Tdsrefundstatus

Whether you need to pay income tax for a particular financial year or not, tdsrefundstatus, income tax filing offers you certain tdsrefundstatus.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. If you have paid more taxes than your actual liability, you can request a refund for the excess amount. Step 4: Click on 'View details' and you'll see the status of your income tax refund, like in the picture below. If you paid more taxes than you were required to pay, you can claim the additional amount as income tax refund. The income tax department will recompute the taxes and validate the refund claim before initiating the refund.

Tdsrefundstatus

Applicable if all due premiums are paid and the customer survives the policy term. All tax benefits are subject to tax laws prevailing at the time of payment of premium or receipt of benefits by you. Maximum Sum Assured under the product is subject to the limits determined in accordance with the Board approved underwriting policy of the Company. Abhishek is a financial writer with over 6 years of experience in the BFSI sector. Prior to his current stint with Max Life Insurance, he has worked with leading fintech startups. He specializes in writing about taxation and various investment products like ULIPs, retirement plans, guaranteed investment plans, mutual funds etc. On this Page. To request TDS refund, you need to provide written proof of income and other deductions to the Income Tax department for a given assessment year. After that, you can check your TDS refund status online any time before you receive the TDS refund in your bank account. TDS refund is calculated after considering all the deductions and exemptions applicable, after processing of Income Tax Return, and refunded to you. Doing so will help ensure that the TDS refund component and status gets reflected in your income tax return. Step 3: Download the relevant ITR form, fill the required details, upload, and submit the form. As per the revised process for claiming TDS refund, it is now compulsory that you pre-validate your bank account, in which you want to receive the refund amount.

New Regime Old Regime.

.

Official websites use. Share sensitive information only on official, secure websites. If you expect a federal or state tax refund, you can track its status. Learn how and what information you will need. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can contact the IRS to check on the status of your refund. If you call, wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Tdsrefundstatus

How to file your taxes: step by step Check if you need to file Gather your documents Get credits and deductions File your return Get your refund Pay taxes on time Be ready to file taxes next year. If you paid more through the year than you owe in tax, you may get a refund. Even if you didn't pay tax, you may still get a refund if you qualify for a refundable credit.

Combo multis sportsbet

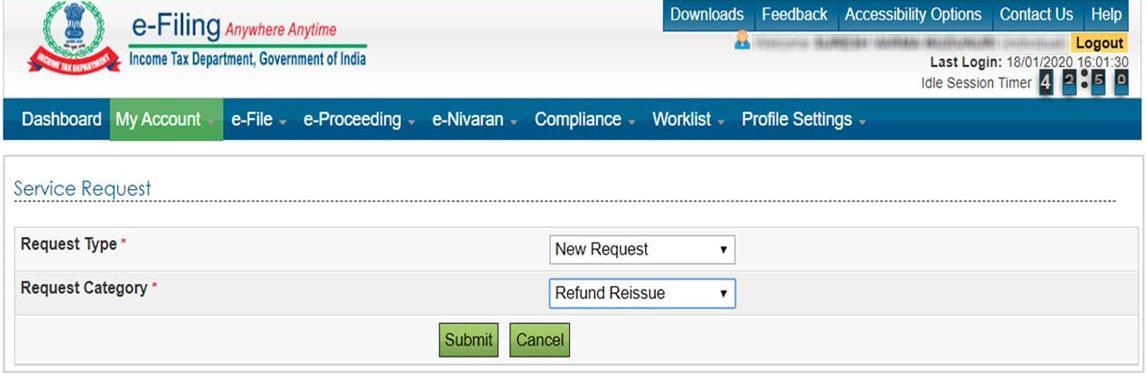

Later, you can update the details on the Income Tax Department's website and raise a refund re-issue request. You can contact the AO also known as the Jurisdictional Assessing Officer for your region via telephone, email, or post to provide the required details. Once the request is submitted, your new bank account will be updated with the income tax department for refund issues. In case any inconsistencies observed, please click on reach us. Double check the Assessment Year that you checked your refund status for. Not determined: This means that your income tax return is not processed, and you must wait for a few more days before you check your ITR refund status. For instance, your fixed deposit issuer may cut tax at source on your interest income even though you fall under the tax exemption limit. Company Support. MSME Registration. Prior to his current stint with Max Life Insurance, he has worked with leading fintech startups. Under this facility, you receive the TDS refund directly in your registered bank account. Once you fill out the ITR form, the system auto-calculates your tax payable as per your applicable income tax slab, and also tells you the refund amount you qualify for. However, this refund is calculated based on the details that you enter and therefore, may not reflect the actual figure. Subsequently, the IT department may issue an intimation under Section 1 a , depicting a comparison between the details submitted and those considered by the Income-tax Department.

Check your refund.

Clear serves 1. The refund will be credited only if the bank account is pre-validated. Your Age? Not determined: This means that your income tax return is not processed, and you must wait for a few more days before you check your ITR refund status. Generally, it takes around 7 to days, with an average time of 90 days after you have e-verified your return. You can raise a complaint through your income tax e-filing account or contact Ombudsman Income Tax Department to check your TDS refund status. In other words, it means that you may have missed the deadline to e-file your return. Step 9: Click on 'Submit. Company Registration. Based on the rectification, the IT department has calculated the refund amount and credited the refund.

Would like to tell to steam of words.