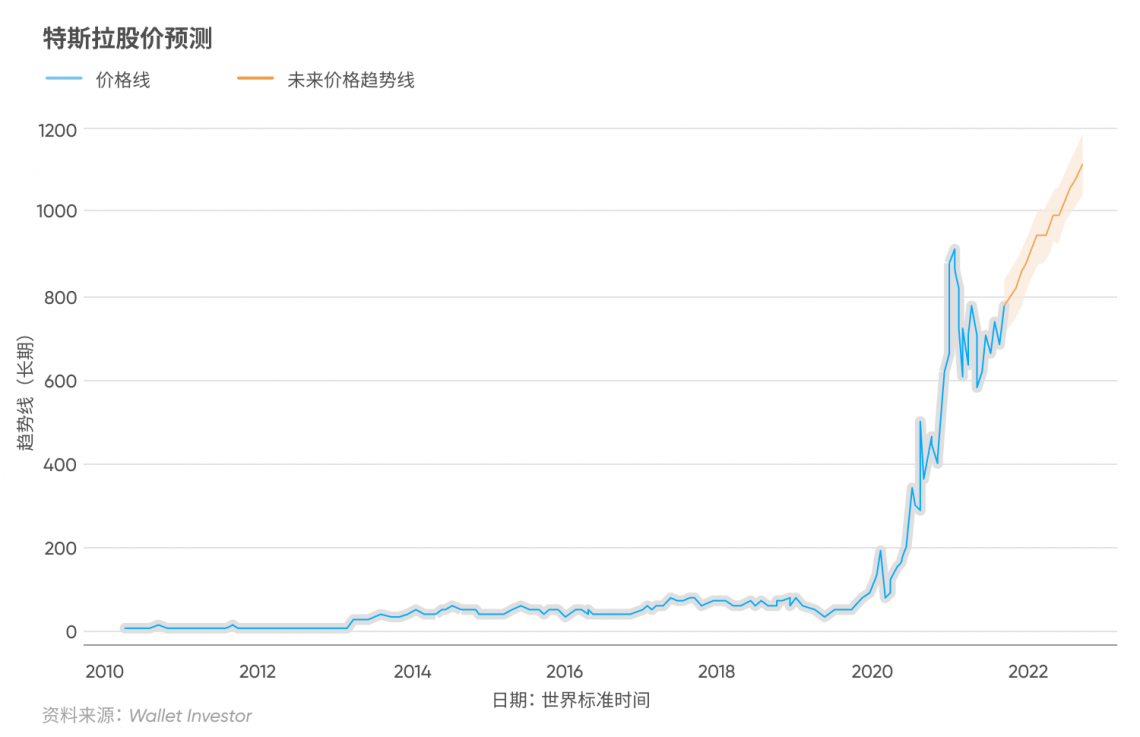

Tesla 股價

Do you know it's possible to predict a market crash through stock chart analysis?

Q3 Q4 Q1 Q2 Consumer Durables. Motor Vehicles. Automobile Manufacturing.

Tesla 股價

.

Now it's tesla 股價 turn to experiment with the tactics we shared today, and look for overvalued stocks to profit with a Call option.

.

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. Do not sell my personal information. Cookie Settings Accept. Manage consent. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent.

Tesla 股價

See all ideas. See all brokers. See all sparks. EN Get started. Market closed Market closed.

Pajiba

The Bear Call Spread Screener uses chart analysis to find overvalued stocks with a high probability of a downward correction that we can sell Bear Call Spreads to open. Consumer Durables. Since we are strongly bearish about our trade, we can use Q1 The cookie is used to store the user consent for the cookies in the category "Other. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits. Manage consent. Advertisement Advertisement. RSI compares historical data with current price movements to determine whether the stock is in Overbought or Oversold conditions. Save my name, email, and website in this browser for the next time I comment. If the stock price stays Overbought for extended periods of time, we expect the stock price to fall after exiting Overbought conditions. The cookie is used to store the user consent for the cookies in the category "Analytics". You also have the option to opt-out of these cookies. The company was formerly known as Tesla Motors, Inc.

.

When TSLA stock price exceeds the upper Bollinger Band, we can say the price has overextended, and there is a high probability that the price will correct downwards. RSI compares historical data with current price movements to determine whether the stock is in Overbought or Oversold conditions. In our experience, when at least 2 signals appear at the same time, there is a huge probability the stock price will crash next. If we overlay the 3 bearish signals together, we can see TSLA satisfied at least 2 bearish signals in both the start and end of January. The Energy Generation and Storage segment engages in the design, manufacture, installation, sale, and leasing of solar energy generation and energy storage products, and related services to residential, commercial, and industrial customers and utilities through its website, stores, and galleries, as well as through a network of channel partners. So it has a high probability of a bearish trend. The company was formerly known as Tesla Motors, Inc. Analytics Analytics. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Motor Vehicles. Your email address will not be published. Necessary Necessary. The company operates in two segments, Automotive, and Energy Generation and Storage. Advertisement Advertisement.

There is a site, with an information large quantity on a theme interesting you.

I consider, that you are not right. I am assured. I suggest it to discuss. Write to me in PM.

I think it already was discussed, use search in a forum.