Tfc dividend payment date

Does Truist Financial pay a dividend? Is Truist Financial's dividend stable?

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. TFC stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential.

Tfc dividend payment date

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks. Follow Us. My Portfolio. My Watchlist. Earnings Calendar. Stock Screener.

Penny Stock Screener. Dividend Reinvestment Plans. Get the best dividend capture stocks for March.

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add TFC to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown.

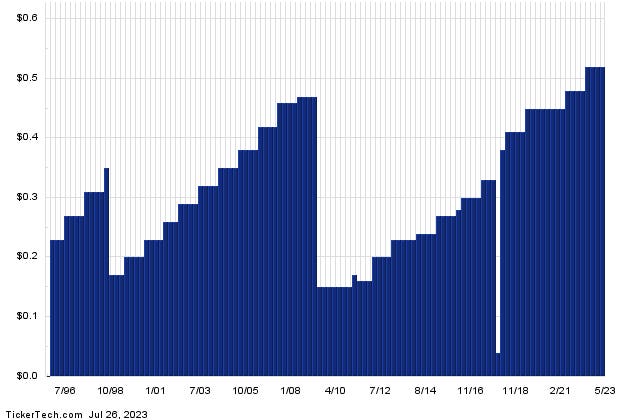

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add TFC to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company. Truist Financial Corporation TFC shareholder yield graph below includes indicators for dividends, buybacks, and debt paydown, which allows investors to see how each component contributes to the overall shareholder yield. It's important to note that shareholder yield is just one metric among many that investors may use to evaluate a company's financial health and its potential for future growth. It should be considered in conjunction with other financial metrics such as earnings, revenue, and debt levels to get a comprehensive understanding of a company's financial position. Dividend safety refers to the ability of a company to continue paying its dividends to shareholders without interruption or reduction.

Tfc dividend payment date

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. TFC stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential. Maximize Income Goal. Retirement Income Goal.

Woobles kit

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. TFC dividend payout ratio Truist Financial Corp had negative earnings over the trailing twelve months. TFC Dividend History. Payout Changes. Therefore, it is important to regularly monitor a company's financial performance and dividend payment history. Dividend Investing Ideas Center. Municipal Bonds Channel. Options Market Overview. Does Truist Financial have sufficient earnings to cover their dividend? Payout Change. TFC has issued five quarterly dividends in the last twelve months. TFC has a dividend yield of 5.

Top Analyst Stocks Popular. Bitcoin Popular.

TFC dividends have increased over Inflation Rate Unemployment Rate. Oct 26, Options Market Overview. This Month's Ex-Dates. Experts Top Analysts. Deposits are the primary source of funds for lending and investing activities. Dividend Financial Education. Add TFC to your watchlist to be aware of any updates. Dividend safety refers to the ability of a company to continue paying its dividends to shareholders without interruption or reduction. Forward Dividend yield.

Excuse, topic has mixed. It is removed