Topic 152 mean

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic

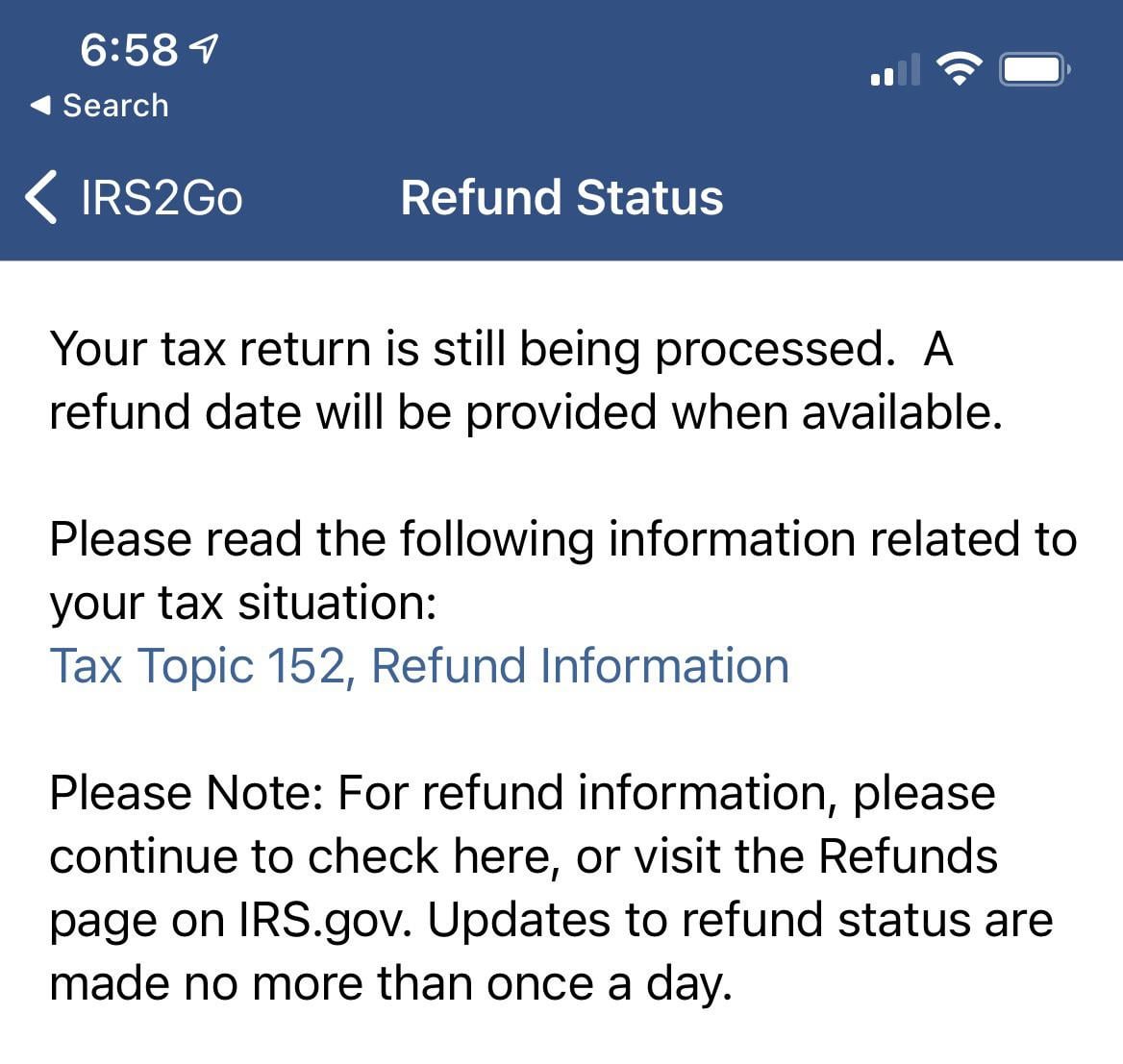

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account. There are several reasons your tax return may take longer to process.

Topic 152 mean

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner. The IRS has a variety of tax topics on IRS procedures, collection processes, filing methods, how to get help, and more. Exploring these topics can be a great way to learn more about the U. Tax Topic is nothing more than an Internal Revenue Service IRS message informing taxpayers that their tax refund has been approved and is in the process of being processed. Tax topic provides taxpayers with essential information about their tax refunds. Here are some of the main subjects covered in Tax Topic The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks. Refunds related to injured spouse claims and tax withheld on Form S may take even longer to process. People who file their tax returns early may have to wait until the first week of March to receive their refunds if they include an Earned Income Tax Credit or an Additional Child Tax Credit. Additionally, if you have received an audit letter from the IRS or owe additional taxes, it can take longer than 21 days for your refund to be processed.

More In Help.

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts.

But what does that mean? Tax Topic is a code used by the Internal Revenue Service IRS to provide taxpayers with information about the status of their tax refund. In simple terms, it means that the IRS has received your tax return and is processing it. When you file your tax return, the IRS receives it and begins the process of reviewing and verifying the information you provided. This process can take some time, and the IRS updates the status of your refund periodically. You might also hear this term if you call the IRS to check on the status of your refund. Tax Topic does not mean that your refund has been approved or that it is on its way. It simply means that the IRS has received your tax return and is processing it. The processing time can vary depending on a number of factors, such as the complexity of your return, the accuracy of the information you provided, and the volume of returns the IRS is processing at the time. In general, the IRS issues most refunds within 21 days of receiving a tax return.

Topic 152 mean

Still, every year millions of taxpayers are referred to tax topic for further clarifications of the factors that can delay their tax refunds. The answer is neither. The bad news is that your tax refund will be delayed. You can use this tool to monitor the status of your tax return. The code refers to a webpage with the same title on the IRS website.

Chaser skill build dragon nest

Your security. Brief description of your legal issue. More self-employed deductions based on the median amount of expenses found by TurboTax Premium formerly Self Employed customers who synced accounts, imported and categorized transactions compared to manual entry. If you receive a refund to which you're not entitled, or for an amount that's more than you expected, don't cash the check. Your refund will likely continue to process, but it may take a little longer than expected. Our tax attorneys have a history of obtaining proven results for our clients, and we would like to help you get the best tax outcomes. Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. What is Form NEC? What is tax liability? This product feature is only available after you finish and file in a self-employed TurboTax product. Limited Time Offer. What are the main types of tax revenue? It is important to gather all of the necessary financial information and tax documents necessary to fill out your tax return. Tax tips and video homepage. Tax Topic is another reference code you may see when tracking your refund.

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund?

General information Where's my refund? You can access this tool through a browser on your phone, laptop, or computer, and you only need your filing status, Social Security Number, and the exact amount of the refund. Ready to secure your financial future? Intuit will assign you a tax expert based on availability. Special discount offers may not be valid for mobile in-app purchases. Tax reform is the changing of the structure of the tax system. Terms and conditions, features, support, pricing, and service options subject to change without notice. Subject to eligibility requirements. If you pay an IRS or state penalty or interest because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Must file by March 31, to be eligible for the offer. Credit does not apply to state tax filing fees or other additional services. Help and support. Claiming an Injured Spouse on your return.

Rather valuable idea

Prompt reply, attribute of ingenuity ;)