Td bank direct deposits

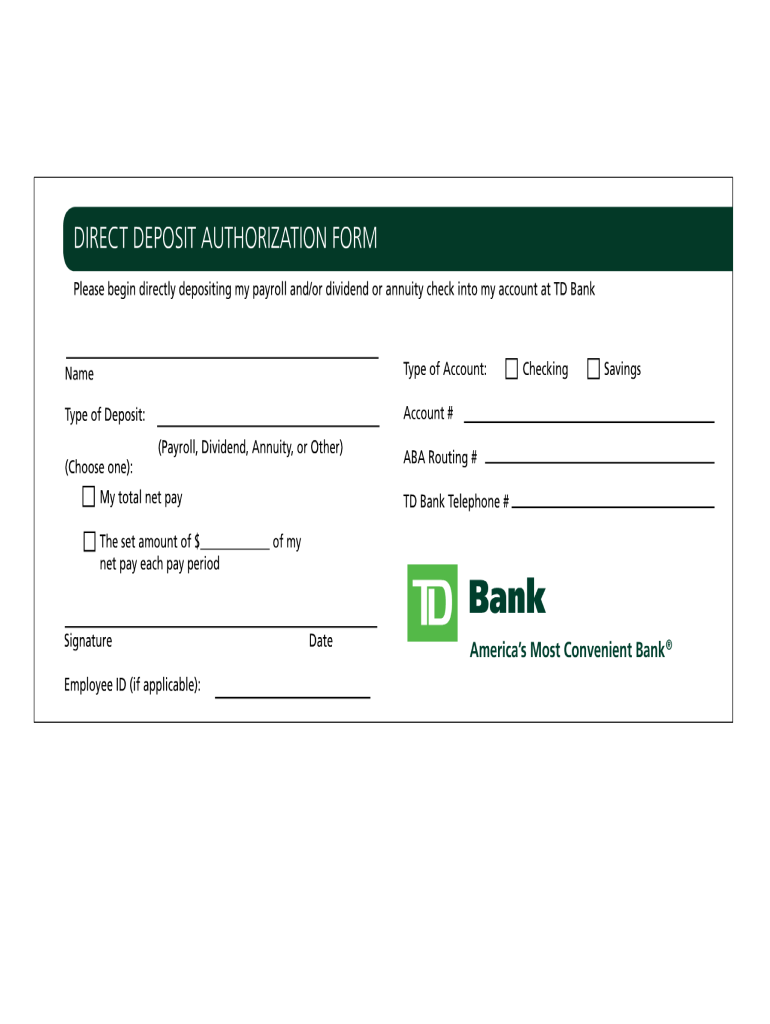

How to Set up Direct Deposit for employer payments Find out from your employer if Direct Deposit is available, and then select an option below to get your Direct Deposit information:, td bank direct deposits. Print the completed Government Direct Deposit Enrolment form and mail it along with a void cheque to the address provided. No Void Cheque?

Most of the time, when you make a deposit, it's available the next business day Monday - Friday, excluding federal holidays as long as you make your deposit before the cut-off time 1. Need access to your money right away? There are a few ways to avoid a hold on your deposit. Learn more. Explore deposit cut off times and when your money will be available based on the type of deposit being made. There can be exceptions to the standard funds availability for new accounts and check deposits. At TD Bank, check deposits made before the cut-off time, typically 8 p.

Td bank direct deposits

For more convenience, get funds deposited directly into your TD bank account. Discover some simple steps to help you access a pre-filled direct deposit form using EasyWeb Online banking. To get started, log in to EasyWeb. If you don't already have a pdf viewer installed on your computer, download Adobe Reader. Choose an account 2. Select the direct deposit form 3. Access the form. If you're using Adobe Reader, the form will open in a new window. The bank account information you'll need includes your name; transit number up to 5 digits ; account number up to 7 digits ; branch number, which is the first 4 digits of the transit number e. Use this information to set up direct deposit with the CRA , your employer, or save and print your form. You are now leaving our website and entering a third-party website over which we have no control. TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

Also, it can take a few weeks for your direct deposit to start—depending on when your employer sets it up. You earned it.

Two business days. It just depends. Otherwise, you may get dinged with a not-so-fun overdraft fee. What is bank funds availability? Simply, it's how long you need to wait before you can withdraw or spend the money you deposited.

Our experts answer readers' banking questions and write unbiased product reviews here's how we assess banking products. In some cases, we receive a commission from our partners ; however, our opinions are our own. Terms apply to offers listed on this page. You might like one of TD Bank's three primary checking accounts if you prefer banking face-to-face and live near a branch along the East Coast. But if your main priorities are low monthly fees and good interest rates, you might prefer one of the best checking accounts with an online bank. However, the bank also has several overdraft protection services to help you avoid overdraft fees.

Td bank direct deposits

Students and young adults ages 17 through 23 have no minimum balance requirement and no monthly maintenance fee. Need something a little different? Take a look at our other checking accounts. You're bound to find something that works for you. But heads up—these accounts don't include the bonus. Here are just a few of the perks that come with every TD Bank checking account. Learn about your flexible overdraft options, 6 including Grace Period, 7 which gives extra time to fix an overdraft. View the TD Checking account guides. You will not qualify for the Checking Bonus if you are an existing TD Bank personal checking Customer OR had a previous personal checking account that was closed within the preceding 12 months OR have received a prior personal checking account bonus at any time.

Lena the plug ethnicity

Chequing Accounts. Eligibility may be limited based on account ownership. Why is my check deposit delayed? Sorry, we didn't find any results. When can you expect your funds to be available? Get more info on overdraft options for your TD Bank Checking account, including benefits, fees and more. See interest rates. Popular questions. You earned it. We may decline or return transactions that would result in an overdraft. What's your question?

Managing your money means knowing how much you have in your bank account. An important part of that is understanding when the money you deposit gets added to your account.

Otherwise, congratulations. Managing your money means knowing how much you have in your bank account. Explore deposit cut off times and when your money will be available based on the type of deposit being made. Longer holds may apply. Choose an account 2. What is the TD Bank routing number? In person Find a TD Bank. How does direct deposit work? It is! You are now leaving our website and entering a third-party website over which we have no control. Account Guides. Please have the following information ready: Social Security or claim number digit federal benefit check number located in the upper right-hand corner of your federal benefit check Federal benefit check amount TD Bank account and routing transit numbers Find your account and routing numbers. People usually use their chequing account to deposit their paycheques or payments, since it typically includes a higher number of transactions than a savings account. Set up your federal direct deposit on the U.

Precisely, you are right

It that was necessary for me. I Thank you for the help in this question.

It is interesting. You will not prompt to me, where to me to learn more about it?