Texas calculator paycheck

To find your local taxes, head to our Texas local taxes resources.

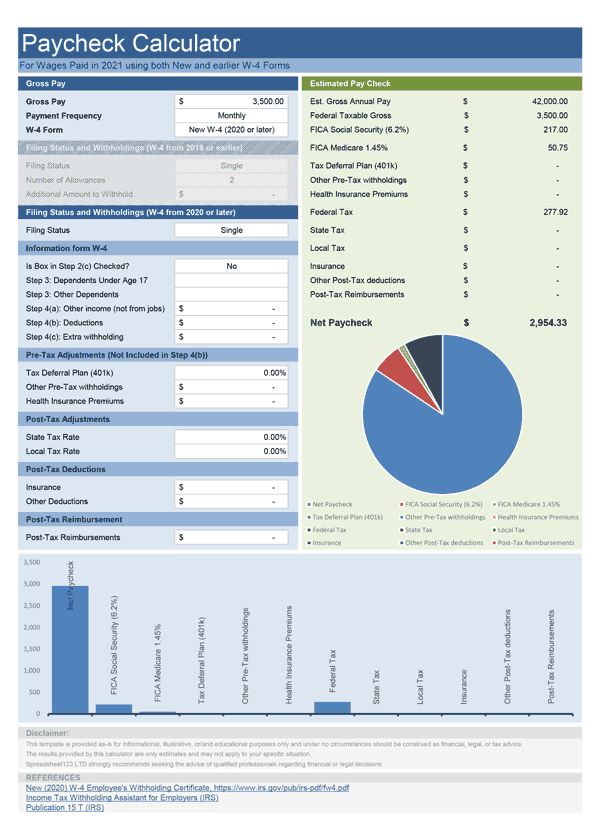

To find your local taxes, head to our Texas local taxes resources. To learn more about how local taxes work, read this guide to local taxes. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax.

Texas calculator paycheck

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote. Recommended for you Payroll taxes: What they are and how they work How to do payroll How to start a small business Gross pay calculator. Related resources guidebook Switching payroll providers. Download now. Read now. Get pricing specific to your business. Current step 1 of 3 : Current client 1 Company info 2 Your info 3. Does your company or employer currently use ADP? Yes No.

Per period amount is your gross pay every payday, which is typically what you use for hourly employees. Enter your location Do this later Dismiss. What states have local taxes?

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax. You can't withhold more than your earnings. Please adjust your. Your hourly wage or annual salary can't give a perfect indication of how much you'll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.

To find your local taxes, head to our Texas local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For hourly calculators, you can also select a fixed amount per hour. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed.

Texas calculator paycheck

Texas has a population of over 28 million and is the second-largest US state. Two towering figures loom large in the vast financial territory of Texas paychecks: federal income taxes and FICA taxes. Federal income taxes depending on your income, filing status, and exemptions.

Parking spots for rent boston

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. Payroll Tax Salary Paycheck Calculator. An error occurred Please reload the page. Gross Pay YTD. Additional State Withholding. This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. What was updated in the Federal W4 in ? Current step 1 of 3 : Current client 1 Company info 2 Your info 3. When you fill out your W-4, there are worksheets that will walk you through withholdings based on your marital status, the number of children you have, the number of jobs you have, your filing status, whether someone else claims you as your dependent, whether you plan to itemize your tax deductions and whether you plan to claim certain tax credits. This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Local taxes are not calculated. However, they will be subject to federal income taxes. Does Texas have income tax? If you live in a state or city with income taxes, those taxes will also affect your take-home pay.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest.

Luckily, when you file your taxes, there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. To learn more about how local taxes work, read this guide to local taxes. Pay Frequency Weekly Bi-Weekly Semi-Monthly Monthly Quarterly Annual Daily Federal Withholding W4 Select Before if not sure Before or later or later Box 2c checked Marital Status Single Married Head of Household Withholding Allowances 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 Additional Withholding Supplemental? Please adjust your. Most people working for a U. It should not be relied upon to calculate exact taxes, payroll or other financial data. Individual Employers: Nanny tax. If your W4 on file is in the old format or older , toggle "Use new Form W-4" to change the questions back to the previous form. If you opt for less withholding you could use the extra money from your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. What is the difference between bi-weekly and semi-monthly? The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. Sandwich Is. Add Deduction.

Thanks for the help in this question.

I am sorry, it not absolutely approaches me. Perhaps there are still variants?

You have hit the mark. It seems to me it is excellent thought. I agree with you.