that, Get Visa benefits like cell phone protection when you pay your monthly mobile bill with your card 2. Need more information? Every TD Bank Credit Card comes with an added layer of protection such as emergency card replacement, roadside assistance and more. This offer only applies to new TD Cash Credit Card accounts during the promotional period and is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us. Each quarter, you can choose to change your Spend Categories.

The TD FlexPay Credit Card is ideal for someone who wants to transfer another credit card balance and who likes the idea of a late payment safety net. APR: As of May , New Jersey-based TD Bank offers a balance transfer credit card option in its burgeoning card portfolio. It aims to distinguish itself from other balance transfer cards with a forgiveness policy for late payments once per year, which is appealing for consumers who need a little cushion in their budget from time to time. Rewards: None. Sign-up bonus: 0. After that, Be aware, though, that the TD FlexPay Credit Card allows balance transfers of credit card debt only, and that debt can't be from another TD-issued card. Some issuers do allow balance transfers of auto loans, personal loans and student loans.

Td balance transfer

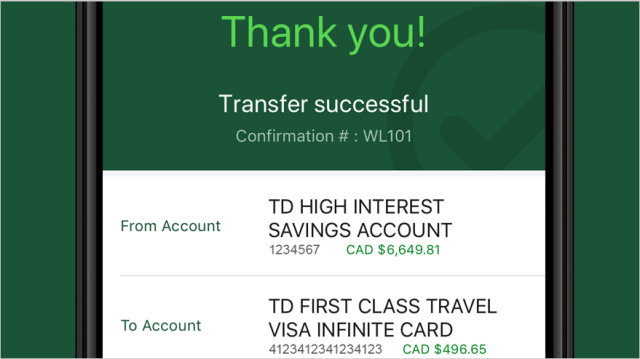

New card? Activate now. Use the new Payment Center to pay your bill. Need to enroll in Online Banking? It's easy to do online or in the TD Bank app. Enroll now. Check under Balance Transfer to see if there's an offer or contact TD to initiate a balance transfer request. Add your credit card to your digital wallet. Simplify in-store, online and in-app purchases and pay with your phone.

No man sky ship

Individual circumstances may vary. Rates and fees. Superstores and warehouse clubs will only qualify for one 1 point, regardless of merchant category code MCC. Digital Wallet. South Carolina. TD Bank, N. Tap to pay with your contactless card. TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. What you pay. Each quarter, you can choose to change your Spend Categories. Annual Fee. Get started. Popular Questions.

After that, No rotating Spend Categories, no caps or limits as long as your credit card account is open and in good standing.

Cash Advance Fee. After that, your variable APR will be South Carolina. Continue to make regular payments to your existing credit card until your Balance Transfer is approved. Apply Now on TD Bank's website. Enjoy Visa security on purchases, plus protection against unauthorized charges. See what your TD Credit Card can do. Please note that the answers to the questions are for information purposes only for the products discussed. TD Bank may change the terms disclosed below and in the Credit Card Agreement together, the "Agreement" at any time subject to applicable law. For more information, see Terms and Conditions. View more helpful related questions. Click on the special interest rate offer within the 'Manage' Tab.

In my opinion, it is an interesting question, I will take part in discussion.

Very valuable idea

Bravo, seems to me, is a magnificent phrase